U.S. Energy Policy Pivots Towards Domestic Security

September 9, 2025 - US President Donald Trump significantly pivoted US energy policy with the signing of The One Big Beautiful Bill Act (OBBBA), transforming supply chains, redirecting investment flows and solidifying the US government’s support of traditional fuels. The act, which underscored the administration’s domestic energy dominance ambitions, was packed with various cost-cutting measures that directly reversed key provisions of the Inflation Reduction Act (IRA). Rystad Energy estimates that the OBBBA’s aggressive foreign content tests, and restrictions on Specified Foreign Entities (SPEs), may force companies to build more resilient, but potentially more expensive, supply chains, independent of target nations. Specific provisions, like the North American feedstock requirement for biofuels, will likely directly reshape global trade flows, creating clear-cut winners and losers in international commodity markets.

Compared to the IRA’s original timeline, the OBBBA shortens the runway for projects in several key sectors, accelerating the termination of tax credits for wind, solar and clean hydrogen. In a clear policy choice, biofuels received a favorable multi-year extension of credits, while consumer-facing credits for electric vehicles (EVs) and residential solar are eliminated.

One of the law’s most significant revisions is the shortened timeline for Clean Electricity Production and Investment Tax Credits, known as the 45Y and 48E credits. Now, solar and wind projects must begin construction within the next 12 months and be placed in service by end of 2027, rather than after 2032. Rystad Energy expects developers to rush orders for project materials to comply with the new one-year period set by the OBBBA to safe-harbor incentives for projects to be placed in service by 2029-2030.

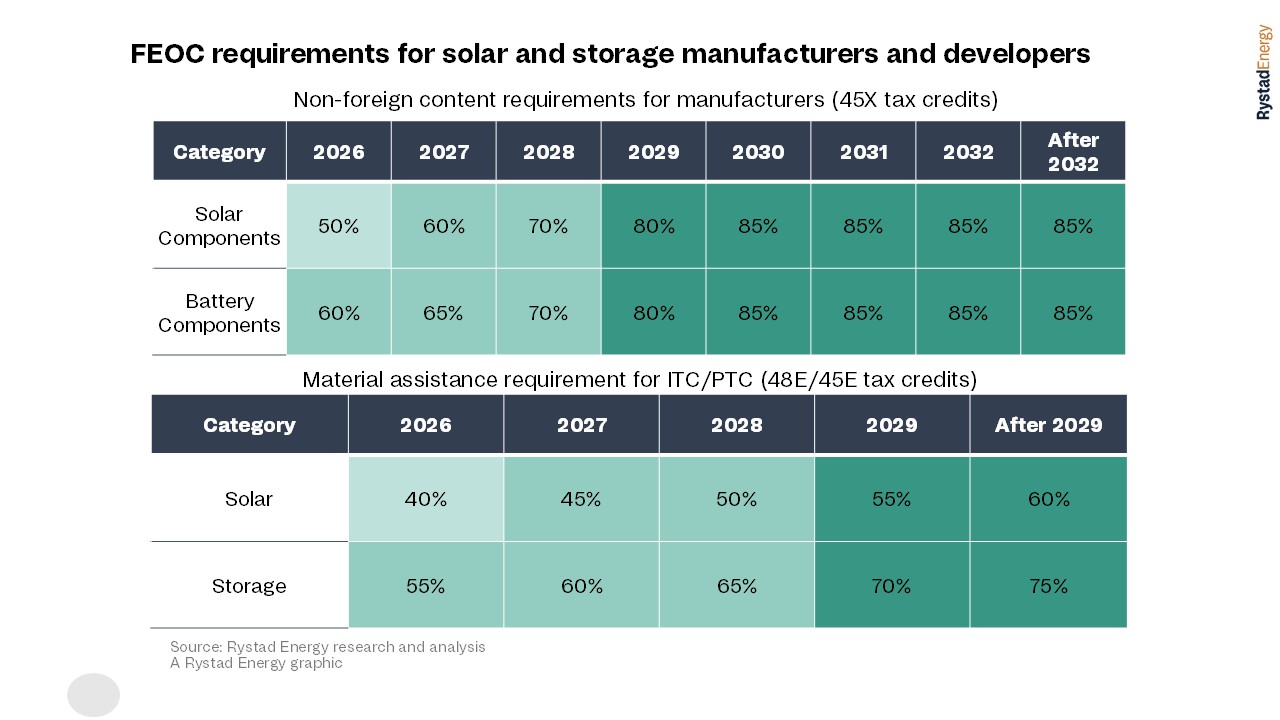

The OBBBA also?introduces stringent changes for clean energy manufacturing and supply chains, with the most critical changes in the introduction of new restrictions on foreign content. To qualify for the remaining tax credits, project components must meet domestic or ‘friend-shored’ sourcing thresholds that escalate over time, topping out as high as 90% for some equipment. From a solar developer’s perspective, meeting the Foreign Entity of Concern (FEOC) requirements will be a costly and arduous process.

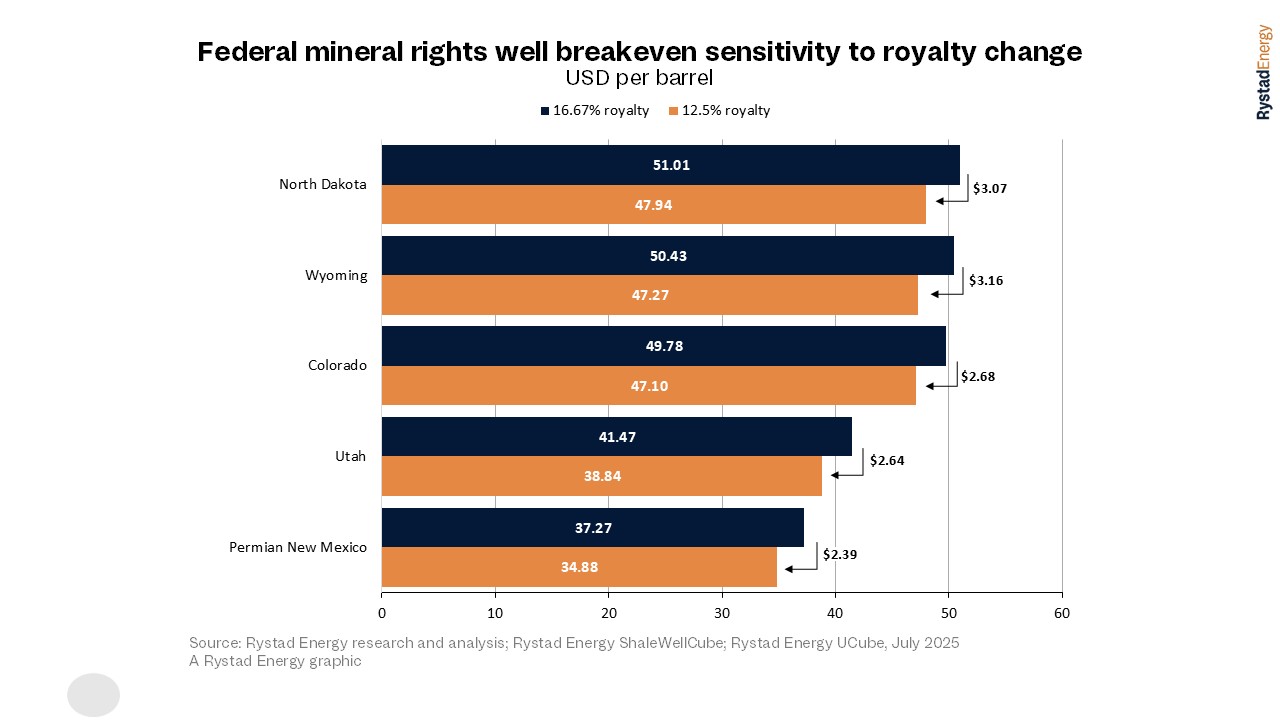

US shale companies with the most exposure to federal land with mineral rights stand to benefit from the royalty rate cut and tax incentives ushered in through the OBBBA. Although the legislation may not spur a new era of high growth from US shale oil plays, marginal benefits can be realized through continued near-term investments and improved economics that will favor companies with the most exposure to federal lands. In the long term, reduced federal royalty rates could help lower the marginal supply cost needed for new incremental sources of gas. Additionally, Rystad Energy finds that the reinstatement of the 100% bonus depreciation for tangible capital expenditure could lower breakeven prices by one to two dollars per barrel for short-term development in most core unconventional US oil plays, assuming consistent recurring investment. This benefit will apply to all companies, regardless of federal lands exposure.

The impact of the OBBBA, much like the IRA, will resonate globally, calibrating the competitive landscape for clean tech investment. Ultimately, the US has shifted its policy away from green technology acceleration to a more guarded strategy focused on domestic energy security, creating a more complex and uncertain environment for the future of the energy transition.