Met Coal Relativities PLV-PMV Narrow on Shifting Market Dynamics

By Yi-Le Weng and Jessie Li

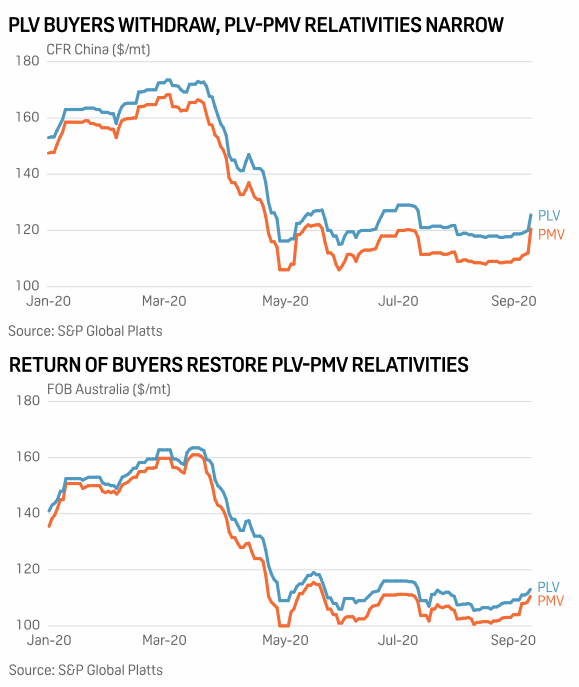

September 10, 2020 - The price relativities between premium hard coking coal of low volatile matter and mid volatile matter have narrowed, led by a gradual change observed in market dynamics, S&P Global Platts data showed.

The relativities between the two grades of coal have narrowed from a month ago to 96% for the China-bound market from 92%, and to 98% from 95% for trades done on an FOB Australia basis, Platts data showed.

The narrowing of relativities was due to a renewed demand for premium mid volatile coals from the international market as end-users were restarting or increasing their steel capacities. At the same time, demand for premium low volatile coals was significantly weaker as major steelmakers in China, utilizing the grade with high coke strength after reaction, stepped away from the market due to a lack of import quotas.

As a result, spot prices for premium mid volatile cargoes have recovered, narrowing the price gap between the two types of coals. Market participants are adjusting to the current price relativities in a fluid and fast-moving metallurgical coal market. Currently, the spotlight would be on China and developments regarding its port-related matters as the country is a key driver of spot market prices.