|

Signature Sponsor

November 9, 2025 -

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge. Warrior Met Coal Investment Narrative RecapTo invest in Warrior Met Coal today, you need confidence in the company’s ability to pivot quickly, execute large-scale projects efficiently, and capture growth from higher steelmaking coal demand, even as pricing remains under pressure from weak global steel markets and increased Asian sales exposure. The early Blue Creek longwall startup boosts Warrior's production outlook, strengthening the key short-term catalyst: achieving higher, lower-cost volumes. However, risks tied to soft coal pricing and concentration in volatile Asian markets remain present, with the news event not eliminating revenue volatility risk. Among recent company announcements, the updated 2025 production and sales guidance is most relevant: management raised output expectations by 10% following the early Blue Creek ramp. This directly supports the main catalyst of accelerated volume growth, while revealing both operational strength and the inherent risk that increases in supply must still meet market demand in a challenging industry climate. Yet, against these operational gains, investors should also know there is … Read the full narrative on Warrior Met Coal (it's free!) Warrior Met Coal's outlook foresees $2.0 billion in revenue and $636.5 million in earnings by 2028. This scenario assumes 18.8% annual revenue growth and a leap in earnings of $596.2 million from the current $40.3 million. Uncover how Warrior Met Coal's forecasts yield a $74.00 fair value, a 9% downside to its current price. Exploring Other Perspectives

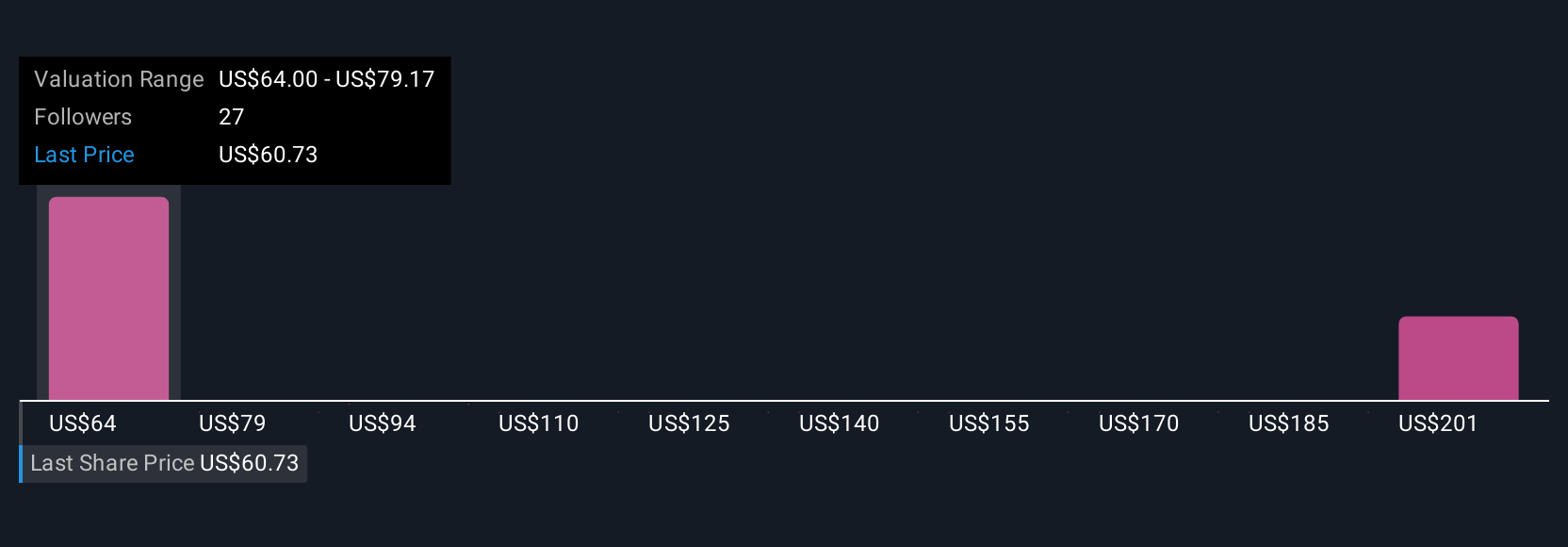

Four fair value estimates from the Simply Wall St Community range from US$74 to US$155.71, highlighting significant differences in expectations. With Asian demand shifts shaping Warrior Met Coal’s future earnings potential, you can see how different viewpoints play a part in market performance. Build Your Own Warrior Met Coal Narrative

|

|