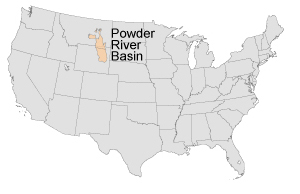

February 11, 2021 - A sharp decline in coal demand from the U.S. power sector is wreaking havoc on the Powder River Basin as mine operators in the region scaled back production during 2020 with few indications of improved prospects for volumes.

|

Production in the country's largest coal-producing basin fell 21.8% year over year in 2020, and two of the largest producers in the region have indicated that 2021 may not be much better.

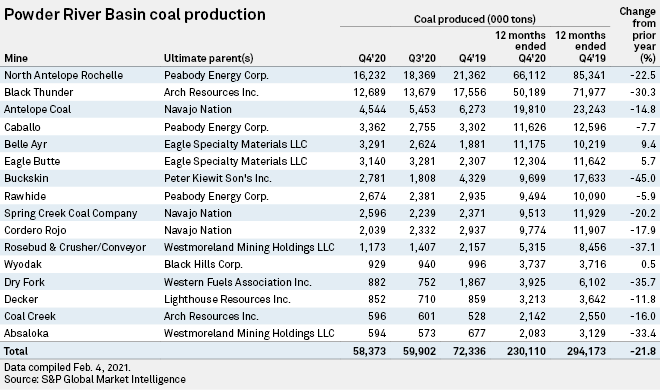

Powder River Basin coal producers mined 230.1 million tons of coal in 2020, down from 294.2 million tons in 2019. Quarterly production slid from 59.9 million tons in the third quarter of 2020 to 58.4 million tons in the fourth quarter. The U.S. Energy Information Administration recently projected U.S. coal demand would bounce back 12% in 2021 after U.S. production fell to pandemic-driven lows in 2020, but production guidance regarding the coal basin has been less optimistic.

Arch Resources Inc. announced Feb. 9 that it is proceeding with an accelerated closure and final reclamation of the Coal Creek mine in the Powder River Basin after fulfilling its 2021 contracts. Another of the 16 mines in the region, Lighthouse Resources Inc.'s Decker operation, recently ceased production. The company filed for bankruptcy in late 2020 while noting the contract with the mine's sole buyer expires in early 2021. Already, the company's mining costs were exceeding its sale price, according to bankruptcy documents.

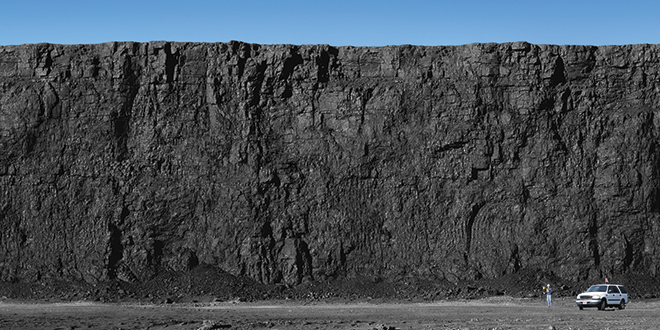

Peabody Energy's North Antelope Rochelle operation is the largest coal mine in the U.S. The mine produced 16.2 million tons of coal in the fourth quarter of 2020, decreasing 22.5% year on year.

Source: Peabody Energy Corp.

Only a few weeks apart, the Coal Creek and Decker announcements mark the first mine closures in the Powder River Basin in modern history.

While Arch Resources' Coal Creek mine is one of the smallest mines in the region by production, the company said Feb. 9 that it is also "laying the groundwork for systematically reducing the operational footprint at its Black Thunder mine." The Black Thunder mine is the second-largest coal producer by volume in the United States and produced 21.7% of the coal mined in the Powder River Basin in the fourth quarter of 2020.

Arch Resources has been pivoting its focus to its metallurgical coal operations in the eastern U.S. as power plant closures in the country continue to whittle away at demand for thermal coal.

"We are driving ahead with our strategic pivot with a strong sense of urgency," Arch Resources CEO and President Paul Lang stated in the company's Feb. 9 earnings release. "Our objective is to continue to harvest value and cash from our legacy thermal assets, even as we execute on reducing our long-term closure obligations in a measured, systematic and sustained way."

While buyers for U.S. coal assets have not been abundant in recent years, Arch Resources noted that is exploring strategic alternatives for its Powder River Basin assets as it ramps down its footprint.

Peabody Energy Corp. recently indicated its Powder River Basin thermal coal production is expected to remain flat in 2021. The company produced about 38.1% of the coal mined from the Powder River Basin in the fourth quarter of 2020. While Peabody does not expect its Powder River Basin demand to bounce back, it is also planning on reduced operations in 2021 at its other U.S. thermal coal mines due to coal plant retirements.

"Our U.S. thermal customers generally take higher volumes in the fourth quarter to meet their full-year commitments," Peabody Energy Executive Vice President and CFO Mark Spurbeck said on a Feb. 4 earnings call. "Together with the slower start to winter, we expect first-quarter shipments to decline modestly."

Only two coal mines recorded substantial year-over-year coal production increases in the Powder River Basin in 2020. Eagle Specialty Materials LLC's Belle Ayr and Eagle Butte mines reported increases of 9.4% and 5.7%, respectively, over 2019 levels. However, both mines were temporarily idled in 2019 due to complications with the bankruptcy of previous owner Blackjewel LLC, and cumulative production in 2020 was 33.9% below 2018 production totals.

Coal production at Black Hills Corp.'s Wyodak mine ticked up 0.5% year over year. The mine primarily provides coal to nearby power facilities.

.gif)