Asian Coking Coal Poised for Late-Year Rebound

By Rou Urn Lee

September 16, 2020 - Asian seaborne coking coal prices have rebounded from four-year lows on new supply risks and returning demand by major consumers.

Tighter coal import restrictions into China have been the main weight on markets. But this pressure is giving way to expectations for looser imports restrictions late in the year, wet weather risks in Queensland and a surprise fourth-quarter mine disruption that have compelled trading firms to take positions in an otherwise bearish market.

Three cargoes of premium mid-volatile Peak Downs North or Riverside for October loading were sold to Chinese steel producers yesterday at $125-128/t cfr China, $18-21/t higher than similar cargoes sold just about a month ago.

The Argus premium low-volatile hard coking coal fob Australia index has risen by 13.5pc, or $14.15/t, to $119.15/dmt from a four-year low of $105/t a month ago. The corresponding cfr China index has increased by 10pc, or $12.30/t, to $130.05/t over the past week.

Australia raised its forecast for La Nina conditions to a 70pc chance last month, raising the prospect of wet weather that could disrupt coking coal supplies in Queensland and New South Wales states by the end of this year.

UK-Australian mining firm BHP said yesterday it will carry out a major dragline shutdown at its Saraji mine in the fourth quarter, which is likely to limit supplies further now that Chinese buyers are starting to emerge. This premium low-volatile coking coal, along with Peak Downs, are highly preferred brands in China where there are limited supplies of premium low-volatile and low-sulphur coal domestically.

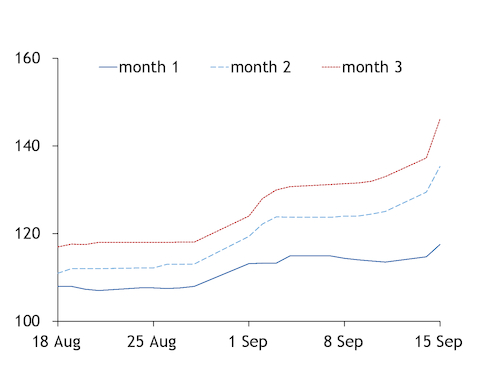

The forward curve reacted to the Saraji news yesterday with September rising by $2.80/t from the previous day to $117.50/t, October up by $5.85/t to $135.30/t and November up by $8.80/t to $146.05/t.

Market participants said the maintenance is probably planned, and the supplier will ensure it has sufficient inventories to fulfil long-term contract obligations. But others countered that it might remove any additional supplies for the spot market, which could be enough to send prices higher.

"The dragline shutdown at the Saraji mine could slow things down for the best part of the last quarter," an international trader said. "While it is not that major news, it could just give enough of a push for prices to really take off, especially with the bullish sentiment in the market right now."

While Saraji occasionally can fetch a premium in the Chinese market, steel producers there are mostly unfazed by the maintenance. "Most buyers in China do not have strict preference for Saraji over Peak Downs, because the two brands are usually seen as perfectly replaceable with the other," an east China steel producer said.

India's steel demand has rebounded quickly for its large blast furnace-based steel producers, lifting steel prices and August steel sales above year earlier levels.

Coking coal curve ($/t)