By Peter Brennan

September 15, 2020 - On the list of countries unveiling green fiscal stimulus policies in recent months there is one glaring omission.

Despite unleashing $3 trillion of measures to tackle the economic consequences of the coronavirus, the U.S. federal government has channeled just 1.1% toward initiatives that could help its transition to a more environmentally sustainable economy, according to Rhodium Group.

The decision by the Republican-controlled Senate to keep any green measures out of the three stimulus bills passed to date by Congress contrasts starkly with Europe, where governments have used the pandemic as an opportunity to invest in the technology they believe will drive economic growth in the coming decades. The European Union and individual member states have dedicated 20% of their combined stimulus spending to green projects, the Rhodium data show.

|

The risk for the U.S. is that it falls behind during a key period of transition for the global economy as it pivots to the use of cleaner materials and less polluting sources of energy. As the EU advances plans for a carbon border tax, which would add tariffs to imported goods depending on the emissions generated in their manufacture, U.S. exports could become less competitive if the country cannot clean up its industrial output.

"Europe believes it has a technological advantage in the green technologies. It needs and it wants to preserve that," Neil Richardson, investment director at Aberdeen Standard, said in an interview. "The green movement is definitely going to be a winner from this [coronavirus], there is going to be more fiscal expansion and that is going to be green."

EU Spends Big

The EU has dedicated €240 billion of its €750 billion Next Generation EU recovery fund to green projects, while Germany and France have set aside €50 billion and €30 billion, respectively, of their national stimulus plans for such schemes.

The €750 billion fund and a revised EU budget of €1.1 trillion combine to make up the bloc's Multiannual Financial Framework, which will provide support for members' economies as they look to recover from the pandemic. Priorities include upscaling production of clean hydrogen, boosting offshore wind energy, supporting biodiversity and greening transportation with 1 million electric vehicle charging stations and improved public transport.

South Korea and the U.K. are among other countries to have included green initiatives in their fiscal packages, with measures worth $10.9 billion and $4.66 billion, respectively, according to Carbon Brief, a website that tracks green policies.

Both the U.S. and the EU face a growing threat from China, which is also a major player in the low-carbon tech space.

Follow the leader

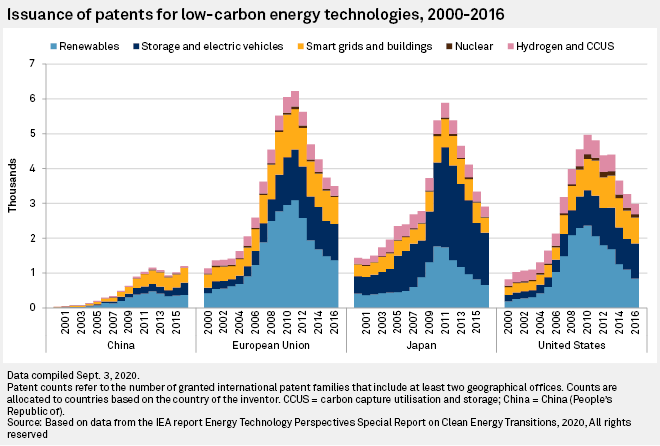

There are numerous ways to measure green technology leadership, depending on which stage of the industry you focus on. The scale of granted patents in renewables, storage and electric vehicles, smart grids and buildings, nuclear, and hydrogen and carbon capture, utilization and storage, or CCUS, suggests there is little to choose between the EU, U.S. and Japan. According to the International Energy Agency, or IEA, in 2016 — the latest available data — EU companies and institutions were granted 3,498 patents, against 2,984 for the U.S. and 2,903 for Japan. China was lagging on 1,201.

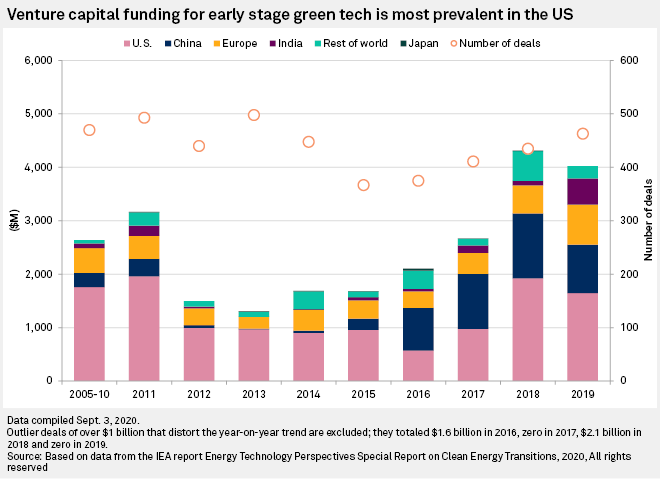

When it comes to venture capital, the U.S. is the clear leader. While investment in early-stage green tech fell from $1.92 billion in 2018 to $1.65 billion in 2019, the U.S. was still way out ahead of China's $905 million and Europe's $748 million.

By other measures, China is dominating, with its companies boasting five of the top 10 lithium-ion battery companies by shipments, installing 43.4% of all new global wind capacity in 2019 and 26% of photovoltaic solar capacity, down from a peak of 44% in 2018.

Meanwhile, Europe has a commanding position in some niches, such as offshore wind, and is keen to play a prominent role in emerging areas, including renewable hydrogen and electric vehicles. Europe accounted for $21.4 billion of the estimated $55 billion companies spent on research and development in clean energy sectors in 2019, with investment driven by the automotive sector's drive into battery electric vehicles.

Help From Above

While the U.S. is famous for its innovative private sector, with Silicon Valley home to most of the world's largest tech companies, industrial technology development tends to be more capital intensive and require greater institutional support from government and academia to carry out high-risk R&D and help to scale up technologies.

In the U.S., some of that institutional support is provided by the Department of Energy, which oversees 17 national laboratories with a combined annual budget of $16.17 billion in fiscal year 2020 that "constitute one of the largest scientific research systems in the world," according to the IEA. The labs focus on a range of energy technologies, not just green tech, and are typically privately run with ties to universities.

The Advanced Research Projects Agency–Energy, or ARPA-E, created under President George W. Bush but first funded through President Barack Obama's 2009 stimulus, has around $350 million of annual funding. Its remit includes maintaining the U.S.’ technological lead in energy technology, and "accelerating transformational technological advances" that the private sector is unlikely to pursue by itself.

More than 100 Nobel Prize winners are affiliated with the national laboratories, among them John B. Goodenough, who jointly won the 2019 Nobel Prize in Chemistry for the discovery of materials critical to the development of lithium-ion batteries.

Financial Crisis Stimulus

America's green economy did much better from the global financial crisis of 2008/9. Clean energy sectors received around $90 billion through direct funding and tax breaks as part of the fiscal response, with around $45 billion for renewable energy and energy efficiency, including expanded production tax credits for wind and investment tax credit for solar.

"In 2009, the U.S. really ramped up its spending on clean energy R&D and that was sustained over a few years," Simon Bennett, an energy analyst at the IEA, said in an interview. "Where you saw the biggest impact was where they could combine the R&D spending with other policies that created markets, particularly electric vehicles. They also gave loans and capital to battery factories and other elements in the value chain."

Government support has been key for developing green technologies elsewhere in the world, too. In Germany, for instance, government incentives enabled SolarWorld to become an early market leader in the solar photovoltaic panel industry.

"Germany transformed the market with solar," said Jeremy Nicholson, vice president of the International Federation of Industrial Energy Consumers, or IFIEC Europe. "It is highly debatable whether it was economic in the early days and at the time it seemed a bit of a bold gamble. That facilitated photovoltaic production at scale which wouldn't have occurred otherwise, and therefore there wouldn't have been a reduction in the unit cost, which has transformed the market for solar."

|

Today, the solar industry is dominated by China, which has been able to produce photovoltaic panels at scale and bring down the costs, sending a swathe of European and U.S. manufacturers into bankruptcy.

In both Europe and the U.S., development of markets for wind turbines and photovoltaics through active investment have had mixed results in terms of producing domestic industries.

"The unit cost of generating from [wind] technologies has been transformative, there is therefore a European turbine manufacturing capacity that has been built on the back of it," said Nicholson. "Whereas in photovoltaics, the benefits weren't had in Europe."

Auto Imperative

Despite holding very few patents for the technology, China is also the world's leading producer of lithium-ion batteries, something that both Europe and the U.S. with their extensive auto industries are keen to turn around.

Europe does not yet have a major player in the lithium-ion battery industry, which is dominated by Asia. In Contemporary Amperex Technology Co. Ltd. and BYD Co. Ltd., China has the world's largest and third-largest producers. Japan's Panasonic Corp. is number two, while Korean suppliers Samsung Electronics Co. Ltd. and LG Electronics Inc. rank fourth and fifth. Tesla Inc., which has partnered with Panasonic on the batteries that power its cars and energy storage systems, fell out of the top five last year.

Europe's world-beating green tech R&D spending last year was driven by the budgets of European carmakers looking to catch up after falling behind in electric vehicle development.

"This is the year that the Europeans really start to get their act together," said Al Bedwell, an analyst at LMC Automotive, an industry forecaster. "From being laggards, if all goes to plan, they'll be up there in a leadership position in a few years. They're just chucking everything at it frankly."

"The battery is where you can differentiate to some extent, and [European original equipment manufacturers] want to be in control of that as they were traditionally with their internal combustion engines," he said.

Scale Matters

One of the reasons that Chinese companies have managed to dominate green tech production is the size of their home market.

Chinese consumers bought 894,000 electric passenger vehicles in 2019, more than double the 236,000 sold in the EU and triple the 200,000 sold in the U.S., according to LMC. China installed 30.1 GW of solar photovoltaic capacity in 2019, compared with 16 GW in the EU and 13.3 GW in the U.S., according to the IEA.

The EU's green stimulus and other Europe-wide programs aim to tackle the challenges that come from having a market fragmented by national borders.

The Next Generation EU fund plans to facilitate the installation of 1 million charging points across its 28 member states by 2025.

The European Commission also created the European Battery Alliance, or EBA, in 2017 with the aim of creating a "competitive manufacturing value chain in Europe with sustainable battery cells at its core" and "prevent a technological dependence on our competitors." In May of this year, the European Investment Bank said it will provide more than €1 billion to support EBA projects, which include developing new materials, improved battery management systems and recycling.

The Next Big Thing

After fumbling its early lead in solar energy and arriving late to the lithium-ion battery party, Europe is hoping to learn from its mistakes with what it believes will be the next important green technology: clean hydrogen.

Support for "green" hydrogen, created with renewable energy, is a significant plank of the Next Generation EU fund as the EU seeks a way to decarbonize heavy industry and achieve carbon neutrality by 2050.

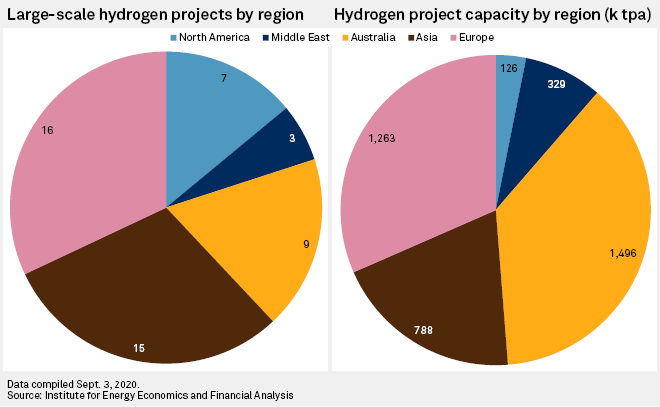

Europe and Asia are leading the way in terms of the number of hydrogen projects with 16 and 15 ongoing projects, respectively, compared with four in the U.S. Australia and Europe have the most planned capacity.

"The companies and countries that get a head start in heavy industry areas including hydrogen, they're going to get a tech lead," said Bennett. "There's a distinction between stimulus that puts money into R&D, and stimulus that pulls the technologies on the cusp of market integration into the big time. Where there has been most excitement this time round is the way the EU has framed its hydrogen package, echoing what the U.S. did in 2009."

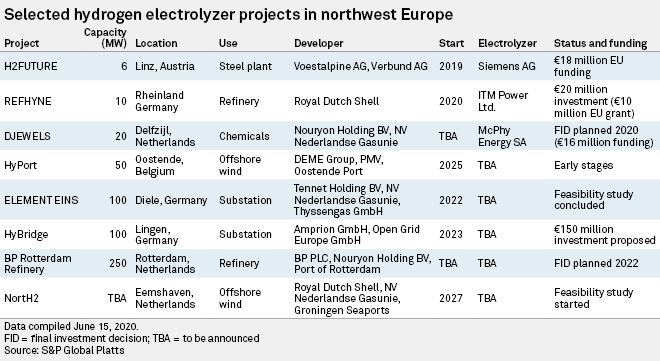

Whereas the U.S. is looking to utilize hydrogen fuel cells mainly for long-haul transport, the EU hopes to apply hydrogen to heavy industry applications, creating a virtuous circle of hydrogen supply and demand. Fertilizer production and refineries already require large quantities of hydrogen to produce ammonia and methanol, while utilizing hydrogen to replace coking coal in the production of steel is one of the more difficult applications but would be a huge step towards carbon neutrality.

The EC plans to make a proposal regarding a carbon border tax in 2021 that would reflect the carbon emissions associated with imported goods. The scheme has heavyweight backers, notably France and the domestic steel lobby group EUROFER, which hope such a tax will reduce import competition.

In an Aug. 24 report by sustainable energy think tank the Institute for Energy Economics and Financial Analysis, analyst Yong Por cited the EU as "a heavy lifter in the new global technology race," but warned the manufacture of electrolyzers, fuel cells and equipment such as hydrogen compressors and bunkering facilities would need to be significantly scaled up.

European industry is backing the drive. On Aug. 3, the WESTKÜSTE100 consortium announced the construction a 30-MW electrolyzer at the Heide oil refinery in Hamburg, Germany. The project consists of 10 partners including Electricité de France SA, Ørsted A/S, the Heide refinery and thyssenkrupp AG.

A number of steelmakers have also trialed the use of hydrogen in production processes, with Sweden's SSAB AB (publ) announcing plans to produce hydrogen steel commercially by 2026. However, such is the power consumption requirement of steel production, a switch to clean electricity via hydrogen would need investment of between €450 billion and €700 billion in extra renewable energy production, according to ArcelorMittal, Europe's largest steelmaker.

China has its own ambitious policy for hydrogen to account for 10% of total energy by 2050, although this is primarily using fossil fuels in the production process. The U.S. is lagging in development of green hydrogen, with little federal support as yet for using the energy source for industrial applications.

Yet, at least two U.S. utilities have plans to press ahead with green hydrogen. NextEra Energy Inc. announced a $65 million project in July to produce hydrogen from solar energy, while Sempra Energy — the largest gas utility in the U.S. — announced that it wants to lead in the space.

A potential Joe Biden presidency could also signal a shift in the federal government's attitude. Developing cost-competitive green hydrogen by 2030 is part of the former U.S. vice president's energy and infrastructure plan.

"The U.S. is not as vocal about hydrogen but the Department of Energy still has a major fuel cell program, while the port of Los Angeles has a project for powering long fuel freight," Bennett said.

In 2019, the port announced a trial of 10 hydrogen fuel cell trucks supplied by Toyota Motor Corporation and PACCAR Inc.'s Kenworth Truck Company for use in the ports of Los Angeles and around Long Beach in California. The state is a world leader in seeking to reduce emissions associated with transport, with the California Air Resources Board mandating zero-emission trucks by 2045.

The tech giants are also pushing technological development, with Microsoft Corp. developing hydrogen fuel cells to power its data centers in its efforts to become carbon negative by 2030.

Green Bonds

One area that the U.S. clearly leads in the green tech space is financing. As well as providing more early-stage financing for green tech, investment in scaling up green tech companies in the U.S. also dwarfs the rest of the world, contributing $7.78 billion of the $16.52 billion global total, compared with $2.86 billion in Europe.

The EU is hoping to use its green pandemic stimulus to improve the financing environment for green tech companies through the creation of a pan-European green bond market.

The EU may sell €225 billion of green bonds to fund the stimulus package, creating a benchmark that will make it easier for companies to raise money for green projects. While €116.7 billion of green bonds were sold in Europe last year, compared with $51.3 billion in the U.S. and $31.1 billion in China, they are not yet fulfilling the same function as the venture capital market in the U.S., according to Bennett.

S&P Global Ratings calculated that 80% of the global proceeds of green bonds in 2019 went toward renewable energy, energy efficiency of buildings and clean transport initiatives, but these were usually projects to install capacity driven by utilities, real estate and transportation companies, rather than to develop technology.

While the EU tries to emulate parts of the U.S. system that brought the world tech giants including Alphabet Inc., Apple Inc. and Facebook Inc., it is also betting that green tech is a different beast that requires more than a college dorm room or garage and some lines of code to get off the ground.

"There's broad agreement on the importance of government, whether it's supranational or state/federal," Bennett said. "There are particular functions that government can fulfill in terms of the higher risk R&D that is conducted when research institutions are well capitalized with the right framework."

.gif)