November 10, 2020 - Powder River Basin coal production had an upsurge in the third quarter, returning from second-quarter lows exacerbated by weak demand due to the global pandemic, while volumes remained well below year-ago totals.

|

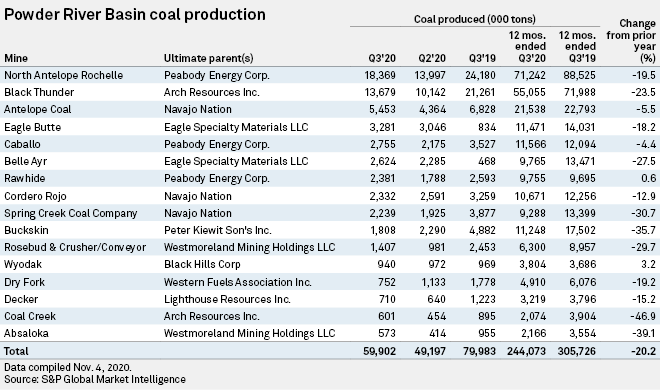

Coal miners reported 59.9 million tons of coal production from the Powder River Basin in the three-month period ended Sept. 30, according to an S&P Global Market Intelligence analysis. That is up 21.8% compared to the second quarter but 25.1% below coal output in the third quarter of 2019. Production from the region has fallen 43.5% compared to the 106.1 million tons produced in the third quarter of 2015.

Coal production from the country's largest mining region decreased 20.2% to 244.1 million tons for the 12-month period that ended with the third quarter.

The Powder River Basin's future is in question after the Federal Trade Commission successfully blocked an attempted joint venture in the region between Arch Resources Inc. and Peabody Energy Corp. Since then, Arch has said it is exploring options for exiting thermal coal, including winding down operations or finding a buyer for its thermal coal assets.

"We're finalizing our plans to shrink the footprint of these [thermal coal] operations with particular emphasis on our Powder River Basin mines, where we are prioritizing the reduction in our asset retirement, bonding and related closure obligations," Arch President and CEO Paul Lang said on an Oct. 22 earnings call.

Black Thunder, the second-largest coal mine in the United States, produced 13.7 million tons of coal in the third quarter, down from 21.3 million tons the year before. Arch COO John Drexler expects Black Thunder to continue generating meaningful amounts of cash as the company aims to shrink the mine's footprint in response to demand, the executive said on the call.

Peabody's North Antelope Rochelle mine, the largest coal mine in the country, produced 18.4 million tons of coal in the third quarter. Production improved 31.2% quarter over quarter but decreased 24.0% year over year.

Long-term prospects for the region look increasingly dim as coal plants are retired by the nation's power generators, which are making no plans for new coal plants. A recent analysis by Market Intelligence found that 30.8% of coal deliveries shipped out of the Powder River Basin in 2019 went to coal plants that have already set retirement dates through 2042. Additional coal plants have been announced since, including several that buy coal from the Powder River Basin.

Across the 16 coal mines in the basin, two increased coal production in the 12-month period that ended Sept. 30. More than six of the mines reduced output by more than a quarter in the 12-month period.

On the other hand, only three mines reported lower production in the third quarter than in the prior quarter as production bounced off low second-quarter production figures. Two relatively new entrants into the Powder River Basin, Eagle Specialty Materials LLC and the Navajo Nation's Navajo Transitional Energy Co. LLC, increased net coal production across their portfolios in the third quarter compared to the prior quarter.

While Powder River Basin coal prices remained below $12 per ton through the summer, Market Intelligence recently forecast that long-haul PRB 8800 coal prices could hit $13 per ton in 2022 due to higher natural gas prices making coal power more profitable. The forecast also suggested declining natural gas prices and coal retirements will again put pressure on coal demand after 2022.

.gif)