NACCO Industries, Inc. Forms Wedge Down Pattern; Strong Momentum for Sellers

By Vernon Prom

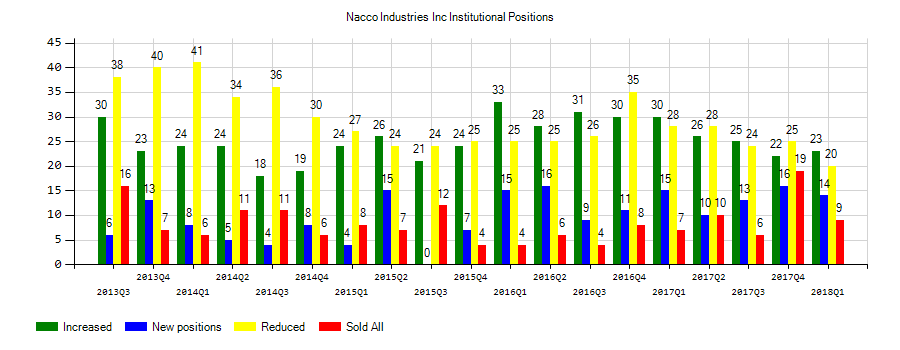

July 9, 2018 - Investors sentiment increased to 1.28 in 2018 Q1. Its up 0.42, from 0.86 in 2017Q4. It improved, as 9 investors sold NACCO Industries, Inc. shares while 20 reduced holdings. 14 funds opened positions while 23 raised stakes. 3.32 million shares or 2.79% less from 3.41 million shares in 2017Q4 were reported.

Morgan Stanley holds 0% or 49,930 shares in its portfolio. Amer Century Inc has 0% invested in NACCO Industries, Inc. (NYSE:NC) for 96,495 shares. Jpmorgan Chase And Communication accumulated 164,833 shares or 0% of the stock. Geode Capital Management Llc holds 0% or 43,619 shares.

Alliancebernstein Lp owns 16,620 shares. Lsv Asset Management holds 0% or 11,896 shares. Envestnet Asset Mgmt invested in 58 shares. 3,442 are owned by Manufacturers Life Insurance Communication The. State Street holds 0% or 134,334 shares. 15,600 are held by Strs Ohio. Massachusetts-based Fmr Ltd Co has invested 0% in NACCO Industries, Inc. (NYSE:NC). Vanguard holds 0% or 212,308 shares. Curbstone Mngmt has 0.36% invested in NACCO Industries, Inc. (NYSE:NC) for 38,654 shares. Renaissance Techs Ltd Liability Com has 168,900 shares. Citigroup reported 0% stake.

The stock of NACCO Industries, Inc. (NC) formed a down wedge with $32.79 target or 3.00 % below today’s $33.80 share price. The 6 months wedge indicates high risk for the $234.48 million company. If the $32.79 price target is reached, the company will be worth $7.03M less.

Falling wedges are poor performers for bullish breakouts and are tricky moments to trade. Investors must be aware that the break even failure rate for up or down breakouts is: 11% and 15%. The average rise is 32% and the decline is 15%. The falling wedges has high throwback and pullback rate: 56%, 69% and the percent of wedges meeting target is not very high.

The stock increased 1.50% or $0.5 during the last trading session, reaching $33.8. About 15,099 shares traded. NACCO Industries, Inc. (NYSE:NC) has risen 148.72% since July 8, 2017 and is uptrending. It has outperformed by 136.15% the S&P500.

.png)

Another recent and important NACCO Industries, Inc. (NYSE:NC) news was published by Globenewswire.com which published an article titled: “Recent Analysis Shows Ford Motor, Lions Gate Entertainment, America’s Car-Mart, WW Grainger, Berry Global Group …” on June 11, 2018.

NACCO Industries, Inc. operates primarily in the mining industry. The company has market cap of $234.48 million. The firm mines coal in North Dakota, Texas, Mississippi, Louisiana, and on the Navajo Nation in New Mexico for power generation. It has a 6.95 P/E ratio. It provides value-added services, including maintaining and operating draglines for independently owned lime rock quarries; coal handling, processing, and drying services; and surface and mineral acquisition, and lease maintenance services.