US Coal Consumption Declines Again as Coal Shipments Hit Lowest Level Since 1983

By Mark Sumner

September 14, 2018 - This week brings a new report from the US Energy Information Administration, which provides a chance to check in on how Donald Trump’s rhetoric matches up with reality. Answer? About as well as expected. While Donald Trump was claiming that the trains were “full of coal again,” the truth is that coal shipments just reached their lowest level since 1983 as coal consumption in the US continues to fall.

At his recent rallies, Trump has once again been heralding “beautiful clean coal” despite the fact that the only plant in the United States designed to use so-called clean coal technology switched over to natural gas before going into operation. There’s not one actual clean coal plant in America.

But forget the “clean” part. How is coal doing, period?

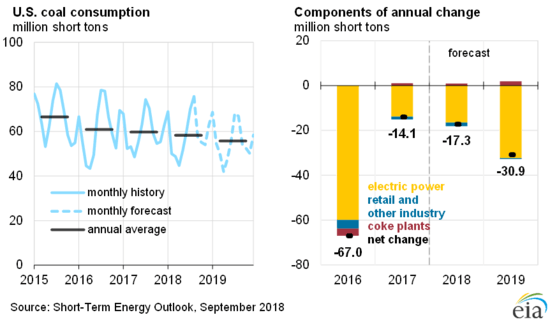

US coal consumption was down in 2016. Then, thanks to Trump, it was … down in 2017. It’s also down in 2018 and projections are it will decrease even more in 2019.

Coal exports were up for the first half of 2018, but that was before Donald Trump, economic genius, began a worldwide cascade of tariffs. Included as a skirmish in his trade war has been a tariff on US coal which has all but locked US production out of the Chinese market. Japan, which actually does have a new generation of plants using clean coal technology, has now entered the list as one of the top US export markets and other Asian markets also have helped make up for some Chinese demand. But even with exports up, overall coal production, and employment, is continuing to drop.

The decline in domestic consumption takes coal from 30 percent of electrical generation in 2017, to 28 percent in 2018 and projects a fall to 27 percent in 2019. As coal declines, natural gas will reach 34 percent of electrical generation in 2018 and add another percent in 2019. Nuclear power will hold steady at 20 percent. Meanwhile solar and wind crossed the 10 percent barrier this year, and are projected to hit 11 percent in 2019.

With California aiming at 100 percent renewables by 2045, coal-based plants continuing to close, and renewables easily undercutting the cost of coal, there are some other big transitions coming up in the US energy market.

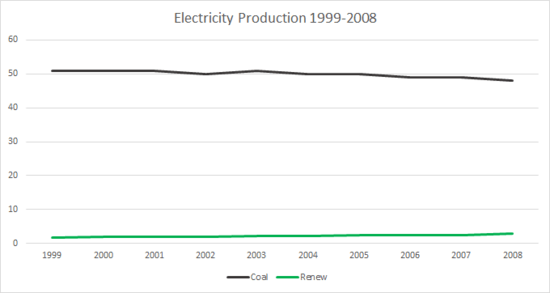

Anyone looking at a chart of electrical production going into 2008 might have felt pretty confident about what America’s energy picture would look like in 2018. Across the decade, coal had slipped only slightly, with most of that change coming in the last two years. Coal producers confidently predicted a “supercycle” that would boost coal to unprecedented demand and their companies to massive profits.

But the next ten years didn’t exactly go as predicted. Rather than holding its spot making roughly half of all electricity, coal began to slide steeply. Meanwhile, as the graphs makes clear, over this time renewables were slowly increasing, going from 2 percent at the turn of the century, to 10 percent today.

.png)

What happened? Two things. First, the decline in coal wasn’t driven by any regulatory change or “war on coal.” The secret was in that inflection that begins around 2006. In that year, widespread use of hydrofracking arrested a slow slide in US natural gas production and began to drive gas availability up and prices down. Then in 2008, as the economy fell and energy demand fell with it, the market was suddenly awash in cheap gas. While coal production struggled to recover, electricity providers became more confident that cheaper to buy, cheaper to burn, cheaper to maintain gas would be available long term and began a wholesale shift. Since 2008 coal has, on average, lost about 2 percent of the market for electricity production every year.

Meanwhile, even as gas availability was increasing, wind and solar were getting cheaper. And cheaper. And cheaper, until they undercut both fossil fuels. Though switching over from coal to wind and solar is a more complicated prospect than moving to gas, the result has been a renewables market that has gained over half a percent every year for a decade.

While the graphs above make it clear that long term predictions in the energy market are never as simple as they might appear, the slow but strong rise of renewables makes it a very good bet that sometime around 2025, the amount of energy produced by wind and solar in the US will pass that produced by coal. Far more people in the US are already employed by the renewables industries than are by coal. Soon, far more people will get their power from clean energy than from not-so-clean coal.

One source is going up, the other irrevocably down. And Donald Trump hasn’t done anything to halt that trend.