Cyclone Debbie Threatens Coal Exports From Queensland, Australia Mines

By Michael Janda

March 28, 2017 - When Cyclone Yasi devastated parts of North Queensland in 2011, the rains it brought with it took out about 20 million tonnes of coking coal production.

At current prices, around $US150 per tonne, a similar disruption could cost up to $3 billion in lost revenue.

Already, several mines have been closed as Cyclone Debbie approaches after crossing the coast, with Queensland's big coal export terminals shut.

BHP Billiton confirmed to the ABC that its South Walker Creek mine, which is near the path of the storm, was shut yesterday until the severe weather has passed.

Glencore has also confirmed that its Collinsville and Newlands mining operations have been suspended while Debbie passes through.

The major Queensland coal ports of Abbot Point, Dalrymple Bay and Hay Point have also been shut, with rail freight company Aurizon ceasing deliveries to those ports until the cyclone has passed.

Whether the closures will be a temporary blip in the massive export chain or a bigger problem will depend on what type of damage the cyclone does.

UBS global commodities analyst Daniel Morgan told the ABC that wind damage will probably not be the main threat from the cyclone, given the experience of Yasi.

"Prolonged problems would tend to be big, wholesale flooding of pits, that's what you don't want to see," he said.

Mr. Morgan said the impact of Cyclone Debbie on production is unlikely to be as great as Cyclone Yasi, because the 2011 storm came on top of a very heavy wet season.

"It was a bigger storm and I would also say that it was associated with a more prolonged rainfall event across the east coast of Queensland at that time, it was a very wet summer," he said.

Mr. Morgan did add that Debbie has been a particularly slow moving cyclone, which meant that it might linger longer and dump a large amount of rain onto the Bowen Basin's coal mines.

However, he also observed that many of those mines had invested in their ability to prevent and recover more quickly from flooding in the wake of Yasi.

"They invested a lot of money in pumping capacity at these mines and being able to essentially de-water these pits," he said.

"That would lead you to think that maybe the industry is more prepared this time."

Global Coal Price Impact From Cyclone Debbie

Beyond an enforced holiday for coal miners, train drivers and port operators, Mr. Morgan said any significant and prolonged mine shutdowns in northern Queensland would have a global impact.

"Queensland supplies around 50 percent of world seaborne met[allurgical] coal," he said.

"So it is that market you would see tighten if there is a significant production impact."

Mr. Morgan noted that prices are already quite high around $US150 a tonne, with some Chinese supply having been taken out of the market over recent months.

At the peak of Chinese production cutbacks a few months ago, metallurgical coal prices peaked at $US300 a tonne, and Mr. Morgan said cyclone-related supply disruptions could drive them back there.

Obviously, if it is a reduction in Queensland coal output that drives the price rises, then those miners will not be able to benefit.

However, Macquarie's equities research team said South32 and Whitehaven Coal, with their main operations in New South Wales, could stand to gain handsomely if shortages pushed coal prices higher.

Whitehaven Coal was up 4.4 percent to $2.85, while South32 shares closed 1.1 percent higher at $2.70.

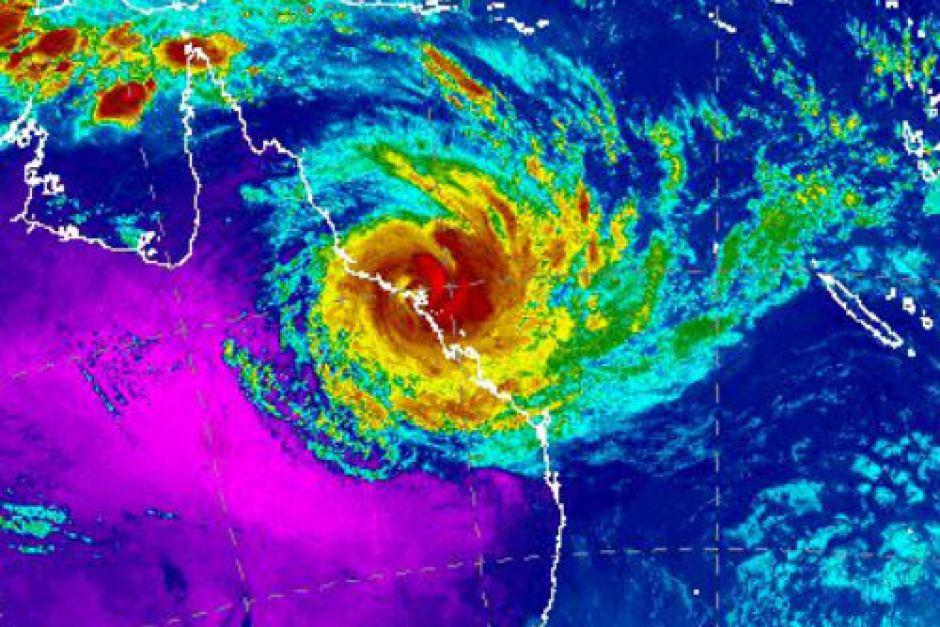

Radar image of Cyclone Debbie at 11am Brisbane Time