Cloud Peak Energy Voluntarily Files for Bankruptcy

May 10, 2019 - One of the largest domestic coal companies has voluntarily filed for Chapter 11 bankruptcy. Cloud Peak Energy warned of its financial problems in November of last year.

By 2018, Cloud Peak had nearly no cash, were hundreds of millions of dollars in debt, and sold less coal than it had in years. The company points to weak coal markets, while analysts add heavy investment into exports caused its problems too. Clark Williams-Derry, director of energy finance at Sightline Institute, an environmentally-focused think-tank, said the company’s big bets into Asian exports didn’t work out.

"Those bets ultimately blew up the company. Asian coal prices collapsed, and Cloud Peak’s investments in export projects turned into hundreds of millions of dollars in losses,” he said.

Andy Blumenfeld, head of market analytics for Doyle trading consultants, a boutique energy research firm, said Cloud Peak also had to compete against companies that cleared their debt in previous bankruptcies: Peabody Energy and Arch Coal.

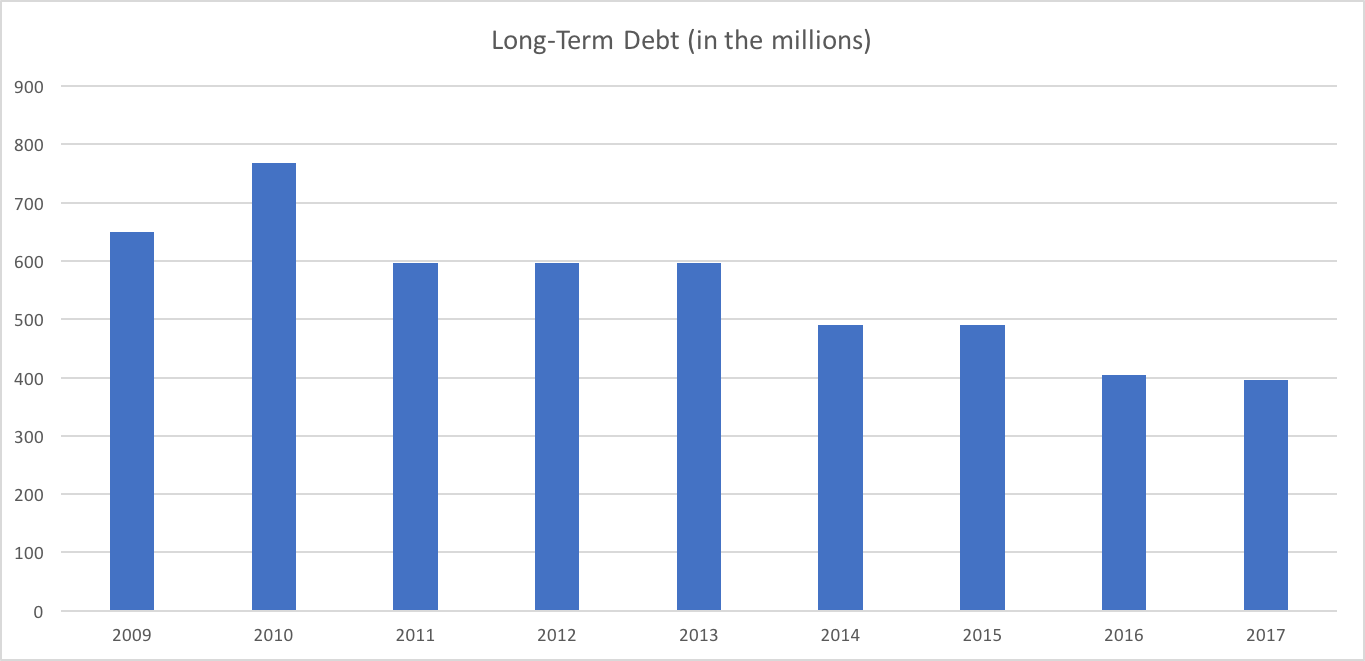

Cloud Peak's long term debt since inception

CREDIT SEC FILINGS

“They’re a good operator, but the strategy didn’t ultimately work out for them mostly because I don't think anyone foresaw the incursion into their marketplace of so much natural gas and renewables,” Blumenfeld said.

The bankruptcy comes after nearly two full months of extensions on debt payments: four in total. Blumenfeld said Cloud Peak was likely buying itself time for a white knight or potentially coming to an agreement with debt holders on restructuring. Cloud Peak’s executives also wrote it had been looking at selling its assets. Blumenfeld said it’s telling that the company filed a voluntary petition for Chapter 11 bankruptcy.

“Which makes it seem like they have some idea of how the sale will take place,” he explained. “They have a plan, but again it’s difficult to say what the plan will be."

In a statement, Cloud Peak’s CEO Colin Marshall said wrote its continuing to market sales of its assets. It has two mines in Wyoming and one in Montana. Many more filings are likely to come in coming days to shed light on their strategy.