House Democrats Seek to Boost US Tax Credits for Clean Energy, Climate Programs

By Zack Hale

September 14, 2021 - Democrats on the U.S. House Committee on Ways and Means late Sept. 10 released a raft of proposed new and revised tax credits as part of a $3.5 trillion budget reconciliation package aimed in part at avoiding the worst effects of climate change.

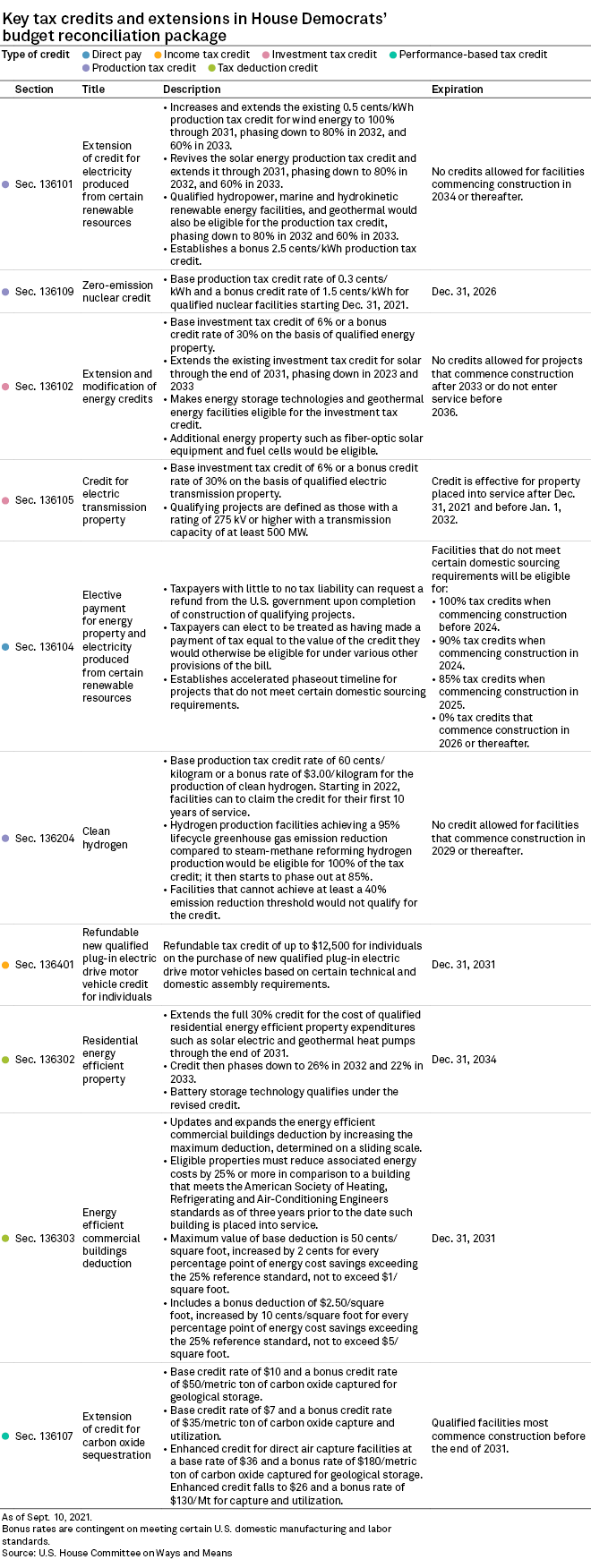

The committee's tax proposals include major extensions of existing production and investment tax credits for wind and solar energy facilities as well as new standalone investment tax credits for energy storage and needed new electric transmission lines.

Existing carbon-free nuclear generators and clean hydrogen production facilities would also be eligible for new production tax credits under the plan, according to a section-by-section analysis of the draft legislation. The tax package would also reward taxpayers for making new investments in residential and commercial building energy efficiency as well as electric vehicles assembled inside the U.S. with union labor.

Notably, most of the tax credits would be directly refundable through a concept known as direct pay, where taxpayers with little to no tax liability are nevertheless able to claim the credits when projects are complete. The direct pay provision would require eligible U.S. taxpayers to source an increasing amount of content from domestic suppliers.

Ways and Means Democrats declined to eliminate certain tax subsidies benefiting U.S. fossil fuel producers, something called for by U.S. President Joe Biden's latest budget blueprint. According to the Biden administration, eliminating certain subsidies would yield more than $35 billion in federal tax receipts over the coming decade. Under the current tax code, for example, oil, natural gas, and coal mining companies are allowed to immediately deduct drilling and development costs.

The Ways and Means Committee released the tax provisions a day after Democrats on the U.S. House Committee on Energy and Commerce unveiled their own contribution of the budget reconciliation package, which includes a Clean Electricity Performance Program, or CEPP. That $150 billion program would reward retail electricity suppliers for sourcing an increasing share of power from clean generators and penalize them for failing to meet annual performance targets from 2023 to 2030.

The Energy and Commerce plan would also significantly expand the number of companies required to report methane emissions data to federal regulators and potentially subject them to hundreds of millions of dollars in annual fines starting for the year 2022.

House Democrats are proposing to pay for the $3.5 trillion reconciliation package by raising the corporate tax rate to 26.5% from 21% and the top individual tax rate to 39.6% from 37%, among other tax hikes.

The tax provisions, together with the CEPP, form the backbone of House Democrats' plan to meet Biden's science-based goal of slashing the nation's economywide greenhouse gas emissions at least 50% by 2030 relative to 2005 levels.

However, U.S. Senate Committee on Energy and Natural Resources Chairman Joe Manchin, D-W.V., in a Sept 12 television interview voiced opposition to the size and scale of House Democrats' spending plan. As chairman of the Energy and Natural Resources Committee, Manchin would be responsible for overseeing Senate Democrats' own version of a CEPP.

But Manchin told CNN's "State of the Union" that the CEPP "makes no sense at all" given the clean energy transition that is already underway within the U.S. electricity sector. The West Virginia moderate also asserted that the final price tag of the reconciliation bill will not be $3.5 trillion.

The House Energy and Commerce Committee will markup its portion of the reconciliation bill on Sept. 13 and the House Ways and Means Committee is scheduled to hold its own markup on Sept. 14.

U.S. House Speaker Nancy Pelosi has promised a full vote on a separate $1.2 trillion bipartisan infrastructure package by Sept. 27 as part of her party's broader budget reconciliation effort.