November 21, 2020 - Despite a campaign promise to put coal miners back to work and support "beautiful clean coal," President Donald Trump is on track to leave the White House with the nation posting the lowest coal production and jobs figures in recent history.

"You watch what happens — if I win, we're going to bring those miners back," Trump said at a 2016 rally.

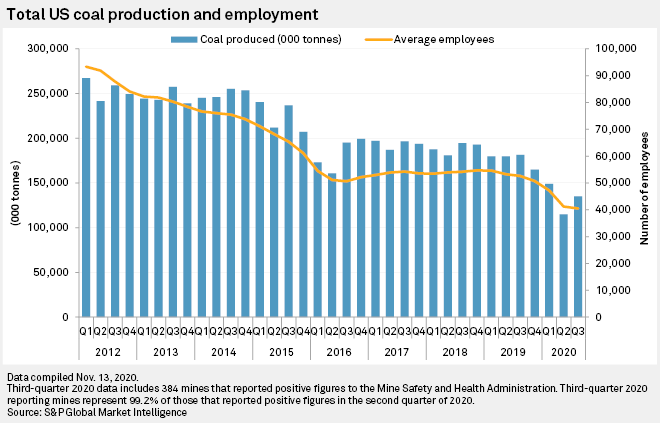

Despite a slight increase in coal production in the third quarter compared to the previous one, the period marked a new low in average coal mine employment with just 40,458 jobs, according to an S&P Global Market Intelligence analysis of available data. Average quarterly coal mining employment fell 23.6% from the first quarter of 2017, when Trump took office, to the most recent quarter. Coal production is down 31.5% in the third quarter compared to the first quarter of 2017.

While coal was a significant issue in Trump's first campaign and he occasionally touted efforts to make coal a "vibrant" sector, the president publicly spoke less about the industry during his 2020 run for the White House. The administration made several attempts to support the sector over the years.

Throughout Trump's term, representatives from the U.S. Environmental Protection Agency, the U.S. Department of Interior and the U.S. Department of Energy attended industry events to assure attendees the administration was working to support the industry. The administration pulled out of the Paris Climate agreement, put an end to an Obama-era stream rule regulating coal mines, replaced emissions rules on power plants, lifted a moratorium on federal coal leasing, proposed a plan to incentivize coal generation, facilitated an export deal for coal to Ukraine, paused a health study related to mountaintop removal and more. The administration also appointed several officials favorable to the coal sector to lead U.S. government agencies, including appointing a former coal executive to lead the U.S. Mine Safety and Health Administration and a former coal lobbyist to lead the EPA.

Still, coal plant retirements in the United States have continued at a quick pace, coal company bankruptcies continue and utilities and financial organizations are increasingly backing away from the fuel. President-elect Joe Biden's climate action ambitions may increase the pressure on coal, but several executives of coal companies even indicated ahead of the election that they were not anticipating a major shift in their fortunes, regardless of who won.

While annual coal production has steadily declined through Trump's presidency, employment was roughly flat for several quarters as metallurgical and export coal demand rose. At one point, some producers were even talking about regional labor shortages as mining companies were hosting job fairs and other events to recruit miners to new or expanding operations.

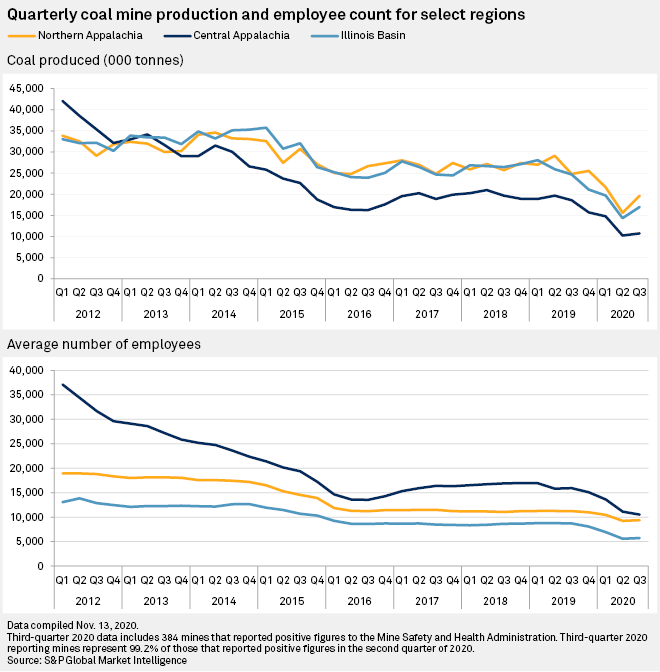

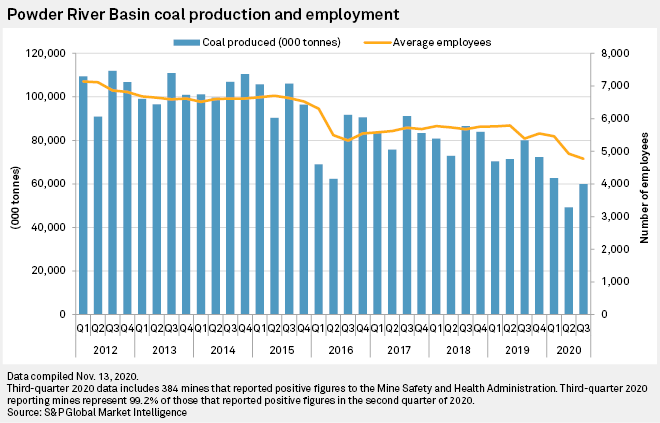

Metallurgical coal, which commands a higher price, also generally requires more labor to extract than, for example, the comparatively huge seams of lower-heat coal mined from the surface in the Powder River Basin. There, far fewer workers are required to mine a much higher volume of coal. The higher metallurgical coal and export demand briefly buoyed coal employment figures starting in late 2016, but largely did not offset the lost demand for thermal coal on a tonnage basis.

There was a flurry of coal mine openings in the early months of the Trump administration, but the mines were primarily tied to the cyclical demand for metallurgical coal. The sharp rise in that market has since retreated and languished as coal employment began to decline rapidly again in 2019. One company, Paringa Resources Ltd., did tout opening the first new thermal coal mine in the U.S. under the Trump administration, but its U.S. subsidiary running that mine has since filed for bankruptcy and is in the process of liquidating its operations.

The COVID-19 pandemic is partly responsible for the more recent sharp decline in coal demand. The U.S. Energy Information Administration raised its 2021 outlook on U.S. coal production and expects the total to come in about 20% higher than the forecast 2020 total. Still, Glenn Kellow, president and CEO of Peabody Energy Corp., said its U.S. thermal coal volumes are expected to be slightly lower in the fourth quarter.

American Electric Power Co. Inc. spokesperson Melissa McHenry recently told S&P Global Market Intelligence the company has no new plans for coal due to more favorable economics in natural gas and renewable generation, a sentiment shared by most power generators that spells out a tough future for coal producers watching the fleet of existing coal plants continue to age.

"Our customers, particularly larger commercial and industrial customers with sustainability goals, have made it clear that they want cleaner energy resources to power their businesses and lives," McHenry explained.

.gif)