|

Signature Sponsor

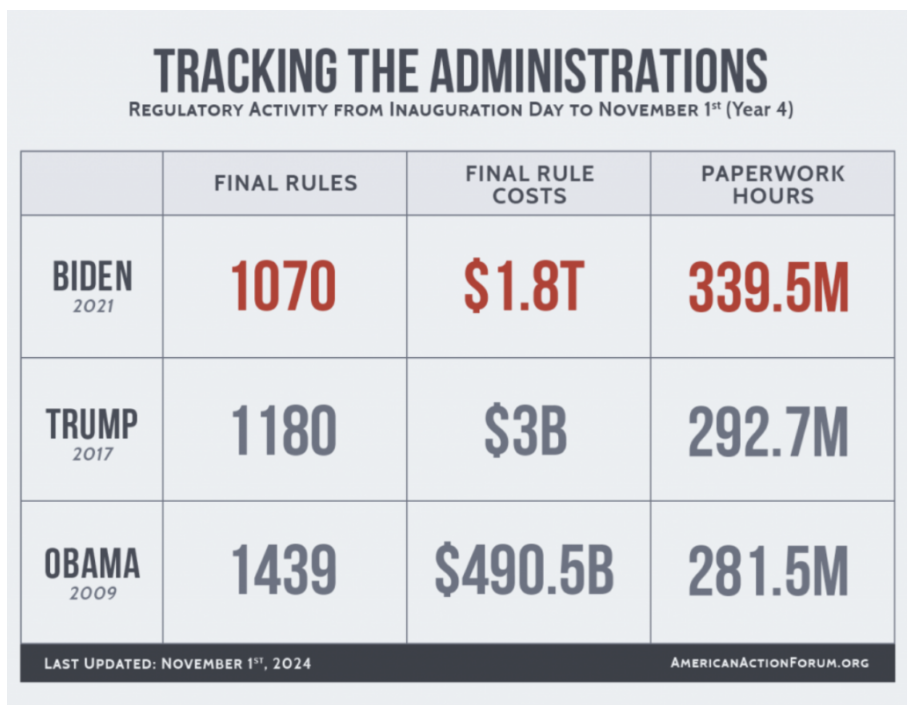

November 12, 2024 - According to the American Action Forum, The Biden Administration’s regulatory cost total now stands at nearly $1.78 trillion – about the same as Australia’s GDP. According to the Congressional Budget Office, it is also roughly equivalent to the fiscal year 2024 federal budget deficit. That level of regulatory costs was 600 times higher than during the Trump administration and about 3.7 times higher than the Obama administration. Regulatory costs are a hidden tax on productive enterprise within an economy, which if significant enough, can stifle investment and job creation by stopping projects. These regulatory actions cut across all government areas.

The regulatory burdens include energy and environmental policies from the Biden-Harris administration’s Environmental Protection Agency (EPA), Department of Energy (DOE), and Department of Transportation (DOT). The EPA’s tailpipe emissions rule sets limits on exhaust emissions from cars and light trucks, compelling automakers to gradually increase the sale of electric and plug-in hybrid vehicles, aiming for two-thirds of all vehicle sales to be electric by 2032. This mandate aligns with the Corporate Average Fuel Economy (CAFE) standards set by the Department of Transportation. President-Elect Trump is expected to issue an executive order on or near his first day in office instructing the EPA to reconsider this rule. He is also anticipated to challenge the Clean Air Act waivers granted to California, which allow the state to enforce stricter emissions standards than the national rules, potentially leading to a ban on gasoline-powered vehicles. California is also seeking similar waivers to impose stringent emissions rules on other forms of transportation, such as trains. Another significant regulation under the Biden-Harris administration is the EPA’s Power Plant Rule, which mandates a 90% reduction in carbon dioxide emissions from existing coal plants and new natural gas plants. This rule relies on expensive, commercially unavailable carbon capture and sequestration technology. The administration also plans to introduce a rule by the end of the year that would reduce carbon emissions from existing natural gas plants. Plants that cannot meet these standards will be forced to shut down, potentially accelerating the closure of the country’s coal plants and possibly some natural gas facilities as well. President-Elect Trump has repeatedly pledged to undo these regulations, arguing that growing demands from artificial intelligence and manufacturing require the U.S. to maintain a steady supply of affordable, reliable energy, which necessitates more electricity generation, not less. Utilities, electric cooperatives, and several states are already challenging the rule in court, claiming the EPA has exceeded its authority and failed to prove that the proposed emission control technologies will achieve the desired reduction levels. Additionally, the Biden-Harris administration has imposed a ban on oil and gas drilling in over half of the National Petroleum Reserve in Alaska, a move the state of Alaska seeks to reverse, as it relies on these resources for energy production and job creation. The administration also revoked leases that the state had purchased in the Arctic National Wildlife Refuge, stemming from a lease sale required under federal law. Combined with a limited five-year offshore lease plan, which includes only three auctions over the next five years, this will likely lead to reduced oil and gas production in the future, driving up oil prices, as offshore drilling accounts for roughly 15% of the nation’s oil output. President-Elect Trump is expected to direct the Department of the Interior to revise these policies on his first day in office. However, it may take up to two years for the department to complete the necessary environmental reviews and fulfill other requirements before a new offshore leasing schedule can be established. Offshore Wind While the Biden-Harris administration has put a damper on leasing offshore areas to oil and gas development, it has done just the opposite for offshore wind, including looking for floating wind turbine opportunities off the west and east coasts. They have promoted offshore wind in places such as Ocean City, Maryland, where the townspeople are opposed to its potential impacts on the essential tourism industry. These very expensive multi-billion-dollar wind facilities that produce about half the energy compared to the same capacity from coal, natural gas or nuclear facilities have had a major impact on whales and birds and the fishing industry. President-Elect Trump could order the Interior Department to pause permitting new projects or selling new offshore wind leases, which would be difficult to challenge in court. Due to the expense of offshore wind as an electricity source, this would be a win for Americans who would avoid the increased electricity prices resulting from these turbines. Biden-Harris Tax Credits The Biden-Harris Treasury Department has found a leasing loophole in the Democrat-passed Inflation Reduction Act (IRA) that exempts leased electric vehicles in commercial fleets from restrictions on where the cars are made, the source of their battery materials, and how much money consumers make. That loophole allowing Chinese electric vehicles and related products to claim tax credits from the IRA will be looked at by the new Trump administration. The IRA not only has EV tax credits, but billions of dollars of “clean” energy and manufacturing tax credits. President-Elect Trump’s Treasury Department could rewrite rules governing which projects and companies are eligible for the lucrative credits so they are harder to obtain or more evenly applied to all energy sources. Oil companies and other developers, for example, would like a more beneficial tax credit for green hydrogen that would provide more flexibility in how they make the fuel. His Treasury Department could also modify the tax credits to avoid loopholes that allow China to claim the IRA’s energy manufacturing tax credits. LNG Permit Moratorium A Biden administration moratorium on new permits to export liquefied natural gas to non-free trade countries has been in effect since the beginning of the year. President-Elect Trump has promised to end that permitting pause on his “very first day back,” which could take the form of an executive order directing the Energy Department to resume its review of applications to export natural gas to key Asian nations and other countries that are not free-trade partners with the United States. Many think the moratorium was issued on faulty data that indicated the emissions from natural gas were far greater than current calculations, while others thought it was a Biden-Harris campaign ploy to get the environmental vote. It also appears as though the required studies have already determined that LNG exports are in the national interest, but may have been withheld from release in what some have labeled “a full-blown scandal.” DOE Energy Loan Program Under the Biden-Harris administration, the Department of Energy is handing out money with funding from the IRA that essentially provides cheap loans for politically correct technologies. However, the track record of the federal government picking winners and losers is very poor. How President-Elect Trump will handle such loans that have seen bankruptcies both in the Obama-Biden and Biden-Harris administrations is not clear but it has been an issue with Congressional Republicans. There are also billions of dollars of grant money to anti-fossil fuel groups politically allied with the Biden Administration, some of which appear to be recently created solely to harvest taxpayer money in enormous quantities. In addition to investigating the legality of these grants, the Administration may put a hold on further handouts until their utility is determined. Conclusion The Biden-Harris administration has put forth $1.8 trillion in regulatory costs—far more than either the Obama or Trump administrations. These regulatory costs will increase energy prices for Americans. President-Elect Trump now has a mandate to fix these regulations and other policies that the Biden-Harris administration put forward that will hurt the U.S. economy. If done speedily, some of the future damage to the economic growth of the regulatory onslaught of the Biden-Haris administration may be mitigated, especially if done towards such goals as American energy Independence. The strong mandate of American voters for a change in direction exemplified by the 2024 presidential election provides a new administration with ample room to reassess the regulatory agenda currently restricting economic growth. |

|