Carbon Capture Simply Won't Work to Meet Net-Zero Targets, Report Says

September 4, 2022 - An Institute for Energy Economics and Financial Analysis report concluded that the majority of carbon capture projects have failed or underperformed, while the few successful projects have mostly contributed to the procurement of fossil fuels.

The findings, published Sept. 1, cast doubt on a widely cited United Nations climate change report that said carbon capture will be necessary for net-zero emissions by 2050.

"Many international bodies and national governments are relying on carbon capture in the fossil fuel sector to get to net-zero, and it simply won't work," study author Bruce Robertson said in a statement.

But carbon capture advocates said the report is based on an outdated view of the technology. And carbon capture's outlook has changed dramatically since the Biden administration's bipartisan infrastructure law and the more recent Inflation Reduction Act.

'Polarizing views'

Carbon capture is a nascent technology that intercepts carbon dioxide from emissions streams, such as gas processing facilities or power plants. Once captured, the CO2 byproduct is piped away and either permanently stored underground or used for other industrial purposes.

The study authors analyzed 13 carbon capture projects in various applications, accounting for about half of worldwide carbon capture capacity. Of the projects analyzed, seven performed below their stated capacities, two failed due to technical issues and one was suspended, the study said.

But even some of the projects that have been technological successes are not net-zero, according to the report, citing Shell PLC's Quest carbon capture project in Alberta, Canada. Despite a high nominal CO2 capture rate, that rate does not account for the CO2 emitted to power the carbon capture technology, which offsets 21% of emissions "saved," the institute said. Shell did not immediately respond to a request for comment.

The successful projects tend to contribute to the production of more fossil fuels, leading to further emissions, the study said. An example is natural gas processing, which requires separating CO2 from raw gas to produce a marketable product. The CO2 byproduct may be sold for enhanced oil recovery, in which CO2 is injected into oilfields to extract more crude.

"This explains why the sector has been using carbon capture technology for decades, not necessarily as a climate-friendly solution but as an inevitability to produce the fossil-fuel natural gas," the authors wrote.

Carbon capture advocates, however, said recent policies favor investment for more climate-friendly purposes.

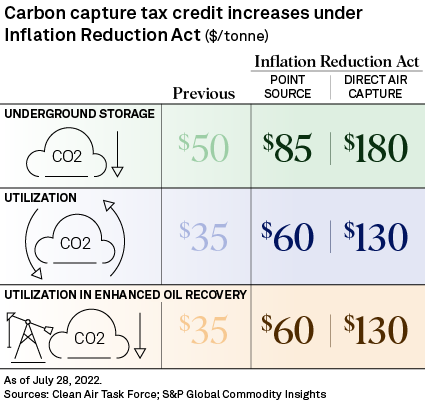

The U.S. government's 45Q tax credit program, expanded in 2018 and again in July by the Inflation Reduction Act's $369 billion of climate and energy provisions, awards a credit for every tonne of CO2 captured and stored. The program also awards a smaller credit for every tonne of CO2 captured and utilized.

"Though enhanced oil recovery was the original driver of carbon capture, secure geologic storage is the future of the industry," said Matt Bright, carbon capture policy manager at the Clean Air Task Force, citing the nonprofit's overview of U.S. carbon capture projects.

Bright said that until now, it was "market conditions, not technological readiness," that stalled carbon capture deployment. "The [Inflation Reduction Act's] 45Q enhancements finally value the reduction or removal of CO2 to a sufficient degree to spur whole systems of decarbonization based on carbon capture rather than isolated projects," Bright said.

Jessie Stolark, public policy and member relations manager with the Carbon Capture Coalition, also said the report "paints an inaccurate picture of the current state of carbon capture."

More than 120 carbon capture projects have been announced since the 45Q tax credit program was expanded in 2018, Stolark said, and most plan to permanently store CO2 rather than utilize it.

The report does not dispel the notion that carbon capture may be the only climate-mitigating tool for "hard-to-abate" sectors, such as steel or cement production. However, these applications should be considered as interim measures and with "careful consideration," the authors wrote.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.