Labor Unrest Threatens to Disrupt Commodities Boom

September 1, 2021 - A rush of labor strikes rattled mine operators this summer as negotiations and walkouts at operations across the Western Hemisphere threatened to exacerbate a supply crunch for key metals needed to transition the world to clean energy.

Unions have flexed their organizing muscles amid a period of high commodity prices and rocketing demand for metals needed for infrastructure, renewable energy and electric vehicle batteries. Workers have fought for, and in certain cases won, improvements in compensation and benefits.

Labor disruptions have occurred at mines in Canada, the U.S., Chile and other countries, forcing mine owners to make unprecedented concessions that could affect their bottom lines.

The workforce conflicts have jolted certain metal markets and have led to tighter supply at a time when demand has been accelerating for copper and other materials needed to make steel. Although the uptick in strikes has been largely driven by the timing of labor contract expiration dates, the commodity price surge, coupled with the persistence of the COVID-19 pandemic and widening economic inequality, has provided union organizers with additional leverage at the bargaining table.

In May, approximately 2,500 unionized workers employed at iron ore mines and facilities in Quebec owned by Luxembourg-based ArcelorMittal went on strike after rejecting a contract offer. About a month later, the company and the union, United Steelworkers, or USW, reached a new collective agreement providing for average salary increases of more than 3% per year as well as average annual increases in pension benefits of 3.75%, including cost-of-living bonuses.

"The current commodity boom has absolutely increased workers' bargaining power," said Guio Jacinto, an economic researcher with USW in Canada. "And I think that has for sure been understood by workers in these sectors, and it has played a role in their bargaining positions and strategies."

Strike Hits Nickel

In early June, a majority of unionized workers at Vale SA's Sudbury operations in Canada also voted to strike after rejecting a contract proposal. Negotiations between the company and the USW over working conditions for about 2,450 workers at the nickel-copper-cobalt facilities stretched for about two months before concluding Aug. 4 with a tentative agreement.

Under the contract reached with Vale, Sudbury workers secured post-retiree benefits for newcomers, a $6,000 signing bonus and a 6% wage increase over five years, among other gains, according to an Aug. 4 statement by the USW Local 6500 president.

"I think it's fair to say that we've seen better wage and compensation outcomes than in other rounds [of bargaining] that didn't coincide with a commodity boom," Jacinto said in an Aug. 26 interview. This year's wave of USW labor disruptions have generally been shorter in duration too, likely because of the economic pressure felt by companies, Jacinto said.

The labor dispute at Sudbury cost Vale about $59 million in additional expenses during the second quarter, according to financial documents.

"If the strike continues for an extended period of time, the results of that [Sudbury] operation may be materially impacted," Vale wrote in financial documents published July 29, six days before reaching an agreement.

Vale's second-quarter nickel sales from the site dropped by over one-third compared to the year-ago period. The strike at Sudbury also affected copper production and caused Vale to place its copper output guidance under downward revision for the year, according to an Aug. 10 report by S&P Global Market Intelligence.

The metals produced at the Sudbury operations could play a key role in the world's race to electrify transportation and energy markets.

"The past two months have been challenging for everyone," Dino Otranto, COO of Vale's North Atlantic operations, said in an Aug. 4 statement announcing the agreement with the union. "We have many opportunities ahead of us with the growing electric vehicle market. The nickel, copper and cobalt we produce are critical metals to achieving a low carbon future."

Price Upswing

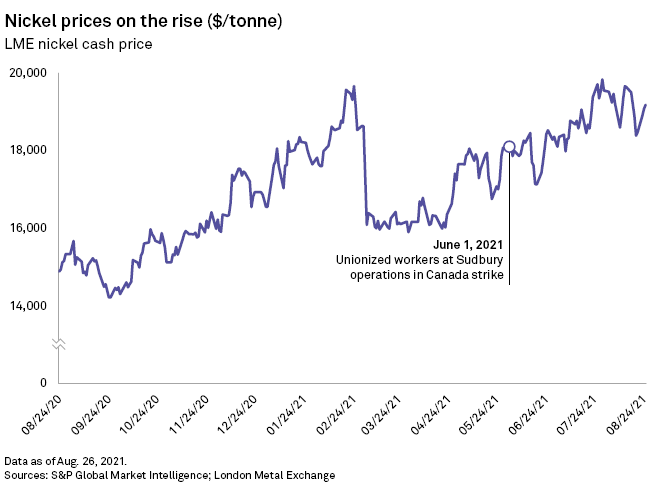

Both nickel and copper prices have been on the rise this year, albeit with a few bumps along the way.

The London Metal Exchange three-month nickel price rose to $19,835 per tonne July 29 amid the Sudbury strike, almost surpassing the seven-year high recorded in late February, according to Market Intelligence data.

Nickel prices dropped in early March on fears of excess supply, booking a 12% downward correction to $16,133/t as of March 5. This followed shortly after Tsingshan Holding Group Co. Ltd. announced plans to use nickel pig iron, a material often used in stainless steel, to manufacture high-grade nickel matte and consequently nickel sulfate for batteries.

Despite a bump in nickel demand from EV battery manufacturers, global stainless steel production has been the primary driver of higher nickel demand in 2021.

"If it wasn't for the global stainless steel market — which is by far the biggest consumer of nickel — if that market wasn't running record-levels at the moment, the nickel price would have dropped back a lot more than it has," said Stuart Burns, founder and editor-at-large for MetalMiner, a metals procurement platform.

Since late July, nickel prices have slipped, settling at $18,385/t as of Aug. 19.

The recent price decline came "amid a general LME metals sell-off triggered by concerns over the global economic recovery and the U.S. dollar strength following U.S. Federal Reserve's comments on tapering bond purchases," Market Intelligence nickel analyst Jason Sappor said.

While high commodity prices were not the direct catalyst for the Sudbury strike, the disruption alongside other hiccups at nickel operations around the world have contributed to a slight supply crunch in the global primary nickel market in 2021.

Returning production at the Sudbury operations to pre-strike levels could take time. Even with the tentative Aug. 9 agreement, Vale said it would not bring the Sudbury facility back into full operation until the fourth quarter due to maintenance work. The delayed restart will further tighten the nickel market, Sappor noted.

On the back of rebounding demand and with the potential for a prolonged disruption at Vale's Sudbury operation, the LME three-month nickel price will increase 29% year over year to $17,936/t in 2021, according to Market Intelligence forecasts.

'Negotiations Tend To Be Tense'

In South America, BHP Group, one of the owners of the world's largest copper mine, has faced labor troubles of its own.

Unionized workers at the Escondida mine in Chile rejected a contract offer by BHP Group in late July and voted to strike. An agreement was reached in mid-August, saving the company and the market from a major disruption. BHP Group holds 57.5% of the Escondida joint venture. Rio Tinto Group owns a 30.0% interest, and Mitsubishi Corp. and JX Nippon Mining & Metals Corp. have the remainder.

As part of the agreement, Escondida workers won the equivalent of $30,000 in benefits, among other bonuses, Reuters reported.

"Unions are powerful in Chile," said Maria Rosa Gobitz, a senior research analyst at MetalMiners. "They do take advantage of the situation. They see the high prices and [know] companies want workers to keep working."

Labor unrest has also cropped up at other copper mines in Chile, which produces more of the red metal than any other country. For instance, JX Nippon Mining's Caserones mine and state-run Codelco's Andina mines, among others, have been plagued with strained labor negotiations. Workers at BHP's Cerro Colorado mine also recently threatened to strike.

"Unions cannot force the timing of contract renewals simply because there is a bull market," Eleni Joannides said in an email. Joannides is a principal copper analyst at Roskill, a critical materials research firm. "Negotiations generally begin several months before the end of the contract, initiated by both sides."

Still, "if negotiations overlap with a bull market, organizers can use these conditions as leverage to secure better conditions," Joannides said.

High copper prices, paired with economic inequalities exacerbated by the pandemic, are affecting this season of negotiations, according to Market Intelligence copper analyst Aline Soares.

"Under this environment, negotiations tend to be tense, with workers demanding higher pay and increased benefits while miners need to consider the economic sustainability of improved compensations in low-price scenarios," Soares said.

Disruption at Warrior

About 1,000 employees have also struck for better conditions at a Warrior Met Coal Inc. mine site in Brookwood, Ala. The company produces metallurgical coal, an ingredient used to make steel. Negotiations between the mining company and the union, United Mine Workers of America, have stretched on for nearly five months.

The strike caused second-quarter production declines at a time when global demand for metallurgical coal soared, supply stayed tight and prices for the commodity recovered, Warrior Met Coal CEO Walter Scheller acknowledged during an Aug. 4 second-quarter earnings call.

The CEO maintained that the company would continue to negotiate in good faith with the union and work toward maintaining "long-lasting careers" for employees.

But the future remains uncertain for the coal company.

"While we have business continuity plans in place, the strike may still cause disruption to production and shipment activities, and the plans may vary significantly from quarter to quarter for the remainder of 2021," Scheller said.