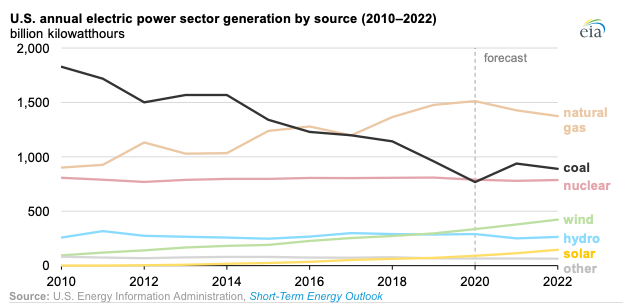

Coal-Fired Generation Expected to Rise This Year for First Time Since 2014

November 1, 2021 - A recently released federal report shows coal-fired electricity generation is estimated to increase this year for the first time since 2014.

According to the U.S. Energy Information Administration’s “Short-Term Energy Outlook” report, there is expected to be 22% more U.S. coal-fired generation in 2021 than in 2020 — largely as a result of increased natural gas prices caused by the COVID-19 pandemic.

The report’s forecast shows coal production is expected to total 588 million short tons in 2021, 53 million short tons more than in 2020.

The share of electricity generated by coal in the U.S. is expected to increase this year for the first time since 2014, according to the U.S. Energy Information Administration.

Source: U.S. Energy Information Administration

Demand for coal from the electric power sector is expected to increase by 84 million short tons in 2021.

Production growth is unlikely to match the increases in demand in the near term due to many coal mines operating at a reduced capacity and limited available transportation, according to the report’s findings.

In 2022, coal production is expected to increase by 34 million short tons to 622 million short tons, as the production and transportation constraints experienced in 2021 ease.

Secondary inventories of coal at electric utilities decreased in the first half of 2021, and the forecast expects this trend will continue into the second half of 2021 and 2022.

Chris Hamilton, president of the West Virginia Coal Association, said the report’s nationwide forecast is in line with what he’s been hearing from West Virginia coal producers.

Chris Hamilton

“We agree, of course,” he said. “Our information indicates that coal production within the state of West Virginia is about 20 to 22% over last year’s output. We’re seeing a lot of new orders coming in, which allows people to ramp up very modestly.”

Coal supplies are currently “tight,” but market prices are favorable, Hamilton said.

“The export market is going very well,” he said. “We’ve had a better than average third quarter so far. We’re hearing reports of local shortages of coal (around the world), because of that restricted supply. The world is responding to very low output last year — basically because of COVID. As those basic supplies are being brought back to normal levels, a number of foreign countries that we ship coal to are asking for more and are desirous to use more.”

Germany, Japan and portions of China have experienced local shortages of coal, Hamilton said.

“Some are rationing power and a lot of headlines are highlighting energy crises in portions of the world,” he said.

Like just about every other business and industry, the state’s coal industry has felt some impacts of the strains on the global supply chain, Hamilton said.

“We’re running into that,” he said. “There have been times over the past 18 months or so where the supply has created more issues than not. But for the most past, that has evened or balanced out in our world and it’s returning back to normal.”

The EIA’s report says this year’s expected increase in coal-fired electrical generation is not likely to continue in the years to come.

About 30% of that nation’s coal-fired generation facilities have been retired in the last two decades and no new coal-fired capacity has come online since 2013. Additionally, the report notes, coal stocks at U.S, power plants are relatively low and production at operating coal mines has not been increasing as rapidly as the recent increase in coal demand.

While this may be the case for the U.S. as a whole, Hamilton said that’s not what he expects to happen in West Virginia.

“The export of coal thorough the world is really doing well right now,” he said. “We’re shipping our metallurgical coal, the coal for steel-making, to 37 foreign destinations. And there’s been a increase in stream coal exports as well. We’re exporting thermal, or steam coal, to more than 20 foreign destinations as we speak.”

World consumption of coal is on the increase, even as the U.S. continues to move away from coal and toward natural gas and renewable sources, Hamilton said.

“China not only uses five times the amount of coal we use today, but they have actual coal plants under construction that equates to our entire coal fleet here in the United States,” he said. “It appears that we’re moving toward ratcheting down our fossil energy production, while world carbon emissions increase.”