.gif)

|

Signature Sponsor

January 15, 2019 - Zacks has issued an updated research report on Kennametal Inc. (KMT - Free Report) on Jan 14.

This industrial tool maker currently carries a Zacks Rank #3 (Hold). Presently, its market capitalization is approximately $3 billion.

Few growth drivers, as well as certain headwinds, which might influence Kennametal, have been discussed below.

Factors Favoring Kennametal

Financial Performance & Outlook: Kennametal recorded positive earnings surprise of 7.69% in the first quarter of fiscal 2019 (ended September 2018). Its earnings of 70 per share surpassed the Zacks Consensus Estimate of 65 cents and the year-ago tally of 55 cents by 27.3%.

For fiscal 2019 (ending June 2019), Kennametal anticipates gaining from strengthening end-market demand and its tactical initiatives. Adjusted earnings are predicted to be $2.90-$3.20 per share, above $2.65 recorded in fiscal 2018 (ended Jun 2018).

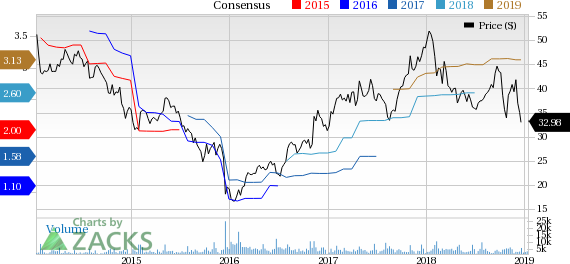

Currently, the Zacks Consensus Estimate for earnings is pegged at $3.13 for fiscal 2019 and $3.54 for fiscal 2020, reflecting year-over-year growth of 18.1% and 13.2%, respectively.

Diversification & Tactical Initiatives: Kennametal operates through three reporting segments — Industrial, WIDIA and Infrastructure. The Industrial segment was the largest revenue contributor in the first quarter of fiscal 2019, accounting for the quarter’s 54.6% sales.

Through these segments, the company serves a vast customer base in the farm machinery, highway construction, machine tools, coal mining, aerospace, oil and gas exploration, automotive, and quarrying end markets. Strengthening of businesses in the end-markets served by the company has been and will continue proving beneficial.

Further, restructuring measures undertaken by Kennametal — as well as its growth, modernization and simplification initiatives — will be advantageous. The restructuring initiatives are predicted to yield $10 million in pre-tax savings in the first half of fiscal 2019. These growth initiatives have been improving commercial execution and hence, aiding sales growth while the simplification initiatives have helped in improving operational efficiency and reducing costs. Still progressing, the modernization initiative is expected to yield gain in the future.

Long-Term Prospects: Kennametal has set some long-term targets, including achieving adjusted sales of $2,500-$2,600 million and adjusted gross margin of approximately 41% by fiscal 2021 (ending June 2021). Adjusted operating expenses are predicted to be roughly 20% of sales while adjusted earnings before interest, tax, depreciation and amortization (EBITDA) will be $600-$675 million, EBITDA margin will be 24-26% and adjusted operating margin will be 19-21%.

During fiscal 2019-2021, sales generated by Kennametal’s Industrial segment are anticipated to grow 2-4% (CAGR). Revenues of WIDIA and Infrastructure segments are projected to grow 9-11% and 3-5%, respectively.

Factors Working Against Kennametal

Share Price Performance and Weak Top-line Outlook: In the past three months, Kennametal’s shares have declined 6% against the industry’s growth of 0.8%.

For fiscal 2019, the company predicts organic sales growth of 5-8%, low compared with 12% growth registered in fiscal 2018.

Forex Woes: In the first quarter of fiscal 2019, unfavorable movements in foreign currencies adversely impacted Kennametal’s sales growth by 2%. Moreover, forex woes lowered earnings by 2 cents per share.

For fiscal 2019, Kennametal predicts forex woes to adversely impact its earnings by 7-9 cents per share and sales by 2-3%.

Higher Costs: Over time, Kennametal has been dealing with adverse impacts of higher costs of sales. In the last three fiscals (2016-2018), the company’s cost of sales increased 1.2% (CAGR). Furthermore, cost of sales grew 4.3% year over year and operating expenses expanded 2.8% in the first quarter of fiscal 2019, mainly due to higher employment expenses, temporary manufacturing inefficiencies in certain locations and overtime expenses.

For fiscal 2019, Kennametal fears to deal with higher raw materials.

|

|