|

Signature Sponsor

By David Roberts

March 24, 2018 - Last year, the Trump administration attempted a ham-handed bailout of the US coal industry. In a nutshell, Rick Perry’s Department of Energy told the Federal Energy Regulatory Commission (FERC) to guarantee the profits of coal plants.

FERC, to its eternal credit, responded: No. No, thank you. That is a very dumb idea, and we shan’t be doing that.

It was a rare bright spot in this bleak last year, a blow struck for reasoned, empirically informed policy.

But there are no periods in politics, only commas, and there are still powerful forces pushing to keep dirty old fossil fuel power plants open as long as possible. If they succeed, if FERC accepts their arguments, it could mean higher costs to consumers, more pollution, and uneconomic power plants delaying the market entry of cleaner alternatives. The commission has already sent some unsettling signals, and several fateful rulings will be made over the next year.

In short, it still very much matters what FERC is up to. The problem is that Perry’s absurd attempts to manipulate FERC were easy to explain. The decisions FERC is now facing are ... not. I will be frank with you, dear reader: They are hell on wheels to explain. There Will Be Acronyms (TWBA).

But we are going to do this, together, because the speed at which coal plants retire and renewables come online will determine America’s ability to meet the greenhouse gas targets it pledged in the Paris climate accord, which someday may matter again.

A Bit of Background on How Electricity Markets Work

In the 1990s and early 2000s, a wave of reform swept the US electricity sector. Before, power utilities were “vertically integrated monopolies,” which meant they owned the entire electricity supply chain, from generator to customer. In “deregulated” areas — which now cover about two-thirds of the country and 70 percent of US customers — the power generation part was split off and handed to competitive wholesale power markets.

Power utilities in deregulated areas still have a monopoly on the local distribution of electricity, but they procure their power from regional markets, in which generation companies (gencos) compete to provide the cheapest electricity.

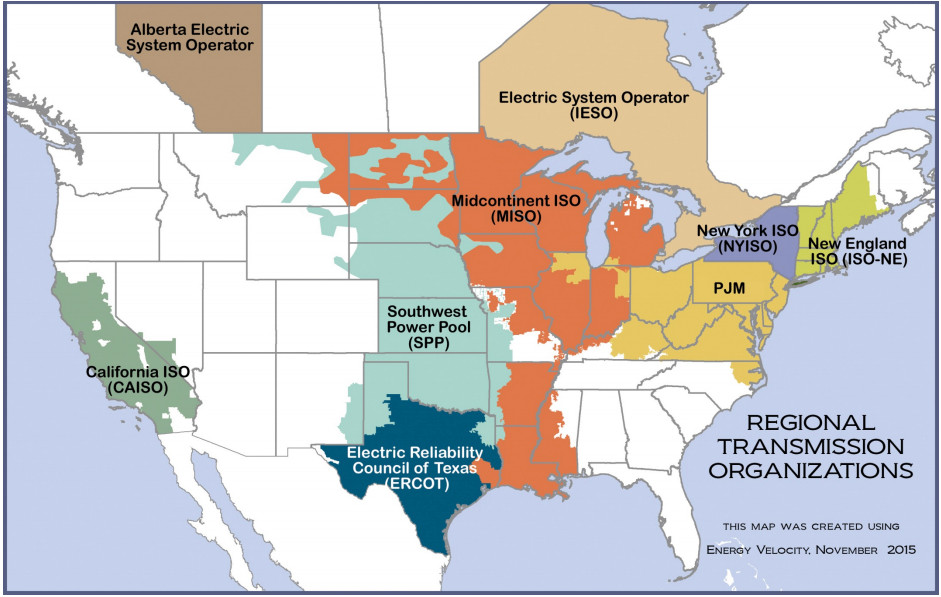

Wholesale power markets are overseen by Regional Transmission Organizations (RTOs) and Independent System Operators (ISOs). They monitor and enforce the rules.

While states have jurisdiction over all retail, distribution-level electricity and power plants themselves, the electricity involved in wholesale markets travels on high-capacity transmission lines across state borders, so it comes under federal, i.e., FERC, jurisdiction.

FERC’s job is to ensure that ISO/RTOs are operating power markets in such a way as to produce reliable power at “just and reasonable” rates. Gencos, utilities, advocacy groups, and other interested parties can petition FERC to make a new rule or change an existing one. To do so, they have to show that existing rates are not “just and reasonable” and that new rules would be.

The Other Kind of Wholesale Energy Market

One more important bit of background.

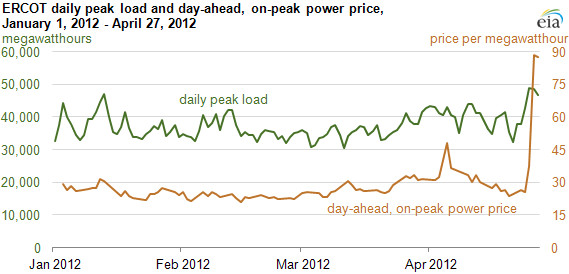

Some power markets, like the one overseen by the Electric Reliability Council of Texas (ERCOT), are pure energy markets, which is to say, there’s only one market, and the only product traded on that market is electricity.

Pure energy markets make people in other regions nervous, for a variety of reasons. If power reserves run low, or there’s an unexpected surge in demand, it is reflected immediately in prices, which can spike extremely high in some rare instances. Back in the heat wave of 2012, for one fateful hour, wholesale power prices in ERCOT reached a whopping $500 per megawatt-hour (compared to an average in the high 20s).

That’s just markets doing what they are supposed to do — bringing supply and demand into balance — but it scares the pants off politicians and regulators. Price spikes are politically unpopular.

Plus, market operators worry that periodic price spikes will not send the economic signals necessary to induce investment in reserve margins. Without sufficient investment, the buffers of capacity that ensure reliability will grow thin; disaster might strike.

(You’ll notice a recurring theme here: When it comes to something as essential to life as electricity, leaders say they want to harness the power of markets, but many of them don’t entirely trust markets. For the record, ERCOT — which, operating within a single state, is not under FERC jurisdiction — arguably has the best-run energy market in the country, but it is, in fact, staring down a summer with projected record-high demand and unusually tight margins. It will be an important test for the energy-only model.)

Thanks to these fears, alongside their power markets, several big ISO/RTOs — ISO-New England, New York ISO, and the PJM Interconnection — also operate capacity markets.

Like power markets, capacity markets are run via competitive auctions, with power plants bidding in and the lowest bid needed to meet demand setting the “clearing price” for all participants. But in a capacity market, what’s being offered is not electricity but availability. A power plant is pledging to serve as backup capacity, to be available during a specified period of time should it prove necessary. (The Midwest ISO operates a voluntary capacity market.)

Do capacity markets, in fact, bolster reliability, which is their whole reason for existing? According to a report from the US Government Accountability Office (GAO) report last year, we don’t know. FERC does not have enough, or consistent enough, data to make that determination. So, that’s comforting.

What capacity markets have been is a magnet for tinkering by regulators and other interested parties.

Capacity Market Shenanigans Are Afoot

Capacity markets are problematic, for a whole variety of reasons that will have to wait for their own post. What’s important to know now is that lots of dirty, old fossil fuel plants are operating in deregulated markets, and they are struggling. Many are staying alive only via capacity markets. And they would very much like to continue staying alive, which requires that prices on capacity markets remain high.

The low price of new, more efficient natural gas plants, along with stagnant demand and the headlong growth of renewable energy, has pushed prices down in both energy and capacity markets. What’s more, FERC has recently ruled that energy storage and demand response (shifting demand around) must be allowed to participate in wholesale markets. Both those resources are getting cheaper every day and can be expected to further suppress prices.

In most markets, when competition from new entrants drives down prices, it’s considered good news. When it happens in capacity markets, it causes all sorts of people to panic.

Gencos have seized on low prices to make the following argument: State-level policies that support renewable energy (or, in the case of New York, nuclear energy) artificially lower the prices of those resources, thus giving them an unfair advantage and distorting wholesale markets. Because prices of renewable energy have been artificially suppressed, capacity markets won’t receive the right economic signals and won’t produce enough capacity to maintain reliability.

There is, as yet, not much evidence to support this argument. All the ISOs and RTOs are currently meeting or exceeding their target reserve margins. There is no reliability crisis; there’s not even a discernible reliability problem. Renewable energy is growing, and everything is working fine, at least for now.

But some market operators have become convinced that tightening reserve margins mean a future of insufficient capacity. They want capacity market prices back up, to induce more investment.

It is true that state energy policies are getting more ambitious and complex, capacity markets have been overlain with rule upon rule to accommodate them, and the whole interaction of federal and state energy jurisdiction around power markets probably needs a rethink. FERC had a technical conference on the subject in May 2017. Many of the market tweaks being implemented or pondered are ... not good.

Meet the MOPR, a Way to Boost "Investor Confidence" — and Prices

So ISO/RTOs want to boost capacity prices. And they’ve found a strategy, which has already been implemented in a few places and now threatens to expand. I’m sorry to report that it involves more acronyms.

So, think back to capacity markets. Some of the participants are “utility holding companies,” which own both distribution utilities and power plants. In other words, they are, through separate affiliates, both providers and purchasers of capacity.

There has always been a worry that they will offer artificially low capacity bids to suppress prices, knowing that they will make it back by buying cheap capacity. To prevent this kind of market manipulation, FERC came up with the “minimum offer price rule” (MOPR), which stipulates that suppliers of capacity that are also buyers of capacity must meet certain minimum price bids, meant to reflect their true operating costs.

So that’s the MOPR. Now here’s the crucial pivot.

ISO/RTOs are increasingly using MOPRs on renewable energy (and demand response) participation in capacity markets — requiring minimum bids from those resources, often high enough to price them out of capacity markets. They justify this by effectively defining state renewable energy policies as market manipulation, an artificial suppression of prices.

A MOPR on renewables, by this way of looking at things, restores accurate price signals to capacity markets, ensuring that they properly vouchsafe reliability. It also, coincidentally, ensures higher capacity market prices and serves as a lifeline to old fossil fuel plants.

ISO-NE uses a MOPR like this, though it has long had a 200 MW-per-year exemption for renewable energy. Gencos petitioned FERC to kill the exemption, but FERC upheld it in April. (NYISO’s 1,000 MW renewables exemption from its MOPR is also being challenged before FERC, which has not yet ruled.)

But ISO-NE also submitted another proposal, which would involve killing the exemption altogether. That’s what FERC ruled on last Friday. Within that ruling were some troubling signals.

FERC’s Unsettling Paragraph 22

The New England ISO faces unique problems — the region is unusually dependent on natural gas, for both electricity and heat. It had particular worries about capacity and wanted to implement something called the Competitive Auctions with Sponsored Policy Resources (CASPR), which would split its capacity market into two phases, replacing the old market and the renewables exemption with it.

Reader, we have our sanity to think about, so I’m not going to get into the complexities of the CASPR. Suffice to say, four of five commissioners approved of it on the merits and the dissenter, Robert Powelson, thought it didn’t go far enough. (Powelson thinks state energy policy and competitive wholesale markets are wholly incompatible; if states want to craft their own generation mix, he wrote in dissent, they should “also assume the responsibility for resource adequacy and reliability.”)

But the commission was not similarly united behind one particular part of the ruling — namely, paragraph 22. It says: “Absent a showing that a different method would appropriately address particular state policies, we intend to use the MOPR to address the impacts of state policies on the wholesale capacity markets.”

Whaaat now? That is an outright endorsement of the expanding use of MOPRs to counteract the price effects of state renewable-energy policies. It seems to suggest that FERC will be accepting, even pushing, ISO/RTOs to use MOPRs more liberally.

Two commissioners were behind that sentiment, both Trump appointees: Neil Chatterjee and new chair Kevin McIntyre. One Obama-appointed commissioner, Cheryl LaFleur, and another Trump appointee, Richard Glick, made a point of writing in their concurrences that while they approve of the CASPR, they do not endorse using MOPRs in this broad fashion.

In fact, as Glick pointed out in his (unusually lucid and forceful) statement, given his and LaFleur’s dissent on this point, the rationale for broad use of MOPRs “is not adopted by a majority of the Commissioners that support the order.”

So, now that we’ve finally reached the meat of the matter, let’s look briefly at why profligate use of MOPRs is such a bad idea.

Using MOPRs to Prop up Baseload Plants Makes No Dang Sense

Using MOPRs to “address the impacts of state policies on the wholesale capacity markets” is, in Glick’s immortal words, “ill-conceived, misguided, and a serious threat to consumers, the environment and, in fact, the long-term viability of the Commission’s capacity market construct.” Here are a few reasons why.

1) It’s not FERC’s business to mess with state policies.

The Federal Power Act (FPA) clearly leaves responsibility for the electricity generation mix to states. Given the way the US electricity system operates, it is inevitable that decisions states make about that mix will affect wholesale power markets. But that is not a problem for the commission to solve, it is the natural course of things.

When MOPRs are used to raise the prices of renewable sources, it counteracts the effects of state policies meant to lower those prices. It makes state goals that much more difficult and expensive to reach. FERC ought to be accommodating state policy goals, not attempting to purge their effects from wholesale markets.

“While there are times when the Commission must check state action that impermissibly interferes with the wholesale markets,” wrote then-Chair Norman Bay in his concurrence on the order reaffirming ISO-NE’s renewables exemption, “it should endeavor to do so only when necessary. I believe that respect for federalism requires no less.” The MOPR, he wrote, puts FERC “in direct and recurring conflict with the states.”

2) There is no principled way to distinguish which policies count as “costs.”

It is true that state policies like renewable energy standards or New York’s zero-emission credits (ZECs) push down the price of low-carbon energy. And insofar as that lowers the clearing price in capacity markets, it is a “cost” to high-carbon capacity sources.

But that way lies madness. There are all sorts of (implicit and explicit) subsidies for energy sources built into policy at every level. All energy policy affects the prices of various sources in some way or another. And plenty of non-energy policies do too, as do siting and zoning decisions. The FERC order does not offer any principled way to pick apart which policies impose “costs” that FERC must cancel out and which don’t, because there is no principled way.

“The premise of the MOPR appears to be based on an idealized vision of markets free from the influence of public policies,” Bay wrote. “But such a world does not exist, and it is impossible to mitigate our way to its creation.” The “pervasiveness” of public policy supports for energy sources means it is “futile to attempt to unwind them all.”

In short, Bay says, MOPRs for renewables and nuclear are “unsound in principle and unworkable in practice.” FERC should only use MOPRs “in the uncommon situation when state action is not permitted under federal law.”

3) Climate mitigation, in particular, is not a price distortion.

FERC rules do not take greenhouse gases into account. State energy policies do. By giving renewable energy (or nuclear power) credit for a lack of greenhouse gases, state policy is not distorting their prices, it is making their prices more accurate. It is giving them credit for a positive externality.

If FERC uses MOPRs to take away that price advantage, it is not only excluding carbon pollution from its decision-making, it is pushing states to do the same. That is not FERC’s role, and it’s not good policy.

4) A MOPR will force excess capacity.

Placing a MOPR on renewable (or nuclear) resources that have been built as a result of state policy “requires load to pay twice,” Bay writes, “once through the cost of enacting the state policy itself and then through the capacity market.” That raises prices for consumers.

There’s no need for it. If a state supplies a capacity source with extra revenue, the capacity market will receive the correct signal in light of that revenue. “Administrative attempts to remove such revenue could result in inefficiently high capacity prices that signal the need for new capacity when no such need exists,” Bay writes.

And remember, that’s in the context of all ISO/RTOs already meeting their capacity targets, and PJM in particular oversupplied with capacity.

It’s difficult to discern any market logic for MOPRs on renewables and nuclear. It’s almost enough to make one entertain dark suspicions.

“By increasing the market-clearing price in the capacity market, the MOPR increases the cost of every unit of capacity that clears the capacity auction,” Glick notes. “Indeed, it appears to me that this is precisely the motivation underlying certain generators’ support for applying the MOPR to state policies: propping up their capacity-market revenues.”

Indeed.

The CASPR ruling cites “investor confidence” several times as a justification for using MOPRs, though it never defines the term or offers any objective way to measure it.

What could it possibly mean? Capitalism is notoriously harsh and unforgiving. Insofar as a market is truly open and competitive, investors take their chances, and many lose their shirts. Insofar as investors have “confidence,” it is because a government regulator has stepped in to short-circuit competition and guarantee their investments.

FERC’s job is to maintain competitive markets — to “protect competition, but not individual competitors,” as Glick puts it. It should give investors (and states, and consumers) confidence by making and enforcing clear rules. Picking and choosing, imposing price constraints on certain generation sources and not others, in certain markets and not others, is not the road to confidence.

Glick summarizes:

In short, the Commission should get out of the business of mitigating the effects of state public policies and instead encourage the RTOs/ISOs to work with the states to pursue a resource adequacy paradigm that respects states’ role in shaping the generation mix and while at the same time ensuring that we satisfy our responsibilities under the FPA.

(If you want to really nerd out, here’s an interesting academic paper arguing that FERC has been overbroad in its use of MOPRs.)

Next Steps

I personally agree with Bay that “the most market-oriented solution with the greatest transparency, simplicity, and, perhaps, efficiency would be to transition over time to an energy-only market.” But I also agree with him that such an outcome is extremely unlikely anytime soon.

In the meantime, the fight is over MOPRs and, more broadly, how FERC ought to deal with state energy policies. There’s all sorts of regulatory action underway (so many dockets!), but I’ll just mention a few upcoming things.

First, petitioners (enviro and clean energy groups, and others) will ask for a rehearing of the CASPR case; if it doesn’t go their way, that will likely end up in court. Because of FERC’s weird split judgment in the ruling — passing the order with a simultaneous dissent on a particular paragraph — the order is probably vulnerable, as Bay points out:

The “jump ball” in question has to do with a proposal PJM is expected to make to FERC this month, asking FERC to choose capacity market reforms for it, either something like CASPR or expanded MOPRs.

Also, when FERC rejected Perry’s coal bailout, it asked ISO/RTOs to report in on grid resilience. Those reports are in, and PJM’s contains yet more requests for various stealth bailouts. There are also outstanding dockets on nuclear and offshore wind.

Those upcoming rulings will reveal a great deal about how much FERC has bought into gencos’ arguments and plans to support MOPR-type price hikes.

The Takeaway

There’s a big difference between Perry’s crude coal bailout and the use of MOPRs in capacity markets, but both are animated by the same concern: the idea that state clean-energy policies are suppressing prices in capacity markets, which is pushing older coal and natural gas plants off the grid, and reliability is going to suffer as a result.

The first two parts of that are true; it’s the third part that’s contested.

Gencos say it’s true, but they have a vested interest in keeping capacity prices high. Market incumbents don’t want competition, they want “confidence.” Some regulators and market monitors worry that it’s true — as I said, the electricity sector is full of people who talk a lot about markets but don’t actually trust them.

But FERC ought to have better evidence of a crisis, a more coherent rationale, and clearer criteria before it authorizes expanded use of price mandates like MOPRs.

The spirit of empirical inquiry that led FERC to reject Perry’s coal bailout ought to caution it against this subtler but no less misguided sequel.

CoalZoom.com - Your Foremost Source for Coal News |

|