Growing Shortage of Coking Coal Expected From Early 2030s

November 9, 2023 - At the Indian Steel Association's (ISA) maiden coking coal summit held recently in New Delhi, India, an array of experts from the global steel and coal industries gathered to share their views. Industry leaders who participated in the inaugural session on global demand-supply perspectives were Edwin Basson, Director General, World Steel Association; Tong Minghua, Director, Market and Research Department, China Iron and Steel Association; Bimlendra Jha, Managing Director, Jindal Steel and Power; V.S. Chakravarthy, Director (Commercial), SAIL; Matt Latimore, Founder and President, M Resources; and Gerhard Ziems, Group Chief Financial Officer, Coronado Global Resources.

Earlier, M. Nagaraju, Additional Secretary, Ministry of Coal, Govt. of India, delivered the keynote address on measures taken to raise domestic coking coal production.

Key takeaways:

Global steel outlook

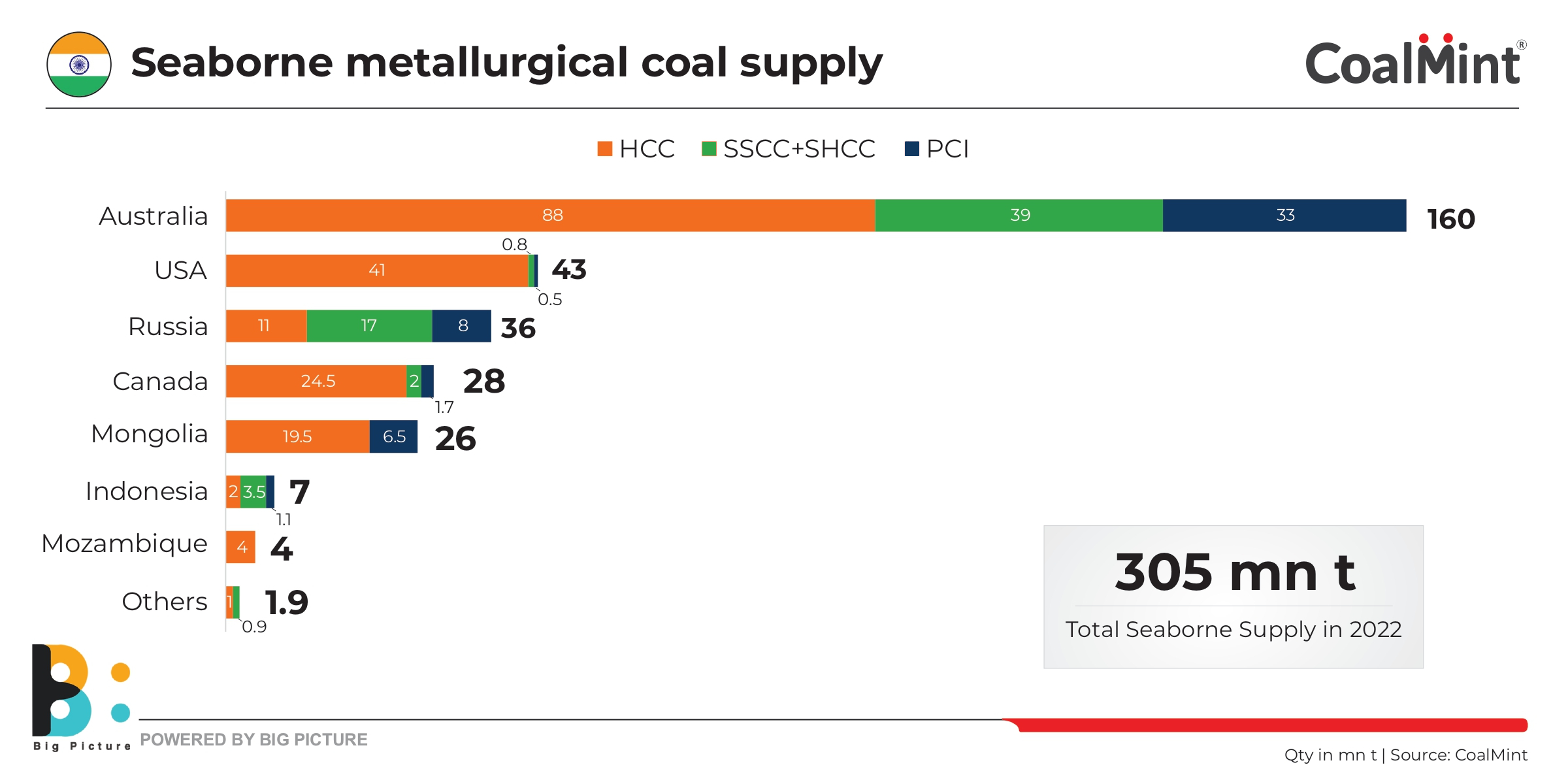

*Global coking coal market is around 1.1 bnt and seaborne trade is around 305 mnt but the steel industry is reliant on a very narrow supply base which is the main cause of disruptions and volatility.

*In steelmaking, lower and more efficient use of carbon, increasing scrap, pellets, DRI use, efficiencies in iron-making and higher HCC, hard coke use are short-term trends.

*Hydrogen and other green steelmaking technologies will have an impact only in the mid- to long term. Hydrogen use in BFs will require changes in coal specifications.

*Under scenarios in which the steel industry decarbonises slower than expected and/or steel demand is higher than expected, the global steel industry is likely to suffer from growing met coal shortage from early-2030s.

*It may be expected that steel demand in China will fall by around 5% from now to 2030, and if China succeeds in increasing the share of EAF steelmaking to 20% by that time from 10% at present, the global ratio of BF-BOF:EAF steelmaking will stand at around 65:35 in 2030 from 72:28 at present, as per ISA estimates.

*Provided sufficient scrap availability is ensured, and given the possibility of rising share of DRI-EAF steel production, the share of electric steelmaking may rise to 50% globally by 2050.

*China is targeting to raise the share of EAF steel production on sustained growth in recycled steel supply due to very high steel production since 2000.

*The share of imports in China's coking coal consumption is just 10% and, going forward, production controls in view of carbon neutralisation efforts will impact met coal demand.

Supply concerns

*The only hurdle that can prevent India from attaining its steelmaking targets for 2030 or 2047 is growing supply tightness of prime coking coal. Both desired grades and total volumes may become increasingly insufficient.

*The maturation of alternative technologies such as hydrogen or electricity-based, electrolytic reduction of iron ore will be much slower than the pace at which prime coking coal supplies may dry up.

*In mines across the world, the stripping ratios are going higher and it is expected that underground mining operations will increase in Australia going forward.

*Canadian supplies are slowly decreasing over the years on ageing mines, public protests centered around coal mining, and ban on open cut mining restricting new supplies such as the Tent Mountain project which was shelved.

* US met coal exports, however, totalled 42.1mnt in 2022, trade data show, 3.2% higher than a year earlier on better rail and port connectivity. US coking coal output increased by around 3% y-o-y in CY22.

*All listed diversified miners have divested coal assets, and BHP is holding on to only PHCC assets. Luckily, all the divested mines have gone to private miners that are unlisted and do not face investor pressure to decarbonise. As a result, seaborne supplies are still there but fast drying up due to mine depletion and lack of investments.

*High utilisation rate of Australian port and rail logistics and low inventory holding capacity increase volatility risks.

*For Indian mills, partnerships with Australian miners are an imperative. The Australian government is progressing towards recognising met coal as an asset in the energy transition. Therefore, despite high royalties and taxes currently discouraging investments, government-level interaction between India and Australia is needed to mould policy going forward.

India's rising PCI demand

*All new blast furnaces will have extra capacity for pulverised coal injection (PCI) and the PCI rate is expected to reach around 200 kg per tonne of hot metal. It is a key cost reduction tool.

*The PCI rate is a key measure of blast furnace steelmaking. It is even possible to go up to 220-230 kg of PCI/tonne of hot metal, but this contradicts the use of prime hard coking coal. For Indian mills, the sweet spot is 200 kg of PCI/tonne of hot metal.

*PCI supplies from geographies other than Australia are going up and this is a positive sign indicating stable supplies going ahead compared with PHCC, with India as a stable market.

Domestic production: targets vs. reality

*Domestic washed coal production, accounted for primarily by Tata Steel and SAIL, has decreased over the last five years from around 5 mnt to 3 mnt, while CIL has raised production from 1.5 mnt to around 2.7 mnt.

*India has very low reserves of low-volatile hard coking coal. Washery capacity is still insufficient and yield is abysmally low making the process uneconomical.

*Around 16% ash domestic coking coal is ideal only for stamp charging. So, all the new coke ovens will be based on stamp charging technology to increase use of domestic coal. Trials are needed to arrive at the right blend for Indian mills amid the decarbonisation challenge.

*As per government targets, 140 mnt of raw domestic coking coal will be produced till 2030. Last year, India produced 54 mnt. Looking at current policies and targets, another 32 mnt is likely to be added by 2030, which means a shortfall of nearly 55 mnt.

Measures to raise output

*The government is seeking to increase supplies by putting more coking coal blocks for auction and increasing exploration. Eleven have already been auctioned and 27 have been allocated for auction.

*Abandoned, discontinued mines are being given away on revenue sharing basis.

*The Jharia master plan will increase coking coal production.

*India has no coking coal washeries. Out of 10 new washeries planned, two have been completed and the rest will be completed by 2026-27 to stop diversion of coking coal to the power sector.

*Government will facilitate land acquisition for setting up washeries near mines to increase washed coal volumes for the steel sector.

*There is a proposal for ensuring low-volatile medium coking coal available with ECL to be channelled to the steel sector.

Price volatility and index

*Coking coal price volatility has been a major concern and even during a period when Australian supplies are typically higher in the absence of extreme weather events, prices have shot up to $350/t FOB.

*Lack of liquidity of the coking coal index is a concern. Only one miner has a disproportionate role in the index.

*Recently, Tata Steel has started sourcing met coal through the MJunction platform. So, the emergence of such alternative platforms and the fact that coking coal comes from a diversity of sources indicate that the index needs to be more broad-based.

*Volatility in coking coal prices shows the fragility of seaborne supplies.

*By 2030 it is projected that Chinese steel production will fall by approximately 200 mnt and so met coal consumption will naturally decline along with growing scrap availability. If China finds it profitable then to export coal it may go a long way in tempering global prices. Although for India, national strategic interests will be key when it comes to sourcing Chinese coal.