Alliance Resource Partners LP Sentiment Falls in Q1 2018 to 0.65

By Joseph Norton

July 1, 2018 - In Q1 2018, Alliance Resource Partners LP (NASDAQ:ARLP) big money sentiment decreased to 0.65, revealed SEC filings. That’s down -0.55, from 2017Q4’s 1.2. 28 investment professionals increased or opened new positions, while 43 sold and decreased their holdings in Alliance Resource Partners LP so the sentiment is negative. Funds own 18.98 million shares, up from 17.88 million shares in 2017Q4. Funds holding Alliance Resource Partners LP in top 10 was flat from 0 to 0 for the same number . In total 13 funds closed positions, 30 reduced and 14 increased. Also 14 funds bought new Alliance Resource Partners LP stakes.

Biggest Alliance Resource Partners LP Investors

As of Q1 2018 Energy Income Partners Llc has 1.24% invested in Alliance Resource Partners LP. As of Q1 2018, 1.55 million shares of Alliance Resource Partners LP are owned by Davidson Kempner Capital Management Lp. Further, Nfc Investments Llc reported 113,643 shares in Alliance Resource Partners LP equivalent to 0.71% of its US long equity exposure. Adams Asset Advisors Llc revealed 291,575 shares position in Alliance Resource Partners LP. The Texas-based fund U S Global Investors Inc looks positive on Alliance Resource Partners LP, owning 60,600 shares.

Alliance Resource Partners, L.P. produces and markets coal primarily to utilities and industrial users in the United States.The company has $4.05 billion market cap. It operates in two divisions, Illinois Basin and Appalachia.The P/E ratio is 5.99. The firm operates eight underground mining complexes in Illinois, Indiana, Kentucky, Maryland, and West Virginia.

Ticker’s shares touched $18.35 during the last trading session after 1.10% change.Currently Alliance Resource Partners, L.P. is downtrending after 11.81% change in last June 30, 2017. ARLP has 215,483 shares volume. The stock underperformed the S&P500 by 24.38%.

Earnings report for Alliance Resource Partners, L.P. (NASDAQ:ARLP) is expected on July, 30., RTT reports. Analysts predict $0.64 EPS, which is $0.25 down or 28.09 % from 2017’s $0.89 EPS. This could hit $141.25M profit for ARLP assuming the current $0.64 EPS will become reality. Last quarter $0.55 EPS was reported. Analysts forecasts 16.36 % EPS growth this quarter.

Morgan Stanley holds 1.08M shs. 60,600 were accumulated by U S Glob Inc. Wells Fargo And Communications Mn holds 0% of its capital in Alliance Resource Partners, L.P. (NASDAQ:ARLP) for 204,929 shs. Missouri-based Parkside Bancorporation And Trust has invested 0.05% in Alliance Resource Partners, L.P. (NASDAQ:ARLP). Sei Investments Communications accumulated 0% or 2,770 shs. Intrust Financial Bank Na reported 0.05% of its capital in Alliance Resource Partners, L.P. (NASDAQ:ARLP). 20,000 were accumulated by Boston Family Office Ltd Liability. Walleye Trading Limited Co invested 0% in Alliance Resource Partners, L.P. (NASDAQ:ARLP). Rafferty Asset Mgmt Ltd stated it has 0.03% in Alliance Resource Partners, L.P. (NASDAQ:ARLP). Winslow Evans Crocker has 400 shs. California-based Mountain Lake Investment Mgmt has invested 0.46% in Alliance Resource Partners, L.P. (NASDAQ:ARLP). Kayne Anderson Ltd Partnership has 27,000 shs for 0.01% of their capital. Acadian Asset Management Ltd Liability Com stated it has 712,480 shs or 0.05% of all its holdings. Tru Com Of Vermont reported 83 shs. Cordasco Finance Ntwk accumulated 200 shs.

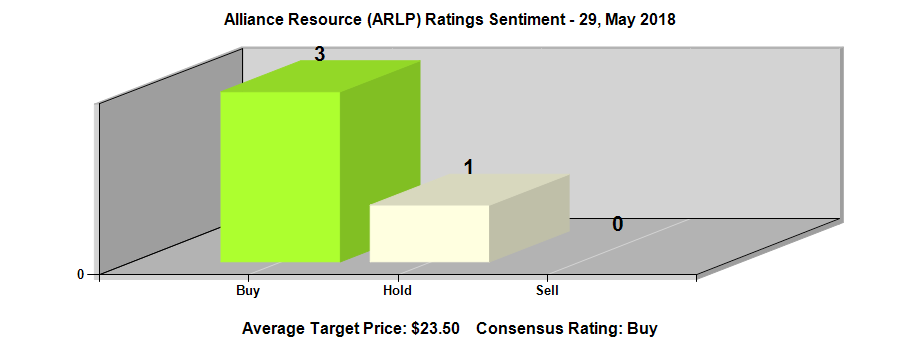

Alliance Resource Partners, L.P. (NASDAQ:ARLP) Ratings Coverage

In total 4 analysts cover Alliance Resource (NASDAQ:ARLP). “Buy” rating has 3, “Sell” are 0, while 1 are “Hold”. 75% are bullish. 4 are the (NASDAQ:ARLP)’s analyst reports since January 16, 2018 according to StockzIntelligence Inc. On Wednesday, May 23 M Partners upgraded the shares of ARLP in report to “Buy” rating. On Tuesday, January 16 Stifel Nicolaus maintained Alliance Resource Partners, L.P. (NASDAQ:ARLP) rating. Stifel Nicolaus has “Hold” rating and $22.0 target. On Monday, April 23 Seaport Global maintained Alliance Resource Partners, L.P. (NASDAQ:ARLP) rating. Seaport Global has “Buy” rating and $2000 target.

CoalZoom.com - Your Foremost Source for Coal News