Arch Takes Steps To Transition From Thermal Coal Focus

By Cooper McKim

May 20, 2020 - On May 15, Arch Coal officially changed its name to Arch Resources, Inc, in conjunction with the launch of its new website. The two moves are part of a larger shift in Arch's focus away from thermal coal.

"Our name change and the new website reflect Arch's intensifying focus on metallurgical markets and the global steel value chain, which we believe offer superior long-term return opportunities for our shareholders," said Paul A. Lang, Arch's CEO and president. Metallurgical coal is the primary source of carbon used in steel-making.

Arch owns the Black Thunder and Coal Creek thermal mines in the Powder River Basin. It also owns four metallurgical mines in the eastern U.S.

The Pivot

The company has previously spoken about an interest in refocusing its efforts towards its eastern metallurgical coal mines. Federal filings show the decision comes down to finances. While Arch once received 100 percent of its revenue from thermal operations, its metallurgical mines are now carrying the load.

"Arch currently derives 70 percent of its normalized operating cash flow from its metallurgical segment, and expects that percentage to grow appreciably over time," reads a federal filing .

In an investor presentation, the company expressed its confidence in metallurgical coal by writing that it expects global steel demand to grow by about 1 percent annually through 2025. The company wrote it expects price volatility to continue, but with an upward trend.

Meanwhile, revenue from the Powder River Basin has fallen 10 percent since 2017. It's profit margin has shrunk by a quarter on PRB thermal coal. In fact, Arch saw its cash margin per ton sold fall into the negatives; in other words, it reported losses on each ton of coal sold.

Rob Godby, an energy economist at the University of Wyoming, said Arch's decision to pivot away from thermal comes down to two factors: one, committing to a market they feel confident will help their bottom line and two, reassuring investors that they're focused on a stable sector.

"We don't have very many alternatives to the use of steel or aluminum," he said. "They've been busy: both expanding mines and developing new ones in the eastern United States to kind of serve that market. So, that's the market of the future. And to be honest with you in the past couple of years, it's paid off."

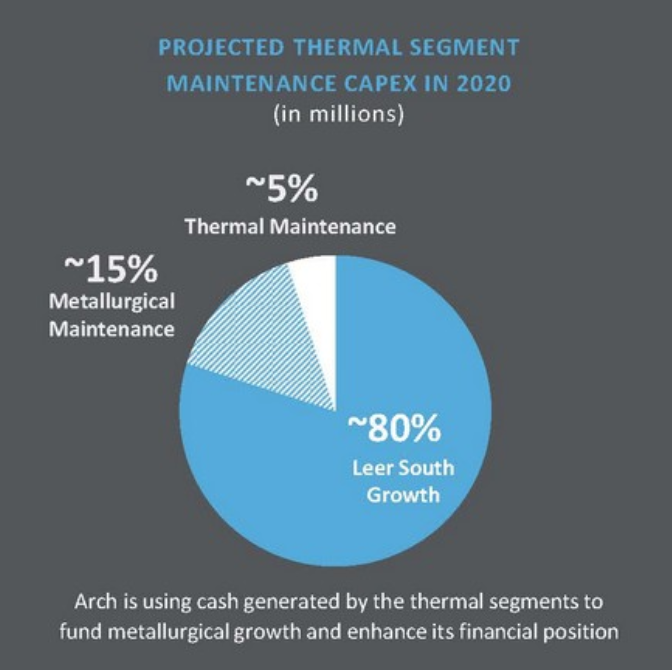

It's a significant shift for the company which was based entirely on thermal coal just a decade ago. Back in 2010, the company invested $768.8 million to acquire Jacob's Ranch and have more access to coal reserves in Wyoming. Now, it's placing 90 percent of its capital budget to its metallurgical portfolio.

Projected thermal segment maintenance capital expenditure

Credit: Arch Resources

Wyoming Impact

Godby said Arch's transition does not mean it will abandon Wyoming assets, just that the company doesn't plan to reinvest in them.

"They haven't given up. What they're trying to do is maximize the benefit they get from those assets, recognizing that their value over time is going to decline. And they're using those proceeds and they're using the time now to move into an area that they expect will create greater profits," he said.

In a presentation, Arch wrote it indeed plans to use cash generated by its thermal segments to fund metallurgical growth.

Andy Blumenfeld, IHS Markit's head of market analytics, said Arch's joint venture plan with Peabody Energy, announced June 2019, is part of the company's effort to distance itself from thermal operations in Wyoming and elsewhere. The company has thermal mines in Illinois and Colorado.

The plan, which aims to consolidate the two coal giants' mines, would leave Peabody as a majority participant. Peabody Energy would hold two-thirds of the economic interest, while Arch would hold one-third. On the joint Board of Managers, Peabody would have three representations to Arch's two. Peabody would also be in charge of day-to-day operations.

The joint venture is currently being stymied by the Federal Trade Commission which filed an administrative complaint challenging the venture in February 2020. The complaint alleged the transaction will eliminate competition between the two largest coal-mining companies in the U.S.

If the venture doesn't go through, Blumenfeld said Arch would have to make a decision to either retain the mines or find a buyer. He said it could also conceivably spin its thermal business into a separate company

Arch Resources did not respond to requests for comment.