Stretched Supply Chains Hit European Coal Availability

By Alex Thackrah

January 24, 2022 - Strained coal supply chains in northwest Europe could limit deliveries to utilities during the peak winter heating season and spark a flurry of arbitration disputes relating to non-performance of contracts.

Amsterdam-Rotterdam-Antwerp (ARA) market participants have warned that contractual obligations might not being fulfilled, either as a direct result of, or a knock-on effect from, rail constraints in Russia — Europe's largest coal supplier.

The exact tonnage under threat of non-performance is unclear, but several supply chains are affected, including coal for some German utilities, participants said.

Russian producers have been struggling to access rail capacity to the northwestern ports that supply Europe's coal market for several reasons. These include freezing temperatures and storms, extended maintenance by state-run Russian Railways (RZD) and a shortage of railcars. The prioritisation of eastbound export deliveries to higher-paying Asia-Pacific buyers is another factor.

What limited Russian spot cargoes are available are changing hands at significant premiums to the API 2 index. Premiums for February-loading NAR 6,000 kcal/kg coal are in the low-$30s/t, with a cargo trading at a premium of $30.50/t on 18 January. A NAR 5,500 kcal/kg off-specification February-loading cargo changed hands at a premium of $34.90/t this week, although the destination is unclear.

January Volume Impact

One trader said Russian supply to northwest Europe in January may be 30-40pc below normal. One Russian producer said supply could drop by 30pc against average monthly flows in the second half of 2022, but another said that while 30pc of deliveries from one supplier may be affected, the overall volume will not drop that much.

Average daily Russian coal rail deliveries to northwestern ports dropped by 19.3pc from December to 121,000 t/d on 1-11 January, rail data shows. December deliveries to northwestern ports declined by 8pc on the month and 18.9pc on the year to 4.15mn t. The year-on-year fall reflects lower deliveries to Ust-Luga and Murmansk.

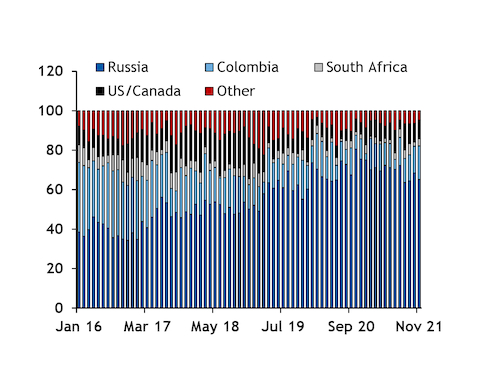

Europe's thermal coal imports picked up in 2021 on higher power-sector demand, with November imports for the EU 27 and UK hitting a 32-month high of 6.9mn t, according to Eurostat. January-November imports rose by 16pc on the year to 71.2mn t, with Russia's share hitting 70pc, up from 68pc a year earlier and 57pc in January-November 2019.

Shipping data suggest western Europe's coal imports rose by around 2pc on the month in December, but that January arrivals could decline by 11pc.

Buy-Side Adaptation

A European power-sector buyer said there have been problems with Russian rail deliveries and delayed or cancelled cargoes for months, and that utilities have to be able to prepare by diversifying supply sources and procuring additional cargoes.

With dark spreads so high, he said it is crucial for power buyers to ensure deliveries.

Tight supply in Colombia, the US, South Africa and Poland is limiting buyers' alternatives to Russian coal, while Indonesia — the world's largest exporter — this month imposed a January export ban, which has only just begun to ease. A 25,000t cargo of February-loading NAR 6,000 kcal/kg coal dealt on-screen at $300/t fob Newcastle on 21 January.

No index-relevant February-delivery offers have been reported in the cif ARA NAR 6,000 kcal/kg market since 14 January, giving an indication of the tightness. Argus' assessment of this grade rose to a 10-week high $180.63/t on 18 January.

Utility Run Rates

Any significant supply shortfall arising from contractual non-performance could affect German utilities' ability to run coal-fired plants at desired rates. Hard coal-fired generation in Germany is strong, averaging 7.9GW on 3-14 January, or 55pc of capacity. And fuel-switching levels based on prevailing spot and forward prices suggest even the least efficient coal-fired plants are in the money relative to gas through to 2024.

Coal stocks at ARA ports are hovering around historic lows of 3.6mn t, and a combination of weak imports and strong coal burn could complicate inventory management and run rates for some utilities. A fresh drop in Rhine river levels to below 180cm this week could also hit barge deliveries.

Coal-fired generation in the UK and other countries in the region has also been running higher than recent norms. France has allowed the operators of the country's two remaining coal-fired plants to step up running hours, amid firm power prices and nuclear plant disruption.

Despite a ramp up in LNG deliveries to Europe, underground gas storage levels remain low, heightening the risk of price volatility over the remainder of winter, not just for gas, but power and coal too. The tensions between Russia and Ukraine and heavy rainfall in several coal-producing regions associated with La Nina are other upside risk factors for coal prices. But weaker Chinese seaborne demand resulting from higher domestic production and a buy-side slowdown ahead of the lunar new year and Winter Olympics could cushion the impact of further supply disruption.

European coal imports market share Pc