Warrior Met Coal & CONSOL Coal Resources Financial Review

May 14, 2018 - Warrior Met Coal (NYSE: HCC) and CONSOL Coal Resources (NYSE:CCR) are both small-cap oils/energy companies, but which is the superior stock? We will compare the two businesses based on the strength of their valuation, profitability, institutional ownership, analyst recommendations, risk, earnings and dividends.

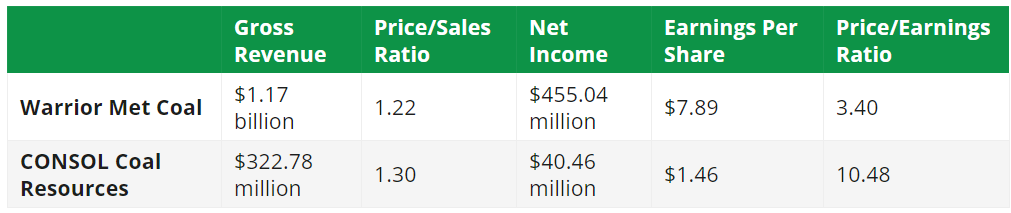

Valuation and Earnings

This table compares Warrior Met Coal and CONSOL Coal Resources’ revenue, earnings per share (EPS) and valuation.

Warrior Met Coal has higher revenue and earnings than CONSOL Coal Resources. Warrior Met Coal is trading at a lower price-to-earnings ratio than CONSOL Coal Resources, indicating that it is currently the more affordable of the two stocks.

Dividends

Warrior Met Coal pays an annual dividend of $0.20 per share and has a dividend yield of 0.7%. CONSOL Coal Resources pays an annual dividend of $2.05 per share and has a dividend yield of 13.4%. Warrior Met Coal pays out 2.5% of its earnings in the form of a dividend. CONSOL Coal Resources pays out 140.4% of its earnings in the form of a dividend, suggesting it may not have sufficient earnings to cover its dividend payment in the future. Warrior Met Coal has increased its dividend for 11 consecutive years.

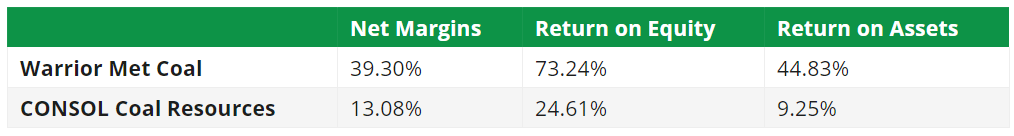

Profitability

This table compares Warrior Met Coal and CONSOL Coal Resources’ net margins, return on equity and return on assets.

Insider and Institutional Ownership

24.1% of CONSOL Coal Resources shares are held by institutional investors. 0.5% of Warrior Met Coal shares are held by insiders. Strong institutional ownership is an indication that endowments, hedge funds and large money managers believe a company will outperform the market over the long term.

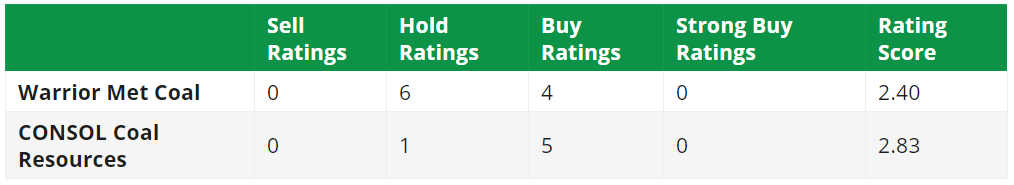

Analyst Recommendations

This is a summary of recent ratings and recommmendations for Warrior Met Coal and CONSOL Coal Resources, as reported by MarketBeat.

Warrior Met Coal currently has a consensus price target of $27.78, indicating a potential upside of 3.61%. CONSOL Coal Resources has a consensus price target of $20.40, indicating a potential upside of 33.33%. Given CONSOL Coal Resources’ stronger consensus rating and higher probable upside, analysts clearly believe CONSOL Coal Resources is more favorable than Warrior Met Coal.

Summary

Warrior Met Coal beats CONSOL Coal Resources on 9 of the 16 factors compared between the two stocks.

Warrior Met Coal Company Profile

Warrior Met Coal, Inc. produces and exports metallurgical coal for the steel industry. It operates two underground mines located in Alabama. The company sells its metallurgical coal to a customer base of blast furnace steel producers located primarily in Europe, South America, and Asia. It also sells natural gas, which is extracted as a byproduct from coal production. Warrior Met Coal, Inc. was founded in 2015 and is headquartered in Brookwood, Alabama.

CONSOL Coal Resources Company Profile

CONSOL Coal Resources LP produces and sells high-Btu thermal coal in the Northern Appalachian Basin and the eastern United States. It owns a 25% undivided interest in the Pennsylvania mining complex, which consists of three underground mines and related infrastructure that produce high-Btu bituminous thermal coal located primarily in southwestern Pennsylvania. The company markets its thermal coal principally to electric utilities in the eastern United States. CONSOL Coal Resources GP LLC operates as a general partner of the company. The company was formerly known as CNX Coal Resources LP and changed its name to CONSOL Coal Resources LP in November 2017. CONSOL Coal Resources LP was founded in 2015 and is headquartered in Canonsburg, Pennsylvania. CONSOL Coal Resources LP is a subsidiary of CONSOL Energy Inc.

CoalZoom.com - Your Foremost Source for Coal News