Shut Off From Conventional Capital, US Coal Companies Seek Creative Options

June 3, 2021 - The U.S. coal sector has limited access to capital, in large part due to concerns about the industry's environmental impacts and its long-term viability, but some companies have found ways to tap into alternative financing.

Increased investor focus on environmental, social, and governance issues has been increasing the pressure on the U.S. coal sector, particularly for producers supplying coal to domestic electricity generators. While the COVID-19 pandemic weighed on the broader economy in 2020, companies in other industrial sectors were still able to tap into debt issuances such as unsecured bonds and secured term loans, Moody's Investors Service analyst Benjamin Nelson said.

A worker uses a continuous mining machine on an underground coal seam at an operation in West Virginia. The demand for U.S. coal is expected to improve in 2021 compared to the prior year, but coal companies continue to have limited sources of capital.

Source: Thorney Lieberman/Photodisc via Getty Images

"We have not seen that in the coal industry," Nelson said in a May 25 interview. "We have seen [coal] companies that are pursuing projects getting pretty creative."

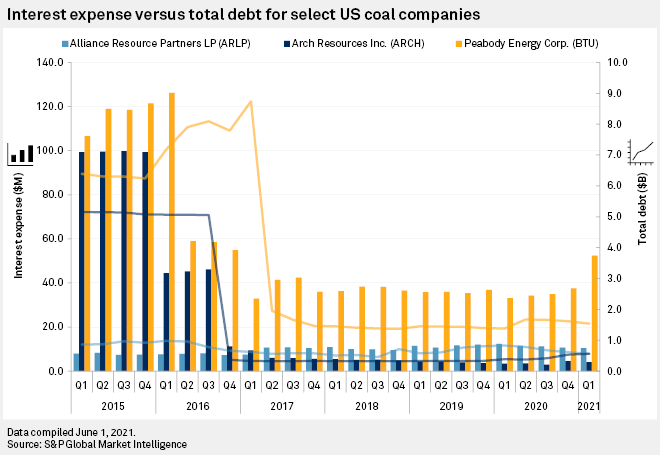

Nelson pointed to Arch Resources Inc.'s recent efforts as it builds out its Leer South metallurgical coal mine in West Virginia. Arch, which expects to employ approximately 1,650 people at the mine, issued $45.0 million in tax-exempt bonds through the West Virginia Economic Development Authority. The company issued a similar $53.1 million offering in 2020. Arch also closed on a $54 million equipment financing facility in early 2020 and priced an upsized convertible note offering of $135.0 million in October 2020.

Consol Energy Inc. President and CEO Jimmy Brock said on a May 4 earnings call that the company was "dedicated to identifying and executing alternative sources of capital." For example, the company recently priced $75 million of tax-exempt solid waste disposal revenue bonds through the Pennsylvania Economic Development Finance Authority. Consol expects the transaction to free up operating cash flow earmarked for the refuse area at its Pennsylvania coal mining complex.

Thermal coal producer Alliance Resource Partners LP Senior Vice President and CFO Brian Cantrell said on an April 26 earnings call that, while there have been some investors who will not invest in companies mining coal used for power generation, "there remains a very wide, deep pool of capital that continues to be available to thermal coal." However, the executive also said the costs of available borrowing opportunities are higher than they should be, and Alliance is assessing new pools of capital.

Alliance President and CEO Joseph Craft said on the same call that ESG issues are leading investors to discriminate against a "well-run coal company like ours." The company is offered double-digit rates instead of single-digit rates because it is a coal producer, Craft said.

Natural Resource Partners LP is also erring on the side of caution regarding its liquidity due to concerns about access to capital from credit or equity markets, President and COO Craig Nunez said during a May 6 earnings call. The Texas-based owner of interests in coal, aggregates and industrial minerals across the U.S. has also been searching for new ways to diversify its revenues with carbon sequestration and renewable energy projects.

Credit ratings for many of the larger U.S. coal producers improved from a year ago, according to S&P Global Market Intelligence data. However, none of the publicly traded coal mining companies have an "investment grade" rating. The lack of recent activity suggests the coal sector's ability to go to the unsecured bond market or traditional bank lenders for new money or to refinance existing instruments is "severely limited," according to Nelson.

Shrinking Investor Base

Peabody Energy Corp. was the last U.S. coal miner to attempt an unsecured offering, Nelson said. The late-2019 effort was unsuccessful, and Peabody faced numerous challenges in the months following, but the company ultimately completed a debt restructuring. Peabody agreed in May to issue common stock in exchange for up to $15.5 million of its 6% senior secured notes due March 2022.

A growing list of banks, insurance companies and other financial institutions around the world are making public pledges to exclude coal or other fossil fuels from investment portfolios and customer bases. Pressure to address ESG issues is limiting coal's access to capital more than decisions based on internal rates of return or other metrics, S&P Global Ratings analyst Vania Dimova said.

"We still see some of those investors that have announced that they are exiting the coal market are hanging on, are invested in certain coal companies," Dimova said in a May 26 interview. "From that perspective, refinancing will be even more difficult because as these term loans and notes are kind of rolling off or maturing, that investor base is shrinking."

Dimova noted that the alternative forms of financing coal companies have tapped into are generally more expensive than term debt. However, many coal companies already have expensive notes and are able to use the financings to pay down higher-rated debt.

Metallurgical coal producer Ramaco Resources Inc. CEO and Executive Chairman Randall Atkins said in a May 25 interview that, while some sources of capital are limited, few coal companies are announcing new projects that require funding. Ramaco is funding new mines in West Virginia with a combination of working capital, small equipment credit lines and free cash flow.

Dead on Arrival

Companies that produce metallurgical coal that used to make steel have more access to capital than those that sell coal used to generate electricity, Atkins said. "Thermal [coal] is dead on arrival," the CEO added. "I just don't think there's capital out there for virtually any types of thermal development."

A group of 15 U.S. state treasurers led by West Virginia Treasurer Riley Moore recently wrote a letter critical of the Biden administration over reports of officials pressuring U.S. banks and financial institutions to refuse to lend to coal, oil and gas companies.

"I don't think it's fair for us to have banks handling our people's tax dollars when they're diametrically opposed to our industries and our way of life," Moore told Market Intelligence.

While the states are not "going to go tear up banking contracts today," Moore said May 26 that the officials will be paying close attention to banks that decline to lend to fossil fuel companies.

"We're not telling any bank to not assess risk and things like that as they decide what they're going to undertake in terms of financing, but to not succumb to this, what I'd call woke capitalism, and cutting off what are legal industries in the United States from any capital or financing, which is going to then end up crushing our economy," Moore said.