Colorado's Coal Production Dips in 2018

By Dennis Webb

March 24, 2019 - Production by Colorado coal mines last year dipped slightly from 2017 levels, with Arch Coal's West Elk Mine in the North Fork Valley continuing to be the most productive location in the state, according to recently released state data.

West Elk mine east of Somerset, Colorado

Photo by Dean Humphrey

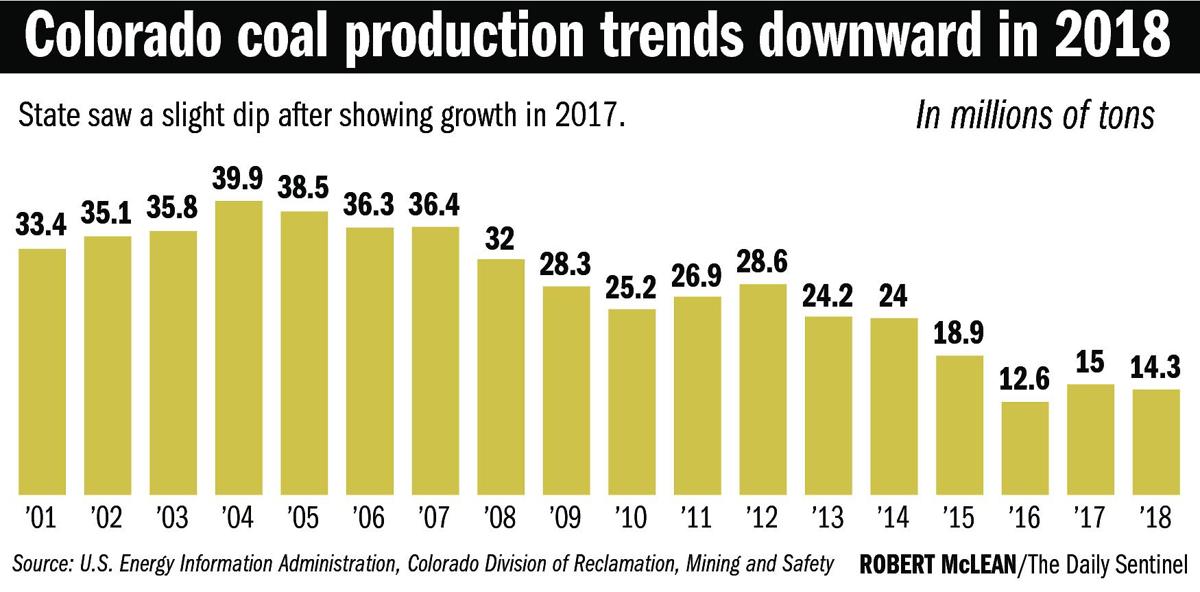

The Colorado Division of Reclamation, Mining and Safety says the state's six producing mines, all located in western Colorado, produced a total of about 14.3 million tons in 2018.

That compares to about 15.2 million tons in 2017 (the federal Energy Information Administration puts Colorado's 2017 production at about 15 million tons).

Arch Coal — which employs nearly 300 people at West Elk, according to the state data — produced about 4.64 million tons last year at the mine, down from 4.86 million tons in 2017. In the company's fourth-quarter earnings news release, it indicated the mine's production during the fourth quarter was affected by having to move its underground longwall mining equipment.

Peabody Energy's Twentymile (Foidel Creek) Mine in Routt County produced about 3 million tons of coal last year, and has 266 employees, the state reports. Its production is down from 3.84 million tons a year earlier.

Production at the Colowyo Mine in Moffat County, which supplies the nearby Craig Station power plant, fell to 1.47 million tons, from about 2.32 million tons a year earlier. But production at the Craig-area Trapper Mine, the power plant's other coal source, grew from 1.58 million tons to 2.14 million tons.

Production at the Deserado Mine in Rio Blanco County totaled 2.36 million tons, up from 2 million tons a year earlier. The mine's coal is used to power a plant in northeastern Utah.

Production at the King II Mine in La Plata County grew to about 615,000 tons from about 543,000 tons in 2017.

The state says that as of the end of 2018, 1,160 coal miners worked in Colorado, up slightly from 1,119 at the end of 2017.

According to the EIA, Colorado ranked 10th as of 2017 in coal production, with Wyoming far out front in output that year, at more than 316 million tons.

Colorado coal production peaked in 2004 at around 40 million tons, and totaled more than 28 million tons in 2012. But it fell to as low as 12.6 million tons in 2016, down from almost 19 million tons in just a year, according to EIA data. The coal industry nationally has faced competition from natural gas as a power plant fuel source following a boom in domestic oil and gas development, and also is facing increasing competition from clean, renewable sources such as wind and solar.

The North Fork Valley in recent years has seen mining end at two underground mines, leaving only the West Elk Mine currently operating there.

The EIA says natural gas surpassed coal as the leading source of U.S. electricity generation in 2016, and coal-fired U.S. generation capacity peaked at 310 gigawatts in 2011, falling to 260 gigawatts by the end of 2017. Domestic natural gas consumption in 2018 soared, to 29.95 trillion cubic feet, from 27.1 tcf a year earlier, the EIA says.

The agency recently projected that combined domestic demand for coal and coal exports from the United States will remain relatively flat through 2050. It says domestic coal-fired generation capacity likely will fall by another 65 gigawatts through 2030, but coal-fired generation probably will remain flat through then as coal plant retirements slow and the utilization rates of remaining plants increases.

Meanwhile, companies continue to look toward exports as an outlet for domestically produced coal, such as that produced by West Elk. Arch Coal reported in its news release that exports accounted for almost half of the coal shipped from a small category of its mines including West Elk in the fourth quarter of 2018, "as Arch continued to take advantage of the strong international market conditions that prevailed for much of the year."

Peabody said in its most recent quarterly earnings release, "Globally, coal-fueled power plants continue to be built, with approximately 56 gigawatts of new capacity added in 2018, with another some 60 gigawatts of additional capacity expected to come online in 2019."

Said Stan Dempsey, president of the Colorado Mining Association, "The six coal mines in Colorado are healthy and are continuing to produce coal for the various markets that they serve."

He said there can be variability in production from mine to mine each year, thanks to factors such as moving longwall equipment. But overall, there wasn't a big drop in production last year the way there was in 2016.

"I think this is a reflection of stability and we expect that to go on into the future," he said.

Jeremy Nichols with the conservation group WildEarth Guardians said the industry is continuing to decline, and while it will hang on for a few years, it's not sustainable anymore.

"I think the writing on the wall is Colorado's future does not include coal at this point," he said.

Dempsey acknowledged that Xcel Energy's power-generation portfolio in Colorado will change.

"On the other hand you have to realize that mines in Colorado serve different kinds of markets," he said.

These include things such as West Elk's exports abroad, Deserado's role providing its sole customer in Utah, and King II supplying coal to a cement plant, he said.

Colorado mines have been making moves aimed at helping allow for their continued operation in the future. West Elk recently received approval from a federal mining agency to produce coal from beneath about 1,700 acres of national forest roadless acreage. The decision, which still requires approval by an Interior Department official, could add an estimated two years to the mine's life.

Just over a year ago, the Bureau of Land Management approved a proposal to let GCC Energy, LLC, expand its existing King II mine lease by 950 acres. And the BLM also is considering a lease application that would provide Peabody access to 640 acres of underground federal coal next to its existing Routt County lease.

The BLM says that in 2017, coal mines in Colorado generated $35 million in federal royalties, which are split with the state. It says mining coal from BLM lands and minerals in the state in 2017 generated $742.5 million in total economic output.

As of late 2017, the BLM said there were 51 federal coal leases in the state covering 60,000 acres.