2030 is the New 2050: Utilities Pressured to Hasaten Decarbonization Goals

February 6, 2021 - With an increasing number of electric utilities setting aspirational midcentury decarbonization goals that lack enforceable milestones, environmental groups are training their sights on a closer target: the year 2030.

The development was made clear last week in a new report released by the Sierra Club, an advocacy group whose Beyond Coal campaign has been at the forefront of efforts to shutter thousands of megawatts of coal-fired capacity over the last decade. Long before a wave of coal plant retirements gained steam, the campaign envisioned a 2030 target for eliminating the country's coal plants.

"2030 is the new 2050," said co-author Leah Stokes, an assistant professor of environmental politics at the University of California at Santa Barbara. "We have learned that the clock is running short and that we have procrastinated for too many decades."

According to the latest special report from the United Nations Intergovernmental Panel on Climate Change, the world needs to cut its planet-warming emissions by about half by 2030 relative to a 2005 baseline to avoid catastrophic effects from climate change.

States such as Washington and Colorado have already set legislative requirements for power companies to cut emissions by 80% by 2030 compared to 2005 levels, but most states in the U.S. have yet to set similar 2030-specific goals.

Assigning utilities an A to F grade based in part on their plans to retire coal-fired units by 2030, the Sierra Club's report gave parent companies with net-zero climate pledges an average score of 20 out of 100 — just above a cutoff of 17.5 for a failing grade, according to the group's criteria. Utilities without such a pledge received an average failing score of 14.

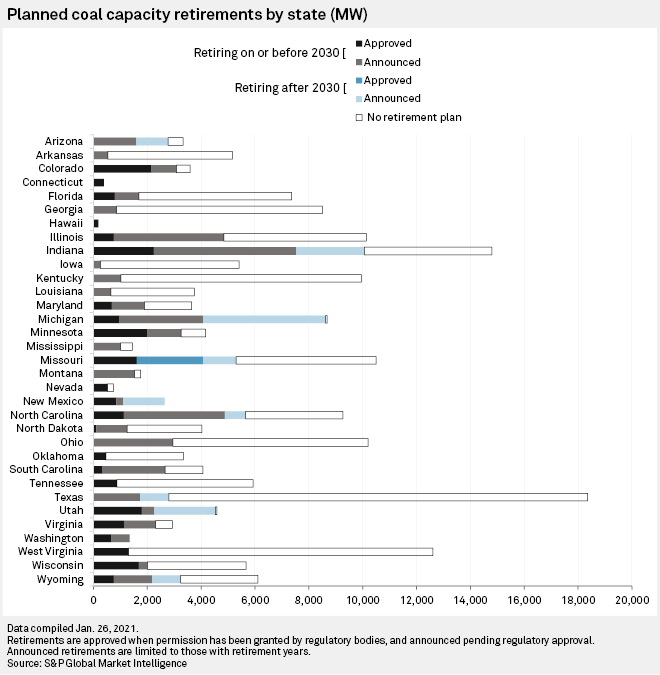

The report highlighted how coal plants operating in regulated states without competitive power markets are insulated from pressure by low-cost renewable energy resources, previewing looming fights ahead in states where companies have unannounced or unconfirmed coal retirement dates.

Utilities are pushing back, arguing that they need to account for cost and reliability concerns as part of a number of planning scenarios. But the report's co-authors countered that a steady drumbeat of scientific reports show deep decarbonization can be achieved reliably with cost savings that flow to consumers as a result of a shift to renewable power.

Recent studies by researchers at Princeton University and the University of California Berkeley, for example, have found that replacing existing coal plants with clean energy would save consumers money while greening the grid amid a surge in electricity demand. Morgan Stanley analysts wrote Feb. 1 that they are modeling a U.S. electricity grid that is 55% renewables, 17% nuclear, approximately 16% natural gas, 8% hydro, 4% other and 0% coal by 2035.

'Can No Longer Compete'

Stokes, who co-authored a separate report on how to pass a national clean energy standard through the congressional budget reconciliation process, said she sees the next 10 years as a historic moment for the electric utility industry.

"If they could just see the potential that their industry has before them in terms of creating new jobs and having massive amounts of investments, I think that they could realize that it's actually in their interest to start making dramatic progress this decade," Stokes said.

Out of 50 parent companies the Sierra Club analyzed, however, the report found that 33 companies with public climate goals have "an enormous gap between utilities' current practices and what they need to do to protect people and the planet."

President Joe Biden has set an ambitious goal of decarbonizing the U.S. power sector by 2035, but Stokes said she still expects much of the climate action ahead to play out not at the federal level but before state public utility commissions in regulated states that exist outside wholesale power markets overseen by the Federal Energy Regulatory Commission.

"Where we don't generally have a coal problem is in areas where we've restructured the market because coal can no longer compete," Stokes said.

Stokes' comments follow a recent request by the Renewable Energy Buyers Alliance — a coalition of corporate giants that includes Google LLC, Amazon.com Inc. and Walmart Inc. — for federal lawmakers and FERC to expand competitive wholesale power markets as part of a national grid decarbonization strategy.

The scores of Duke Energy Corp., a North Carolina-based utility with vertically integrated operations in five states, ranked near the very bottom of the list of 50 parent companies the Sierra Club analyzed. As a case study, the report noted that out of 54 million MWh of coal generation operated by Duke Energy Florida LLC, Duke Energy Indiana, LLC, Duke Energy Kentucky Inc., Duke Energy Carolinas LLC and Duke Energy Progress LLC in 2019, only 11% is "firmly committed to retire by the end of 2030."

"Why are these coal plants still open?" Stokes asked. "Well, because utilities didn't shut them down when they should have. They decided to retrofit them and put enormous amounts of new debt them, and they made bad decisions."

Utilities' Response

Duke Energy spokesperson Meredith Archie noted that the company's 2020 integrated resource plans in the Carolinas present six "out of many possible" generation pathways that project emissions reductions of 56% to 71% by 2030. Each keeps Duke Energy on a trajectory to meet a near-term carbon reduction goal of at least 50% by 2030 in the Carolinas, Archie said in an email. Duke Energy has set a goal of achieving net-zero emissions by 2050 and aims to cut emissions by 50% from 2005 levels by 2030.

"While we welcome all perspectives, not all parties have the same responsibility we do for providing energy that's cleaner, reliable and affordable," Duke Energy said in another statement.

The top five parent companies that plan to continue to operate coal plants without any plans to retire them identified in the Sierra Club report were Duke Energy, Berkshire Hathaway Inc., Southern Co., American Electric Power Co. Inc., and PPL Corporation

Like Duke Energy, many power generators have targeted 2050 rather than 2030 for decarbonization. In response to the report, PPL said it has reduced carbon emissions by 56% from 2010 levels as of the end of 2019 and is "confident that we can achieve significant reductions before 2050."

Southern set a goal of net-zero operations by 2050 and is "embracing an orderly transition of our coal fleet," the company said in a statement to S&P Global Market Intelligence. The power generator is projecting that its full-year generation from burning coal in 2020 will be less than 20% for the first time in modern history.

Some of the utilities also pointed out that plans are evolving as companies continue to evaluate their fleets' economics.

PacifiCorp "has not made a specific pledge regarding coal unit retirements at an arbitrary date," said David Eskelsen, a spokesperson for PacifiCorp, which Berkshire Hathaway owns. He said that of the 24 coal-fired units serving PacifiCorp customers, the company's preferred portfolio includes the retirement of 16 units by 2030 and 20 units by 2038 based on an integrated resource plan completed in October 2019. PacifiCorp expects to file a new plan in April 2021.

While AEP has reduced its carbon emissions by 65% from 200 levels, it expects to reduce its coal capacity by 5,600 MW by 2030, AEP spokesperson Tammy Ridout said. The company expects to complete a climate change scenario analysis that will review its carbon goals and "look at different scenarios on our path to a clean energy future" in the first quarter, she added.

Emily Grubert, an assistant professor in Georgia Tech's School of Civil and Environmental Engineering who researches coal retirements, said one underrated angle to watch in the coming decade is upstream supply.

"One of the things that is actually very interesting to me to watch is, a lot of these places with big coal plants in regulated markets that aren't necessarily planning to close anytime soon actually don't control their own coal supply," Grubert said. "That kind of thing, I think, we haven't really started to see yet, where upstream infrastructure closures are really affecting downstream infrastructure closures."