American Coal is Making a Comeback! Coal Fired Power Generation Will Rise for the First Time Since 2014

January 1, 2022 - Although the U.S. government wants to 2035 Decarbonization of power grid will be realized in , But the shift to clean energy will not happen overnight . Against the backdrop of high natural gas prices this year , Coal power generation is now making a comeback in the United States .

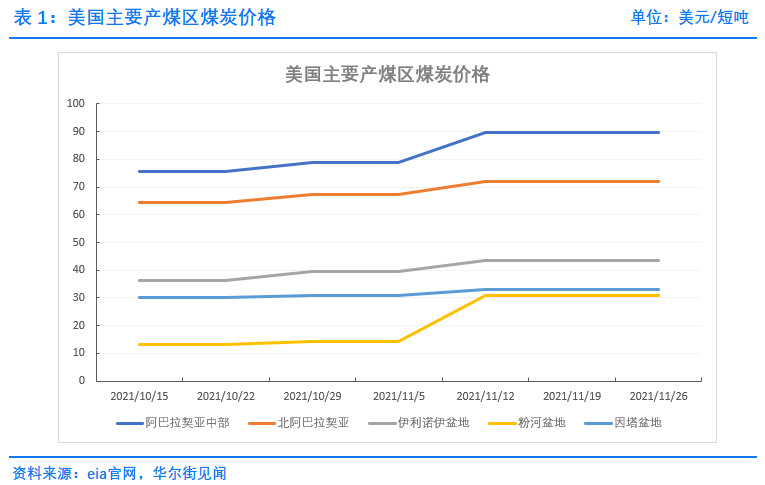

According to the U.S. Energy Information Agency (EIA?statistics , Today, U.S. coal stocks are 1970 Annual low ; Coal prices in the United States have increased since 11 Keep... Since June 2009 The highest level since .

Coal prices in central Appalachia, the main coal producing region in the United States, remain at 89.75 dollar / Short ton high ; North Appalachian coal prices reached 72 dollar / Short ton ; The price of coal in the Illinois basin reached 43.4 dollar / Short ton ; The price of coal in Fanhe basin reached 30.7 dollar / Short ton ; Coal prices in the inta basin also remained at 33.15 dollar / Short ton .

From the demand side , According to the U.S. Energy Information Administration (EIA) The data of , Coal fired power generation in the United States will appear this year 2014 For the first time since , Year-on-year growth 22%. According to the EIA expect , The share of coal in the U.S. power generation structure will also increase slightly , expect 2021 The year will be 23%,2022 Years for 22%, higher than 2020 Year of 19.3%.

From the supply side , In the American market , Most thermal coal is usually sold under long-term contracts , Supply elasticity is weak . meanwhile , Increasing emphasis on environmental protection ?ESG In the context of investment , American companies are interested in coal ? There is little willingness to invest in traditional industries such as crude oil , Unwilling to expand production as much as before . Besides , Limited income ? Uncertain industry prospects and other factors , The size of the labor market in the U.S. coal industry is also shrinking . These factors add up , This has led to a limited increase in U.S. coal production capacity .

It is worth mentioning that , The rise of global coal prices has also greatly promoted us coal exports , Resulting in a limited stock of domestic output .

Oil and gas prices have soared , The demand for coal substitutes has soared , Inventory levels are at a new low

According to the U.S. Energy Information Agency ?EIA? Statistics ,2020 year , The United States still has 60% More than of the electricity comes from fossil fuel power generation , among ,40% Generate electricity for natural gas ,20% For coal .

.png)

2020 Power generation structure in the United States

Chart Source ?EIA Official website

since this year on , Strong demand for electricity ? Driven by the long-term high prices of crude oil and natural gas , Many power plants in the United States choose to use coal to generate electricity , Leading to a surge in alternative demand for coal , Coal prices remain high .

EIA stay 11 month 9 It is predicted in the short-term energy outlook released on the th ,2021 In, the average share of natural gas power generation in the United States was 36%,2022 The year will be further reduced to 35%, lower than 2020 Year of 39%; However , The share of coal power generation will increase slightly , expect 2021 The year will be 23%,2022 There will also be 22%.

Besides , Now U.S. coal inventories are also a record 1970 Annual low . In this short-term energy outlook ,EIA mention , U.S. utility coal inventories are from 2021 year 8 The month begins with 1970 The lowest level since the early s , American power The inventory of the Department is about two-thirds of the average level in recent five years . The agency said ?

“ The growth of coal production in the United States has not kept pace with the growth of domestic demand and export growth of power coal in the power sector , Resulting in a reduction in coal inventories held by the power sector .”

Moodie Vice President, Ben Nelson Previously, it said , In recent years, insufficient investment has hindered the ability of producers to quickly accelerate output . He thinks that ?

“ The response of the coal industry to the surge in market demand is not fast enough .”

The recovery in demand for coal may be temporary

Growing coal demand and the highest coal price in more than a decade , It has rapidly improved the profitability of large coal mining enterprises in the United States , It also gives it a higher bargaining power in the long-term coal purchase order negotiation with utility companies .

American coal developers Ramaco Resources CEO of Randy Atkins Recently expressed ?

“ I remembered that line , Who says Christmas can't come early . We are now in the best annual financial data and operating results since listing .”

On the third quarter earnings conference call ,Alliance Resource CEO of Joe Craft It also shows that he is optimistic about the short-term coal market . He said ?

“ Looking forward to the future , Biden administration's domestic energy policy agenda , Plus Europe and the United States ESG Obsession , It is likely to continue to limit the growth of fossil fuel production . If there is no significant decline in global demand , We expect the price level of fossil fuels to remain or increase next year and the year after .”

Although today's American coal industry looks happy in the cold winter , however , Some analysts in the market still think , The recovery in coal demand may be temporary , The industry is still on a downward trajectory in the long run .

In the big context , Governments increasingly favor the new energy industry , Increase investment in new energy industry . Global right ESG More and more attention to investment , Or lead to higher coal prices is only a flash in the pan . When the cold winter is over , The market demand for coal has weakened , The price of coal may fall into a longer period of silence .

Moody's, a rating agency, has previously said ?

“ Moody thinks , Investors are interested in the coal industry ESG Concerns about the situation are still growing . Despite the current strong coal pricing and improved debt trading levels , But by the middle of this decade , Coal producers will face more and more challenges .”