Coal-Fired Power Generation in Japan and the World

By Sumie Nakayama

May 5, 2017 - The Japanese government set its 2030 power generation target shares for coal at 26%, nuclear at 22%, and gas at 27%. Due to concerns over the slow restart of nuclear power generation, the power sector’s interest in building more efficient coal-fired power generation facilities with low CO2 emissions is increasing. This article examines the reasons behind Japan’s energy policy and the choice of coal. In addition, it looks at the importance of coal for the future of Asian countries and the ways in which Japan is contributing to clean coal technologies both domestically and internationally.

Coal-Fired Generation in Japan

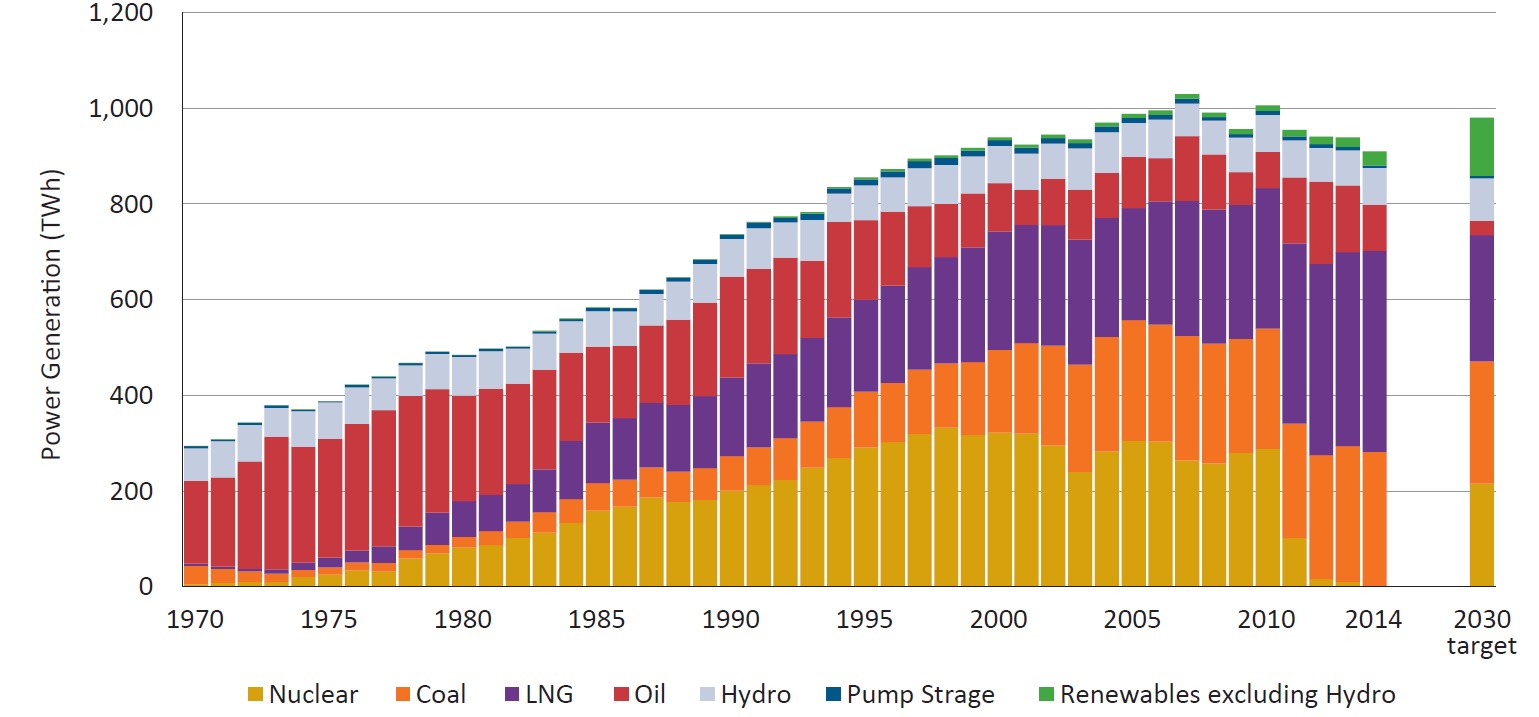

Historically, Japan’s use of energy resources for power demand and supply has experienced two major changes, as depicted in Figure 1. One is the gradual reduction of oil dependence in 1970–2010 and the other is the dramatic disappearance of nuclear after 2011. The heavy dependence on oil (around 70%) in the 1970s risked Japan’s energy security with the oil crisis. Consequently, a new and stronger energy policy was implemented to reduce dependence on oil by promoting coal, liquefied natural gas (LNG), and nuclear power. The result of this diversification reduced oil dependence from around 70% to 8% by 2010 (red bar in Figure 1). However, the major earthquake coupled with the disaster at the Fukushima Daiichi nuclear power plant in 2011 cast a huge shadow over Japan’s energy scene and resulted in major changes. All 54 nuclear reactors in Japan were shut down. In 2012, Japan established a new safety institute, the Nuclear Regulation Authority (NRA), following the introduction of the most stringent new safety standards in the world, which must be implemented before a nuclear reactor can restart.

FIGURE 1. Historical trend of Japan’s power generation portfolio, 1970–2014, and 2030 target.

In 2015, the Japanese government set a new energy policy that includes a 2030 energy supply-and-demand target. The policy was developed to balance energy security, economy, environment, and safety. The power generation national targets set for 2030 are nuclear 22%, coal 26%, LNG 27%, oil 3%, and renewables 22%. Coal-fired power will contribute 56% to the baseload, as the government aims to ensure around 60% baseload for stable supply, together with nuclear, hydropower, geothermal, and biomass.

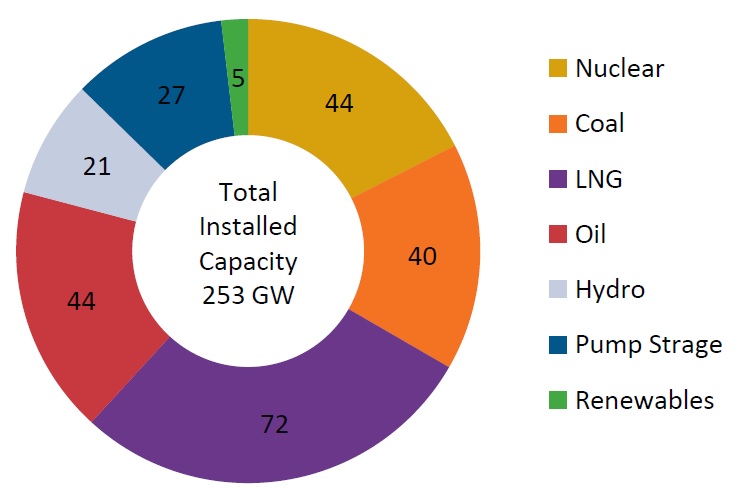

To date, restarting the existing nuclear reactors has taken longer than anticipated. With the permanent shutdown of six reactors at Fukushima Daiichi and five other older reactors, there are now 43 potential reactors that could become operational again. An assessment to meet the new nuclear standard requirements can take up to two years. The NRA has assessed 26 reactor submissions. To date, only five reactors have passed assessment. Due to the extended time it was taking to restart the reactors, several regional power utilities were encouraged to find alternatives to increase baseload power generation. In addition, ongoing deregulation of the power market has encouraged new power generators to utilize more cost-effective power sources. As a result, several new coal-fired power generation projects are being planned, with some already under construction. Figure 2 depicts the breakdown of Japan’s installed power generation capacity by energy source. Coal-fired power generation capacity is 40 GW, accounting for 16% of the total.

FIGURE 2. Power generation capacity by energy source in Japan, 2014.

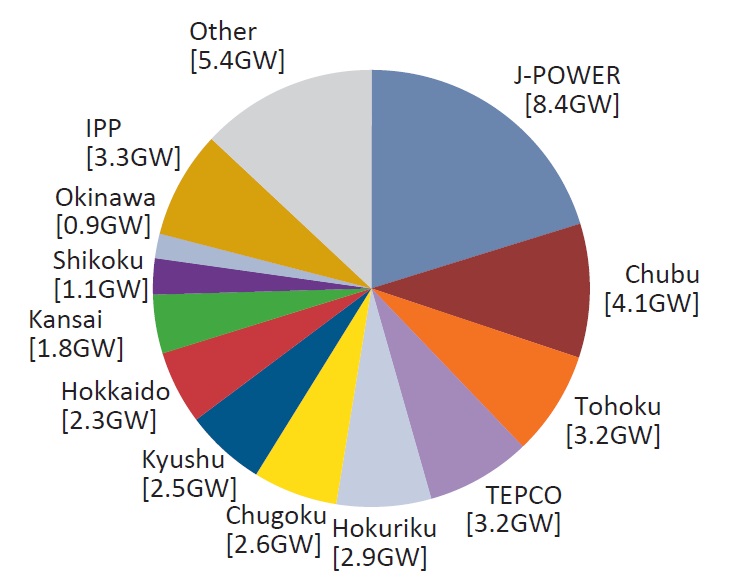

The main owners of Japan’s coal-fired power plants are 10 regional power utilities and J-POWER. Figure 3 depicts the total coal-fired power generation capacity in Japan and the share held by different companies.

FIGURE 3. Owners of coal-fired power plants in Japan, 2014.

J-POWER was established in the 1980s as a state-owned power wholesaler and has promoted imported coal-fired power generation in accordance with government policy. It is the largest coal-fired power plant operator in Japan.

Coal and nuclear are considered the best options for baseload power generation in Japan because it is less expensive than gas. Gas imported as LNG has a high price due to the liquefaction cost and the additional freight cost. According to the International Energy Agency, the relative price of coal to gas differs in the U.S., Europe, and Japan.4 In the U.S., coal is almost equivalent in price to gas for electricity generation, whereas the price of coal in Japan is substantially lower than gas.

Before the Fukushima disaster, no new coal-fired power projects had been built in Japan in the 21st century. All the environmental impact assessments (EIAs) for coal-fired power projects were rejected by the Ministry of Environment (MoE) because they would increase CO2 emissions in Japan. However, after the shutdown of all nuclear power reactors, serious concern developed about a power shortage in the Greater Tokyo area, which resulted in a call for tenders from the Tokyo Electric Power Company (TEPCO) for 2.6-GW baseload power generation. But bidders were reluctant to make detailed bids for coal-fired projects because the MoE would block any coal project in the EIA process even if it won the tender. This obstacle concerned the Ministry of Energy, Trade and Industry (METI), which is responsible for management of energy demand and supply in Japan.

To eliminate concern among potential bidders about the MoE’s hostility to coal-fired power generation, METI and the MoE made an agreement. If new fossil-fired power projects met two conditions, MoE would not block the project in the EIA process, so that companies could submit a tender to TEPCO without fear of being rejected. The first condition is to use the best available technologies (BAT); thus only ultra-supercritical (USC) technologies were eligible. The other condition is that the power sector established a coalition with a targeted emissions cap which is consistent with the government’s 2030 energy mix and CO2emissions targets—and the CO2 emissions from the approved project must be within the cap. The MoE published the energy efficiency standard required to be met by potential bidders in a table by fuel type (coal and gas) and by plant size. For example, a 1000-MW coal-fired power plant must achieve 45% (LHV, gross) energy efficiency.

Currently, 17 GW of new coal-fired power projects are at various stages of development in Japan, ranging from the early stage of the EIA process to being constructed.6 All the large-scale projects plan to use USC technology to meet government conditions. The proposed coal-fired power projects include small power projects without USC as USC is not suitable for smaller size coal-fired power plants. As an alternative for smaller projects, co-firing of biomass fuel is used to reduce CO2 emissions.

In February 2016, due to the MoE’s concerns about the increasing number of new projects, METI announced amendments to two existing laws. One amendment regulates power generators to achieve energy efficiency standards consistent with the 2030 national target; the other regulates power retailers in procuring a share of non-fossil power consistent with the 2030 national target.

Both regulations allow “collective action” to achieve the goal. The 35 main players in the power sector have formed a framework to achieve the goal collectively.

In May 2016, the Oxford Smith School of Enterprise and Environment published a report, “Stranded Assets and Thermal Coal in Japan: An Analysis of Environment-Related Risk Exposure”. The report concluded that the new coal fleet investment of US$6-8 billion would result in a stranded asset in 5–15 years. However, several of the assumptions in the report were incorrect. First, the number of coal-fired power projects was exaggerated; the Oxford paper assumes 28 GW while the Japanese government says a maximum of 17 GW of coal-fired power will be built. The Oxford paper also names eight new J-POWER projects: Takehara, Takasago, Nishiokinoyama, Osaki Coolgen, Kashima Power, Yokohama, Shin Yokosuka, and Yokosuka. However, three of them—Yokohama, Shin Yokosuka, and Yokosuka—are not J-POWER’s projects.

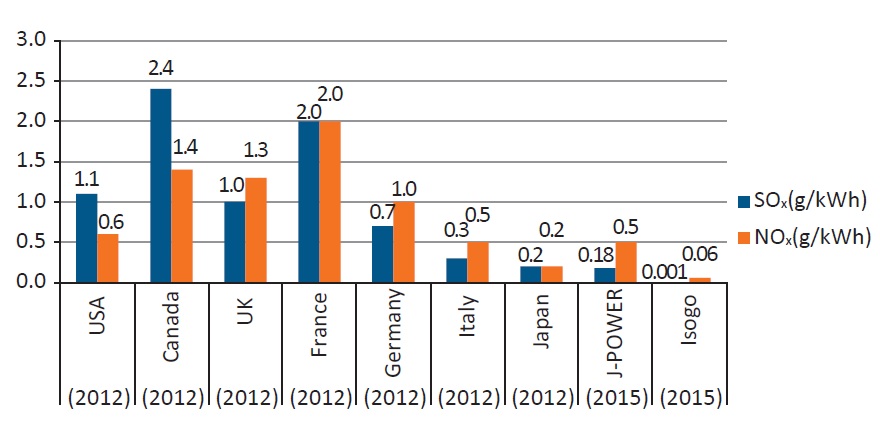

The biggest problem with the Oxford paper, as noted by Professor Arima, is its failure to consider Japan’s energy policy and 2030 national targets. It also fails to consider Japan’s energy security or economy, focusing only on the environment. The study assumes that coal-fired power generation is hazardous for human beings and does not recognize that Japan requires stable and cost-effective power generation. Moreover, the new coal-fired power plants will use the most advanced clean coal technology, which will remove SOx, NOx, and particulate matter (PM) at a nearly 100% rate (depending on the coal’s characteristics). CO2 emissions will also be reduced through high-efficiency plants and through use of CCS in the future.

Japan is a world leader in USC technology for clean coal technology and continues to make further improvements through R&D. As a result, Japan has built coal-fired power plants achieving low emissions. J-POWER’s Isogo Power Station demonstrates Japan’s best clean coal technology, with an efficiency of 45% (LHV, gross), reduced flue gas, single-digit ppm SOx, less than 10 ppm NOx , with PM less than 5 ppm at the stack.

Located in Yokohama, the second largest city in Japan by population, Isogo Power Station is only 6 km from Yokohama’s city center and 30 km from central Tokyo. It is a unique, urban coal-fired power station that employs some of the most advanced clean coal technologies in the world.

Originally, Isogo Power Station had two 265-MW subcritical boilers. The old station started commercial operation in the 1960s, and had been supplying baseload power for more than 35 years. In 1996, the government approved a replacement plan. As a result of discussion with the buyers and Yokohama City, the new station was designed to have 2 units of 600 MW with the world’s highest energy efficiency and lowest emissions for a coal-fired power station. The boilers and turbines use USC technology with a main steam temperature/pressure of 600°C/25 MPa and a reheat steam temperature of 610°C. The plant uses a dry-type DeSOx system to reduce emissions.

FIGURE 4. Japan has some of the lowest SOx, NOx per thermal-power-generation electric energy in the world.

Currently, J-POWER and Chugoku Electric Power are conducting R&D on oxygen-blown integrated coal gasification combined cycle (IGCC). The aim is to improve energy efficiency and develop economic CO2 capture from syngas, and A-USC to further increase efficiency and reduce CO2 emissions. The goal for commercialization of IGCC is the early 2020s; then triple combined-cycle technology also employing fuel cells and integrated coal gasification fuel cell combined cycle (IGFC) is the next R&D step to improve energy efficiency further. Japan intends to remain a world leader in clean coal technologies. It is important to allocate sufficient budget and invest in innovative technologies wisely.

Global Perspective on Coal for Power

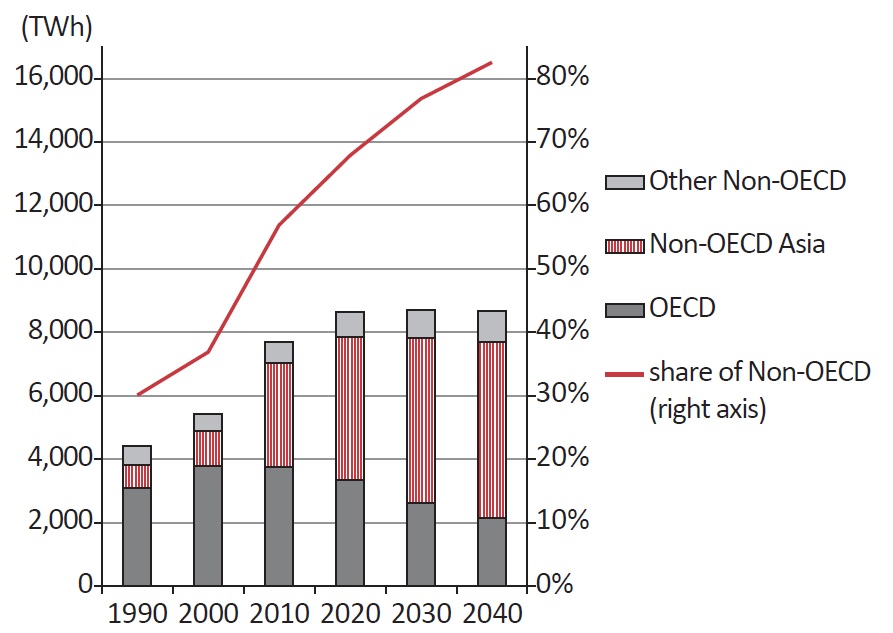

According to the IEA, in 2014, coal provided 40% of the world’s power generation—the largest share. Historically, in the 1990s the OECD’s share in coal-fired power generation was 70%, as depicted in Figure 5. The volume of coal-fired power generation has more than doubled since then and is expected to grow 24% by 2040. The share of non-OECD’s coal-fired power generation began to accelerate in 2000 and, at current levels, is expected to be more than 60% today and will be more than 80% in 2040. Coal demand in the Asian power sector will increase by 67% from today to 2040.

FIGURE 5. Cumulative capacity of retired and added coal-fired power plants by region, 2015–2040.

Figure 6 shows the cumulative capacity of retired and added coal-fired power plants by region between 1990 and 2040. In OECD countries, the total retirement of coal-fired plants is more than 300 GW, whereas total additions are 100 GW. In China and Southeast Asia, a large number of additional coal-fired plants is expected to be built. According to the IEA, between 2015 and 2040 the total additional capacity of coal-fired power plants in non-OECD countries will be more than 1000 GW, or more than half of the existing capacity of coal-fired plants in the world.

FIGURE 6. Coal-fired power generation, 1990–2040

Countries are building coal-fired power generation primarily because coal is an inexpensive power source in comparison to other energy sources. Many of those countries, such as China and Indonesia, also have large reserves of coal. Many of the economic growth plans of non-OECD countries are built around an energy policy based on inexpensive coal-fired power. Therefore it is important to encourage use of coal in the most efficient way—that is, through high-efficiency power generation technology in order to reduce CO2 emissions—particularly in non-OECD Asia.

In the wake of increased awareness about the risks of climate change, criticism of coal is increasing in OECD countries. In addition, public financing for new coal-fired power projects is being restricted. An agreement was reached after several months of intense argument over a proposal by the U.S. and the UK to ban all public financing of coal-fired power projects and a counter-proposal by Japan and Australia to allow efficient coal-fired power projects, with high-efficiency technology to be eligible. In September 2015, the OECD’s Export Credits Arrangement review process was changed to allow investment in coal-fired power projects that employ USC technology. OECD member countries accepted that efficient use of coal helps non-OECD countries reduce CO2 emissions effectively, instead of banning officially supported export credits to all coal-fired power projects.

Given the need for efficient use of coal in Asia, Japan intends to encourage and deploy its clean coal technologies in countries to effectively mitigate global CO2 emissions. J-POWER is engaged in several projects in Indonesia, including construction of two IPP 1000-MW USC coal-fired units in Central Java. The project will use local subbituminous coal and be Indonesia’s first coal-fired power plant to use USC technology. The plant is expected to become operational in 2020. The project will also contribute to the sustainable development of Indonesia and CO2 mitigation.

Conclusion

The Paris Agreement went into force in November 2016 under the United Nations Framework Convention on Climate Change (UNFCCC). To achieve CO2 emissions reduction targets, countries will need to implement a wide array of mitigation technologies, including clean coal technologies. In the short term, efficient use of coal is the key to CO2 emissions reductions in Asian countries. Japan’s clean coal technology will contribute to using coal most efficiently in power generation and support sustainable development in Asia. J-POWER is engaged to demonstrate and implement clean coal technologies commercially both in Japan and internationally and to continue with further research and development.