CSX: I'm Not Impressed

By Leo Nelissen

January 19, 2018 - On the 4th of August, I wrote an article covering the great macro case which supported a CSX Corp. (CSX) long position. Since then the company's share price has increased roughly 17%. In this article, I'm going to review the latest Q4/2017 results and see if they still support a bull case.

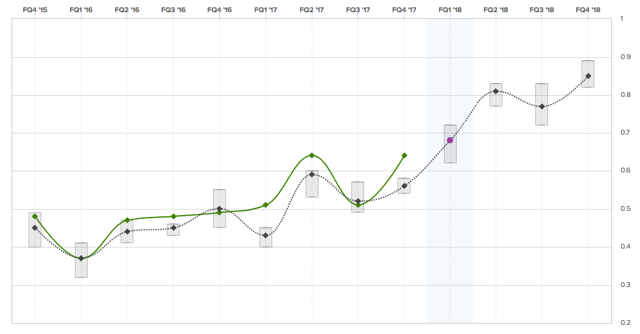

EPS Beats Easily

Fourth quarter EPS came in at $0.64. This is 8 cents above Wall Street consensus of $0.56 and 13 cents above last quarter's EPS of $0.51. It is also quite interesting that CSX has beaten the most positive EPS estimate by a wide margin. We are also seeing the most narrow expectation range since the third quarter of 2016.

Source: Estimize

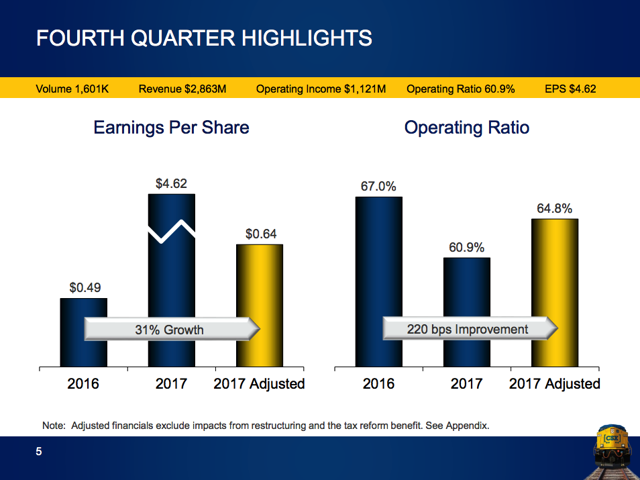

Adjusted EPS results of $0.64 are 31% higher on a year-on-year basis. This is after it has been adjusted for income tax benefits which would have resulted in earnings per share of $4.62.

Source: Q4/2017 CSX Corp. Investor Presentation

After only looking at the first two graphs, it would seem that CSX is indeed perfectly exploiting the current economic growth trend. However, not everything is as good as I hoped it to be.

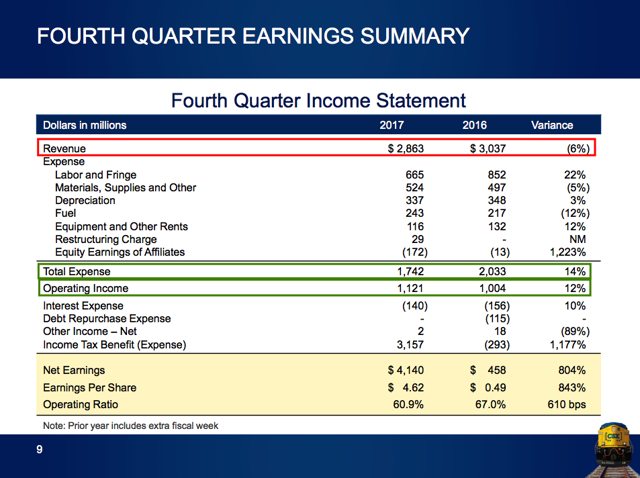

Expenses Are Saving The Day

The bad news is that sales went down 6% in the fourth quarter. This seems to be a red flag given the strong economic growth as I explained in this article: 5 Charts That Sum Up The US Economy.

The good news is that the company was able to reduce total expenses by 14%. Almost all of this is due to a 22% labor and fringe cut. The number of total employees declined by more than 3,000 jobs to roughly 24,000 as of the fourth quarter of 2017.

Source: Q4/2017 CSX Corp. Investor Presentation

The $3 billion tax benefit was due to a revaluation of deferred taxes which would have pushed EPS up to $4.62. Fuel charges were 12% higher along with a 5% materials increase. This is the result of the current inflation trend we are witnessing after global growth and a weaker USD have lifted commodity prices.

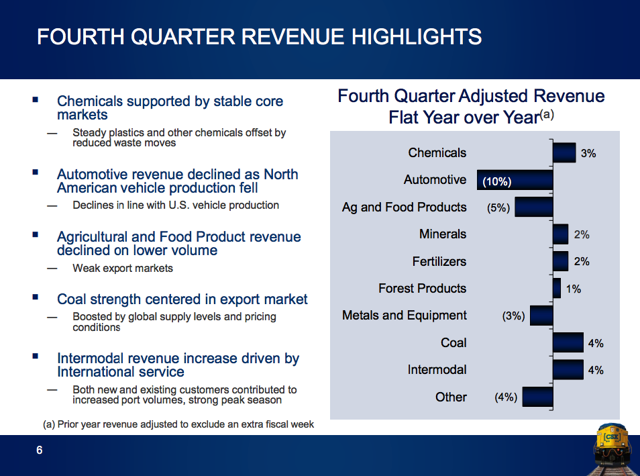

Weakness Among Key Segments

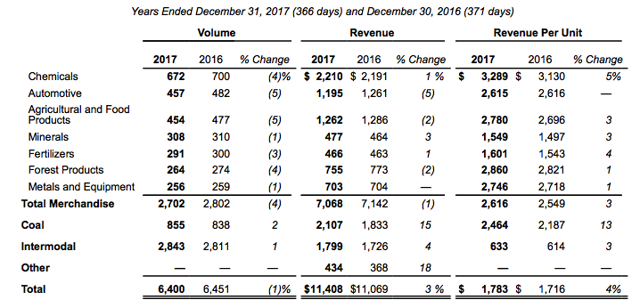

The segment breakdown shows a few very interesting things. The first one being the strength among cyclical segment like chemicals, minerals, forest products, export coal and intermodal. Especially coal and chemicals have shown weakness in the past. The bad news is that automotive weakness is hitting CSX quite hard with a 10% decline while both agricultural products and metals and equipment keep declining.

Source: Q4/2017 CSX Corp. Investor Presentation

Speaking of bad news, the earnings release revealed something we discussed in the beginning of this article. Total merchandise volume declined 4% in the full year of 2017. This decline was led by automotive and agricultural products while every single merchandise product declined. Prices on the other hand were able to keep the revenue decline at a mere 1%.

Source: Q4/2017 CSX Corp. Earnings Release

Coal volume soared 2% while coal sales increased 15% thanks to strong pricing. This also is the main reason that total revenue increased 3% in the full year of 2017.

What's Next?

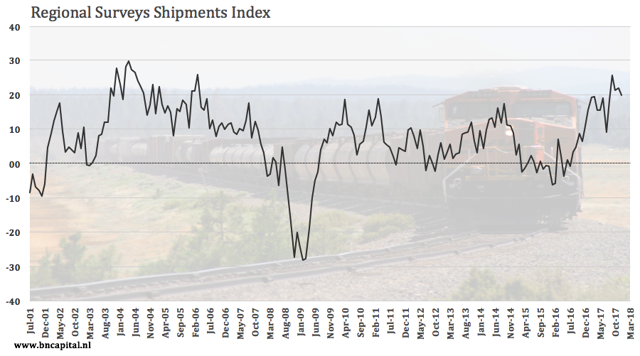

One of the surveys I used in my previous CSX article (link in first line of this article) can be seen below. It shows leading sentiment in the shipments industry. What we see is that sentiment remains at record levels which means that the overall bull case for transportation stocks is strong. It just depends on the company's how well they exploit the economic trend.

Source: Q4/2017 CSX Corp. Earnings Transcript

CSX remains positive when it comes to the export coal market despite some expected pressure on coal prices.

In the first half of the year, we will face tough comparisons on export coal rates which are linked to the price of the commodity. However, we see the coal markets continuing to remain healthy from a volume perspective.

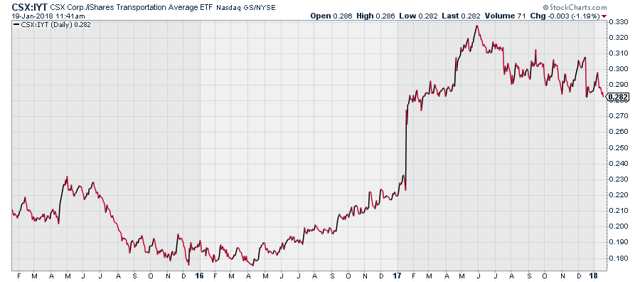

Interestingly enough it seems that the stock price has traded according to unchanged transportation volume. The stock has gone sideways for the better part of the year after the first quarter rally of 2017.

I believe that CSX might keep underperforming as you can see below. The stock has underperformed since May 2017. Note that this ratio spread compared the stock to the iShares Transportation Average ETF (IYT).

Going forward, I'm going to stay away from CSX. It had a good run in the fourth quarter but might cause further underperformance in 2018. Relying on a strong coal market and further pricing power is just not enough.

I will cover the next earnings releases from other major railroad companies to find a more suitable play.

Stay tuned!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.