US Coal Exports to 7 of Top 10 Destinations Declined in Q3'20

By Jacob Holzman

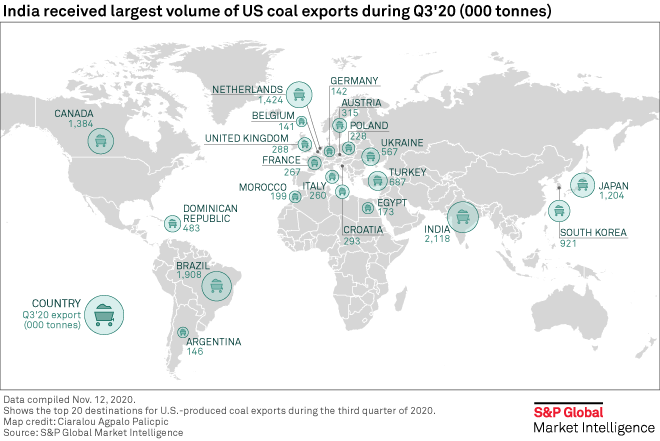

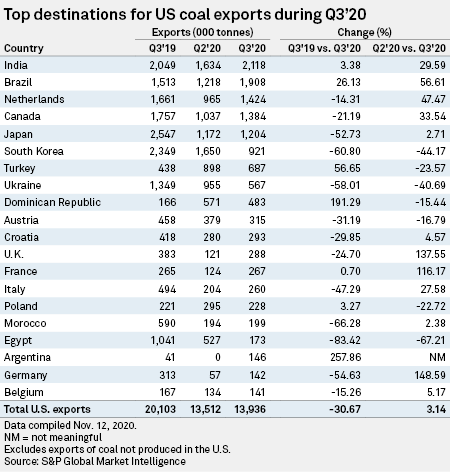

November 25, 2020 - Seven of the top 10 destinations for U.S. coal exports reduced shipments in the third quarter and total exports dragged while only mildly improving quarter over quarter as the global economy rebounded from the initial shock of the coronavirus pandemic.

U.S. coal exports totaled 13.9 million tonnes in the third quarter, down 30.7% from 20.1 million tonnes shipped in the prior-year period, according to data compiled by S&P Global Market Intelligence. Deliveries rose by 3.14% compared to the previous quarter, which could indicate recovering global coal and steel demand among popular U.S. coal customers hit by the pandemic.

Global demand for thermal and metallurgical coal has stabilized in the wake of the coronavirus's initial blow, according to analysts. Improvements in the supply and demand balance in the global coal industry are expected to "modestly" lift coal pricing in most regions in 2021, Moody's said in a Sept. 29 note. In a separate Oct. 7 report, Moody's said demand for steel was strengthening in the automotive and industrial sectors while remaining resilient from the construction sector.

Deliveries to India, the most popular destination for U.S. coal, grew 3.4% to 2.1 million tonnes from 2.0 million tonnes. U.S. coal exports to India recovered by nearly 30% quarter over quarter. The country locked down in the pandemic's initial days, and the Indian government imposed a mandatory quota on domestic sourcing of coal, which has eased.

Coal companies have informed investors that the coronavirus will remain a risk in the global coal market. While Australian coal company Whitehaven Coal Ltd. partially attributed an increase in its third-quarter sales volumes to "strong" coal demand in India, the company warned analysts on a recent earnings call that it was unsure about the stability of Indian demand in 2021 given the country's difficulties controlling the pandemic.

"Our markets have done pretty well generally, but for India, India is having a tough time of course," Whitehaven CEO and Managing Director Paul Flynn said during an Oct. 14 earnings call. "So I reckon our markets will be on the front end of a recovery phase."

U.S.-based CONSOL Coal Resources LP recorded a pickup in inquiries and activity in India during the third quarter as the country loosened coronavirus-related restrictions, executives said on a Nov. 5 earnings call. The company had "very little contract in the export market" in 2021 at the time and was trying to "get a little bit more clear picture here going forward on the export market," CONSOL Vice President of Marketing and Sales Robert Braithwaite said on the call.

"We were on pace for our 10 million-ton goal, 10 million tons of exports this year, and then we had to shut down across the globe," Braithwaite said. "We have seen some pickup here in the third quarter and into the fourth."

Deliveries to seven of the top 10 destinations for U.S. coal fell into the red in the third quarter, with Canada, Japan, South Korea, Turkey, Ukraine and Austria shipping less coal. The Dominican Republic had the widest gains in shipments among the top 10 destinations, receiving 483,000 tonnes, compared to 166,000 tonnes in the year-ago period.