Arch Coal’s Shares Could Catch Fire

By Jack Willoughby

December 3, 2016 - Arch Coal knows how the canary feels.

With the price of one of its two main coal products down 31% in 2015, and the other off 12%, the debt-choked coal miner was tossed down the bankruptcy shaft in January. Shortly thereafter, Peabody Energy (ticker: BTUUQ) also sought protection from creditors, joining several other coal miners. They were done in by China’s overproduction and subsequent weakened demand as growth there slowed; environmental worries; tighter U.S. regulations championed by politicians like then-presidential favorite Hillary Clinton; and a huge drop in the price of natural gas, a rival power-generating source for electrical utilities.

Arch’s stock price fell by 94%, to 99 cents, in 2015 before the bankruptcy filing completely wiped out common shareholders.

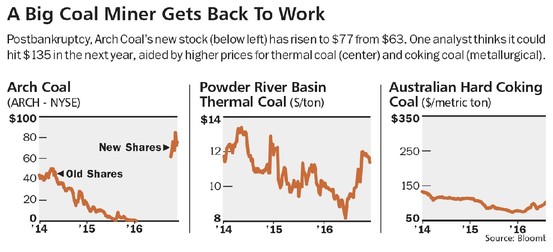

But, finding some oxygen, Arch (ARCH) emerged from bankruptcy court in October as a different company, operating in a different world. The price of thermal coal—Arch’s dominant product and the one that utilities use to generate electricity—has jumped 13% since January, while its No. 2 product, metallurgical coal, used in steel-making, has gained more than 294%.

What happened? Beijing implemented “supply side” controls—limiting the number of days coal miners could operate—to cut production, only to find itself short of electrical supply as winter approached. It had to go offshore to Australia and elsewhere for coal to ensure its citizens would stay warm. Also, Donald J. Trump defeated Clinton, raising the possibility of eased environmental regulations, and natural-gas prices showed signs of rising, relieving some of the pressure on coal.

“Arch’s timing coming out of bankruptcy couldn’t have been better,” says Arthur Calavritinos, a former portfolio manager turned private investor who owns Arch shares. In just a couple of months, the stock has increased to $77 from $63 and has the potential to go much higher if coal prices—often volatile—remain steady or rise. Another bull, Jeremy Sussman, an analyst at Clarksons Platou Securities in New York, thinks the stock could top $100—possibly going as high as $135—within the next year, depending on how high, and for how long, coal’s price rises.

Arch CEO John W. Eaves agrees that circumstances have changed, and he told Barron’s he was surprised at the election of Trump, a friend of fossil fuels. He met with then-candidate Trump and expects the new president to try to stop the forced closure of more plants. “All we’re asking for is to put all fuel sources on an even footing. Stop subsidizing alternatives,” says Eaves.

St. Louis-Based Arch, which operates some of the biggest mines in Colorado, Illinois, Kentucky, Maryland, Virginia, West Virginia, and Wyoming, is likely to benefit from the shifts in supply and demand as it picks up orders for thermal and metallurgical coal, both at home and from China, which consumes nearly half of the world’s supply. Despite the market’s struggles, Arch has become one of the U.S.’s top-grade coal producers, notes Lucas Pipes, an analyst at FBR. The new Arch, he says, offers “a combination of high-quality operating assets, a conservative balance sheet, and an experienced management team.”

Arch has reduced operating costs at its metallurgical-coal mines in the past three years by 30%, to an estimated $49 per ton, down from $70 in 2013. That makes it among the most price-competitive and efficient U.S. miners. At its peak, Arch had a workforce numbering close to 7,000, produced nearly 140 million tons of coal a year, and generated annual revenue of about $3 billion. This year, its roughly 4,000 workers are expected to extract about 100 million tons of coal and deliver revenue near $2 billon. Over several years, Arch has closed more than 32 mines that could no longer compete profitably in changing markets, says Eaves.

Its balance sheet has also been remade. Postbankruptcy debt has dropped to $363 million from $5.1 billion, and annual interest expense has fallen to $33 million from $362 million. “Arch’s operations—on both the metallurgical and thermal sides—are sustainable in any market environment,” the miner boasted in an investor presentation.

No one is suggesting that coal will regain a big share of the U.S. energy market, only that its decline may be uneven—with occasional periods of price stability and, as in recent months, increases. U.S. coal production slid to 900 million tons in 2015 from 1.2 billion in 2008—a drop of 25%. In 2017, it’s expected to total 768 million tons, according to the Energy Information Administration. Overall, coal produces about 33% of the U.S.’s electricity, down from 46% a decade ago. Natural gas, which many experts expect to rise from $2.42 to average $3.23 per million British thermal units over the next four years, now also accounts for 33%.

But investors should be mindful that the U.S. accounts for only 12% of global demand, compared with China’s 49%. Sustained by growing demand from much of Asia, coal’s share of global heat and power generation has remained steady, at 40%, for most of the past 40 years, says the International Energy Agency. Worldwide, China’s policies are more influential, and its “production curbs could help the global thermal market see its first supply deficit since 2011,” notes Sussman.

While that should support thermal-coal prices near the current level of $11.50, it’s the potential jump in the metallurgical, or met, market that could provide the pop for Arch’s shares. “We are in the first year of a multiyear bull market for met coal,” says Sussman, who recently raised his price estimate to $180 from $105 per ton. (He calculates his estimates based on actual contract sales, which show the same upward trend, but at lower levels than the spot-market prices in our chart.)

The strains on supply are attributable not only to China’s production curbs, but also to bad weather and floods that have hindered output there, which typically amounts to about 42% of the world’s total, says Sussman. At the same time, Chinese steel production has regained strength, and steel makers need to restock coal holdings, notes a recent Bank of America Merrill Lynch report. Aging Australian coal mines aren’t as efficient as those of U.S. miners like Arch, now the largest U.S. producer of metallurgical coal.

“Arch offers investors a rare equity vehicle with coking-coal exposure at a time when supplies of this material have tightened again,”says Sussman.

Higher coal prices should translate into more cash flow and a higher share price for Arch. Sussman forecasts a well-above-consensus $577 million in 2017 earnings before interest, taxes, depreciation, and amortization, or Ebitda. If he’s right, Arch stock would be worth $135, or 75% above last week’s level. That would bring it close to the industry’s enterprise value/Ebitda average of 5.8.

Because of restructuring costs and lower coal prices in the first half, Arch in 2016 will lose $389 million, or $18.54 a share, on $1.89 billion in revenue, predicts Sussman. He calls for Ebitda of $168 million. But in 2017, the company will swing to a profit of $196 million, or $7.01 a share, on $2.4 billion in revenue. The following year’s results are expected to level off or decline a bit.

Coal prices are volatile and present the main risk for investors. If, fearing public unrest, China retreats from its production reductions, or natural gas remains below $3, the price of coal could fall, undercutting Arch’s shares.

“A large part of the industry has been in bankruptcy,” says CEO Eaves, a longtime coal operator. “But if you’re in the lower end of the cost curve, you can still generate cash margins, so when markets eventually improve, you catch the upswing,” as Arch is beginning to do.

The shares also offer a hedge. Because of its ultra-clean balance sheet and proven reserves of five billion tons, Arch could make an excellent acquisition for another company, notes Calavritinos. In the meantime, shareholders should enjoy Arch’s revival.