$614 Million in Sales Expected for Arch Coal Inc This Quarter

September 10, 2019 - Equities analysts expect Arch Coal Inc (NYSE:ARCH) to post $614.00 million in sales for the current quarter, Zacks reports. Four analysts have issued estimates for Arch Coal’s earnings, with the lowest sales estimate coming in at $541.00 million and the highest estimate coming in at $648.30 million. Arch Coal posted sales of $633.18 million during the same quarter last year, which would indicate a negative year over year growth rate of 3%. The company is expected to announce its next quarterly earnings results on Tuesday, October 22nd.

According to Zacks, analysts expect that Arch Coal will report full-year sales of $2.33 billion for the current year, with estimates ranging from $2.19 billion to $2.39 billion. For the next fiscal year, analysts anticipate that the firm will post sales of $2.24 billion, with estimates ranging from $1.98 billion to $2.44 billion. Zacks’ sales averages are a mean average based on a survey of sell-side research analysts that follow Arch Coal.

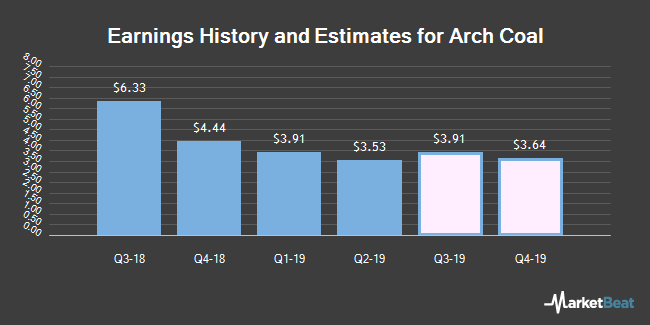

Arch Coal (NYSE:ARCH) last issued its quarterly earnings results on Wednesday, July 24th. The energy company reported $3.53 EPS for the quarter, beating analysts’ consensus estimates of $3.23 by $0.30. Arch Coal had a return on equity of 48.65% and a net margin of 14.31%. The firm had revenue of $570.22 million for the quarter, compared to analysts’ expectations of $558.75 million. During the same quarter in the prior year, the firm earned $2.06 EPS. The business’s revenue for the quarter was down 3.7% compared to the same quarter last year.

A number of research firms recently issued reports on ARCH. Zacks Investment Research lowered Arch Coal from a “buy” rating to a “hold” rating in a research note on Monday, August 5th. B. Riley set a $116.00 price objective on Arch Coal and gave the company a “buy” rating in a research note on Thursday, August 22nd. Jefferies Financial Group lowered Arch Coal from a “buy” rating to a “hold” rating and decreased their price objective for the company from $115.00 to $80.00 in a research note on Tuesday, August 6th. ValuEngine lowered Arch Coal from a “sell” rating to a “strong sell” rating in a research note on Thursday, August 1st. Finally, TheStreet lowered Arch Coal from a “b” rating to a “c+” rating in a research note on Wednesday, May 29th. One investment analyst has rated the stock with a sell rating, four have issued a hold rating and two have issued a buy rating to the stock. The stock has a consensus rating of “Hold” and a consensus target price of $106.67.

In other Arch Coal news, Director Holly K. Koeppel bought 2,200 shares of the firm’s stock in a transaction on Thursday, August 1st. The shares were acquired at an average cost of $89.02 per share, for a total transaction of $195,844.00. Following the purchase, the director now directly owns 2,200 shares of the company’s stock, valued at $195,844. The acquisition was disclosed in a filing with the SEC, which is available through this hyperlink. 0.63% of the stock is owned by corporate insiders.

Hedge funds and other institutional investors have recently made changes to their positions in the business. Hancock Whitney Corp bought a new position in Arch Coal in the 1st quarter worth about $1,755,000. OMERS ADMINISTRATION Corp increased its stake in Arch Coal by 36.6% in the 2nd quarter. OMERS ADMINISTRATION Corp now owns 5,600 shares of the energy company’s stock worth $535,000 after acquiring an additional 1,500 shares during the last quarter. Hartree Partners LP bought a new position in Arch Coal in the 1st quarter worth about $4,107,000. B. Riley Financial Inc. bought a new position in Arch Coal in the 1st quarter worth about $299,000. Finally, Martingale Asset Management L P increased its stake in Arch Coal by 11.8% in the 1st quarter. Martingale Asset Management L P now owns 90,218 shares of the energy company’s stock worth $8,235,000 after acquiring an additional 9,500 shares during the last quarter.

Shares of NYSE ARCH opened at $76.56 on Tuesday. Arch Coal has a one year low of $72.30 and a one year high of $101.92. The company has a debt-to-equity ratio of 0.42, a current ratio of 2.67 and a quick ratio of 2.12. The business’s fifty day moving average price is $80.74 and its 200-day moving average price is $88.65. The stock has a market capitalization of $1.23 billion, a PE ratio of 5.05 and a beta of 0.30.

The firm also recently announced a quarterly dividend, which will be paid on Friday, September 13th. Shareholders of record on Friday, August 30th will be paid a $0.45 dividend. The ex-dividend date of this dividend is Thursday, August 29th. This represents a $1.80 dividend on an annualized basis and a yield of 2.35%. Arch Coal’s dividend payout ratio is currently 11.88%.

Arch Coal, Inc produces and sells thermal and metallurgical coal from surface and underground mines. As of December 31, 2018, the company operated nine active mines. It also owned or controlled primarily through long-term leases approximately 28,292 acres of coal land in Ohio; 1,060 acres of coal land in Maryland; 10,195 acres of coal land in Virginia; 359,122 acres of coal land in West Virginia; 81,868 acres of coal land in Wyoming; 268,802 acres of coal land in Illinois; 33,527 acres of coal land in Kentucky; 9,840 acres of coal land in Montana; 21,802 acres of coal land in New Mexico; 358 acres of coal land in Pennsylvania; and 19,146 acres of coal land in Colorado, as well as owned or controlled through long-term leases smaller parcels of property in Alabama, Indiana, Washington, Arkansas, California, Utah, and Texas.