Trump Vs. Biden: What Does the Election Mean for US Coal Markets?

September 10, 2020 - US voters will go to the polls on November 3 to choose their next president. It’s fair to say that incumbent President Donald Trump and his Democratic rival Joe Biden have very different views on climate change and energy policy.

In 2016, Trump promised to stop the “war on coal” – a message well-received by US coal producers. But what policy changes has he made in office, and how have coal markets fared under his watch? And how might a Biden win change the picture?

Has Trump revitalized the US coal industry?

Trump came into office in 2016 with a promise to revive the coal industry. And he has taken steps towards this goal. The Clean Power Plan (CPP) – one of the Obama administration’s biggest measures to curtail greenhouse gas emissions – was replaced with the less stringent Affordable Clean Energy Rule (ACE). The Obama-era social cost of carbon calculations was also removed, while a freeze on new federal coal leases was lifted. Trump has also announced his intention to withdraw the US from the Paris Agreement.

In this, less restrictive, regulatory environment, have US coal markets thrived? Unfortunately for Trump and coal stakeholders, economics have not been on their side. Coal production in the US has fallen by 50% over the last decade, and 30% since Trump took office.

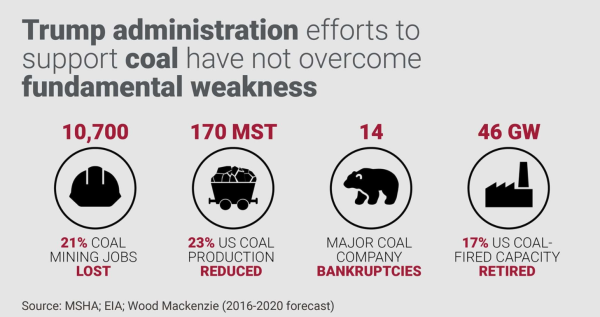

Graphic shows that Trump administration efforts to support coal have not overcome fundamental weakness

Why haven’t policy measures halted the decline of US coal?

Competition from natural gas remains the root cause of coal’s woes in the US. The explosive growth of shale gas drilling has led to massive production increases over the past two decades. As a result, US coal markets have remained under severe pressure from low-price natural gas. Henry Hub natural gas prices averaged US$3.55/mmbtu over Obama’s term in office, compared to US$2.81/mmbtu over Trump’s to date.

Meanwhile, the global political environment for coal has worsened. Financial institutions and insurers face public pressure to halt support for coal projects, with many making environmental, social, and governance (ESG) commitments to move away from the coal sector in varying degrees.

What would a Biden win mean for the US coal industry?

Biden’s stance on climate and energy differs radically from that of the current administration. In July 2020, he released his “Build Back Better” clean energy plan – a potential game-changer for US energy. The most notable point for coal stakeholders is the call for a carbon-free US power sector by 2035 – and the promise of investment in coal and power plant communities impacted by the transformation.

Could Biden deliver this change? His time as vice president offers some indication as to what we might expect from him as president. The Obama administration took a pro-climate stance, particularly in the second term, enacting several environmental and energy measures, including the CPP. Obama’s tenure began more than a decade ago, and the energy transition has only gathered pace since then globally. The scene may be set for an ambitious new plan.

It wouldn’t be easy. A 15-year timetable for a carbon-free power industry would call for an estimated US$2.2 trillion of capital investments in renewable energy and storage. And monetary barriers are only part of the equation. A federal mandate to eliminate coal-fired power plants would require powerful political support. It would also face years of pushback and litigation from opponents. Biden would likely need two terms – and potentially control over the Senate – for his plan to gain momentum.

What outcomes should coal industry stakeholders be ready for?

There are multiple potential outcomes from the US elections this November. In our insight, we take a look at three basic scenarios:

1. Trump is re-elected and Congress is split

2. Biden wins but the Republicans retain a Senate majority

3. Biden wins and the Democrats control Congress.