.gif)

|

Signature Sponsor

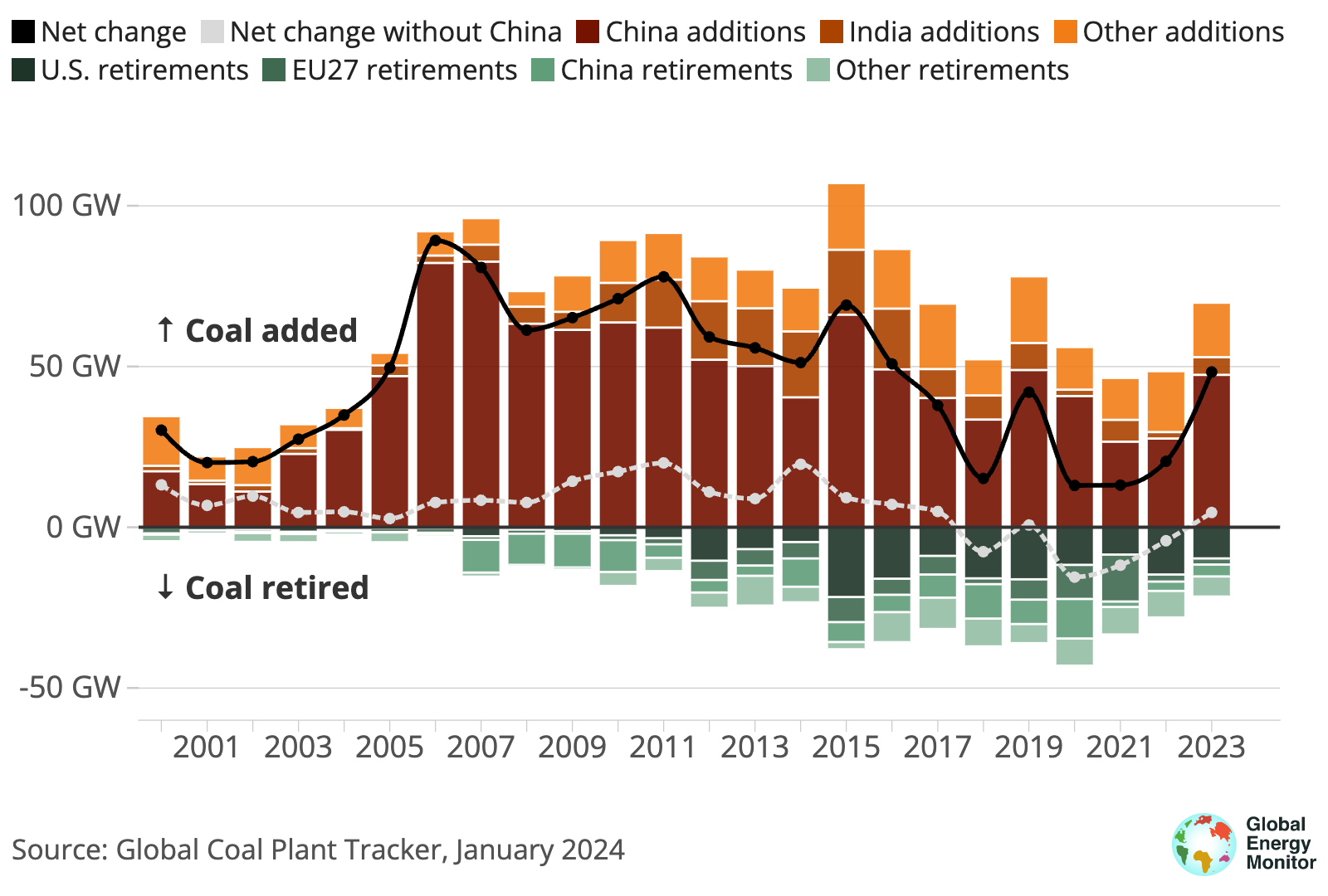

Global operating coal capacity grew by 2% in 2023, with China driving two- thirds of new additions, and a small uptick was seen for the first time since 2019 in the rest of the world, according to Global Energy Monitor's annual survey of the global coal fleet. Data in the Global Coal Plant Tracker show that 69.5 GW of coal power capacity was commissioned while 21.1 GW was retired in 2023, resulting in a net annual increase of 48.4 GW for the year and a global total capacity of 2,130 GW. This is the highest net increase in operating coal capacity since 2016. The global operating coal fleet grew further, including rise outside China for first time since 2019 as retirements slowedAnnual change in coal-fired power capacity, in gigawatts (GW)

A surge in new coal plants coming online in China drove this increase — 47.4 GW, or roughly two- thirds of global additions — coupled with new capacity in Indonesia, India, Vietnam, Japan, Bangladesh, Pakistan, South Korea, Greece, and Zimbabwe. In total, 22.1 GW was commissioned and 17.4 GW was retired outside of China, resulting in a 4.7 GW net increase to the operating coal fleet. Although new retirement plans and phaseout commitments continued to emerge, less coal capacity was retired in 2023 than in any other single year in more than a decade. Lower retirements in the U.S. and Europe contributed to the coal capacity upswing. At 9.7 GW, the U.S. contributed nearly half of capacity retired in 2023, a drop from the 14.7 GW retired last year and its 21.7 GW record high in 2015. European Union member states and the United Kingdom represented roughly a quarter of retirements, with the U.K. (3.1 GW), Italy (0.6 GW), and Poland (0.5 GW) leading the region’s retirements for the year. But the accelerated growth in coal capacity may be short-lived, as low retirement rates in 2023 that contributed to coal’s rise are expected to pick up speed in the U.S. and Europe, offsetting the blip. Heightened capacity additions would also be tempered if China takes immediate action to ensure it meets its target of shutting down 30 gigawatts (GW) of coal capacity by 2025.

The trajectory the global coal fleet takes from here depends to an extent on new construction starts — one of the key indicators of growth in the sector — which declined outside of China for the second year in a row and hit a record annual low since data collection began in 2015. In China, the exact opposite happened, with new construction starts increasing for the fourth year in a row and hitting an eight-year high. The report shows that construction started on less than 4 GW of new projects outside China in 2023, well below the 16 GW annual average between 2015 and 2022 for the same set of countries. Only seven countries, excluding China, appeared to start construction on new coal units last year: one plant each in India, Laos, Nigeria, Pakistan, and Russia, as well as three plants in Indonesia. Moreover, no coal plant construction has started in Latin America since 2016, and no coal plant construction has started for member countries within the OECD, Europe, or the Middle East since 2019. In Nigeria, the start of foundation work at the mine-mouth Ugboba power station in 2023 was the first known construction start in Africa since 2019. |

|