Rail Service Meltdown Constraining US Coal Sector in Hot Market

May 9, 2022 - U.S. coal miners, eager to sell into a reinvigorated market, are struggling to move their product as train lines tangle with a severe labor shortage.

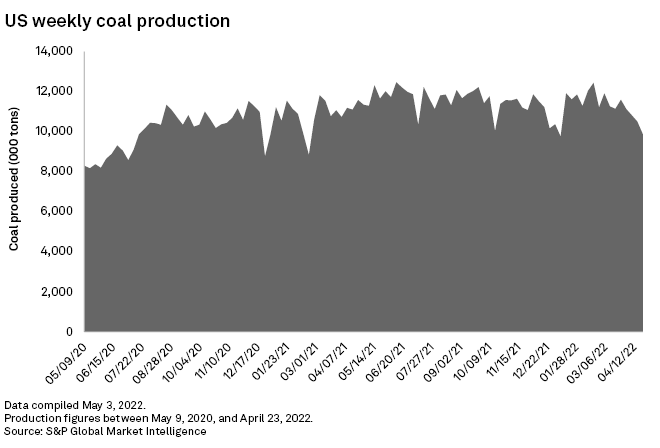

International prices for the thermal coal used by power plants and the metallurgical coal used to make steel have climbed dramatically over the last 12 months as domestic demand and international demand bounced off pandemic-driven lows and coal producers amped up production volumes. But coal is piling up at the mine as expected freight trains simply do not show up.

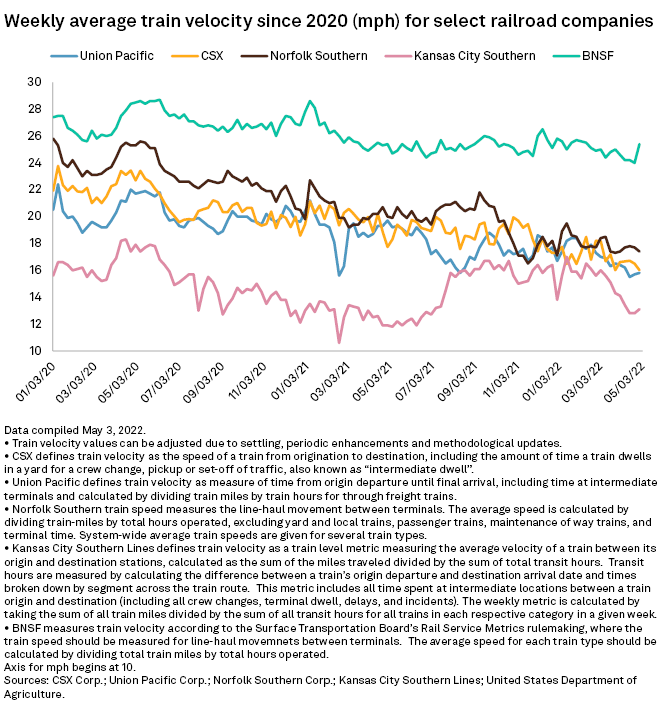

Overall, rail employment is down 20.4% since January 2019, according to the U.S. Bureau of Labor Statistics. Train operators are working to address the issue but acknowledge it could take several months to fix the shortfall in workers. The assessment of high-vol A metallurgical coal prices from the U.S. East Coast, for example, climbed as high as $525/tonne in March after spending most of 2020 just above $100/tonne, but the supply response has been limited due to the slower train service and other factors.

Coal companies are frustrated over the inability to move more coal into the soaring market.

"The situation is entirely attributable to a meltdown in rail service capability that is affecting shippers of every size and type," said John Ward, executive director for the National Coal Transportation Association, a trade association funded by coal producers and power utilities.

Train service impeding coal sales

Many coal producers celebrated improved and even record financial results in recent quarterly reports, but also found that inadequate rail service was preventing a more robust rebound in sales. Coal production increased 8.0% year over year in 2021, according to S&P Global Market Intelligence data.

"Rail performance has been extremely disappointing as we worked through the quarter," Arch Resources Inc. Senior Vice President and COO John Drexler said on an April 26 earnings call. "It's been our biggest challenge and it's created a host of issues for us to be working through and dealing with."

Arch estimated that it received only 60% of the trains required by its Eastern U.S.-based metallurgical coal segment during the first quarter of 2022. While the company said rail services met nearly 70% of those requirements by March, less than half the trains required to match supply levels were arriving in January, the company said.

The coal producer estimates it is now receiving about 80% of the trains typically expected.

"That means we're still adding coking coal to already swollen stockpiles," Drexler said.

Rail issues are also impacting on shipments from the Western U.S., where companies primarily mine thermal coal used for power generation. Arch executives noted that, while the company has sold above its guidance range for Western U.S. coal this year, they expect about 5% to 10% of output to be pushed to later years due to rail issues.

During an April conference hosted by the National Coal Transportation Association, 92% of members participating in a survey said that rail service shortfalls had impacted their company's transportation of coal, with 64% reporting resulting modifications to operating plans in the second half of 2021.

Executives with Peabody Energy Corp., the nation's largest coal producer, have also flagged the impact of railroad service on its coal deliveries, while Warrior Met Coal Inc. estimated on a May 5 call that poor rail performance cost its business $32 million in net income in the first quarter. Other coal companies that have noted issues with rail service during first-quarter earnings calls include Consol Energy Inc., Alliance Resource Partners LP and Alpha Metallurgical Resources Inc.

A survey of utility members also conducted by the National Coal Transportation Association in April found that two-thirds reported poor rail service, and over half reported it was getting worse. Of its utility members, 78% reported missed coal shipments due to rail issues while even more said railroad service is negatively affecting the ability to maintain power plant coal stockpiles.

Good help, hard to find

The U.S. Bureau of Labor Statistics estimated there were 183,000 employees in the rail transportation sector as of January 2019. That figure dropped 20.7% to 145,100 by January 2021 and has since gained little to no ground.

BNSF Railway Co., which ships more coal by volume than any other rail service in the U.S., plans to hire approximately 1,000 additional train crew personnel in 2022 and already has 300 people in crew training, BNSF spokesperson Ben Wilemon wrote in an email. The company has also seen a "significant improvement in crew availability" since updating its attendance policy in February, the spokesperson said.

"BNSF teams have implemented an aggressive service recovery program to generate velocity and fluidity improvement across the network," Wilemon said. "We are making incremental progress in addressing elevated railcar inventory levels, reduced velocity and resource imbalances with freight volumes."

Norfolk Southern Corp. said it has ramped up hiring with 850 active conductor trainees and more on the way. The rail service has also rolled out a plan including capital expenditures to expand its network capacity.

"We are laser-focused on improving service; however, we continue to operate in a tight labor market, and demand on the national supply chain remains extraordinarily high," a Norfolk Southern spokesperson told Commodity Insights.

A Union Pacific Corp. representative told Commodity Insights that the rail service provider is working with customers to address the impacts of several "disruptive events." That includes training new employees, relocating crew members to high-demand areas and adding new locomotives to its fleet.

CSX Corp. is also addressing delays related to the explosion of a coal transfer tower at its Curtis Bay coal terminal in late 2021. A CSX representative said the company expects that facility to be fully repaired later this year and noted the company is also bringing on more employees.

Coal producers demand action

Rail service providers did not say when they would be able to restore service to acceptable levels while attending a two-day hearing on freight rail service issues held by the Surface Transportation Board starting April 26, Ward said.

Industry observers estimate rail service could return to acceptable levels as soon as the third quarter of 2022 or as late as mid-2023, Ward added.

The National Coal Transportation Association and other parties have called on the Surface Transportation Board to take action to improve rail service. That includes potentially requiring increased transparency about reducing or rationing service, requiring action plans to remedy railroad delay issues and imposing certain financial limitations on rail service providers.

Some coal companies are even hiring and training additional staff to load trains when — or perhaps if — they arrive. Katie Mills, counsel for the National Mining Association wrote in a testimony to the board that one coal company was considering third-party rail services for loading, while another was considering reopening a river terminal to move coal.

"Just because the mines are running full speed ahead, it does not necessarily mean that coal is moving across the country by rail," Mills wrote. "The issue is not the number of cars on trains, it is that the trains often do not show up at all."