|

Signature Sponsor

October 6, 2025 -

Peabody Energy Investment Narrative Recap To be a Peabody Energy shareholder, you need to believe that recent U.S. policy support, including expanded federal land access, regulatory rollbacks, and new coal funding, can power a sustained “coal comeback” despite ongoing global trends toward renewables. These tailwinds have been the most important short-term catalyst, reflected in Peabody's sharp share price surge, while the biggest risk remains the enduring threat of long-term coal demand decline and policy shifts if political priorities change. The latest news materially strengthens the short-term narrative but long-term risks tied to decarbonization persist. The company's completed buyback, retiring over 17% of its outstanding shares, stands out against this backdrop. Increased federal support may boost near-term cash flow, supporting capital returns like buybacks and dividends, but long-term revenue visibility still hinges on domestic coal demand and regulatory certainty. However, investors should also consider the potential for abrupt changes in political support for coal... Peabody Energy's narrative projects $4.9 billion revenue and $468.2 million earnings by 2028. This requires 6.4% yearly revenue growth and a $327.3 million earnings increase from $140.9 million today. Uncover how Peabody Energy's forecasts yield a $23.28 fair value, a 27% downside to its current price. Exploring Other Perspectives

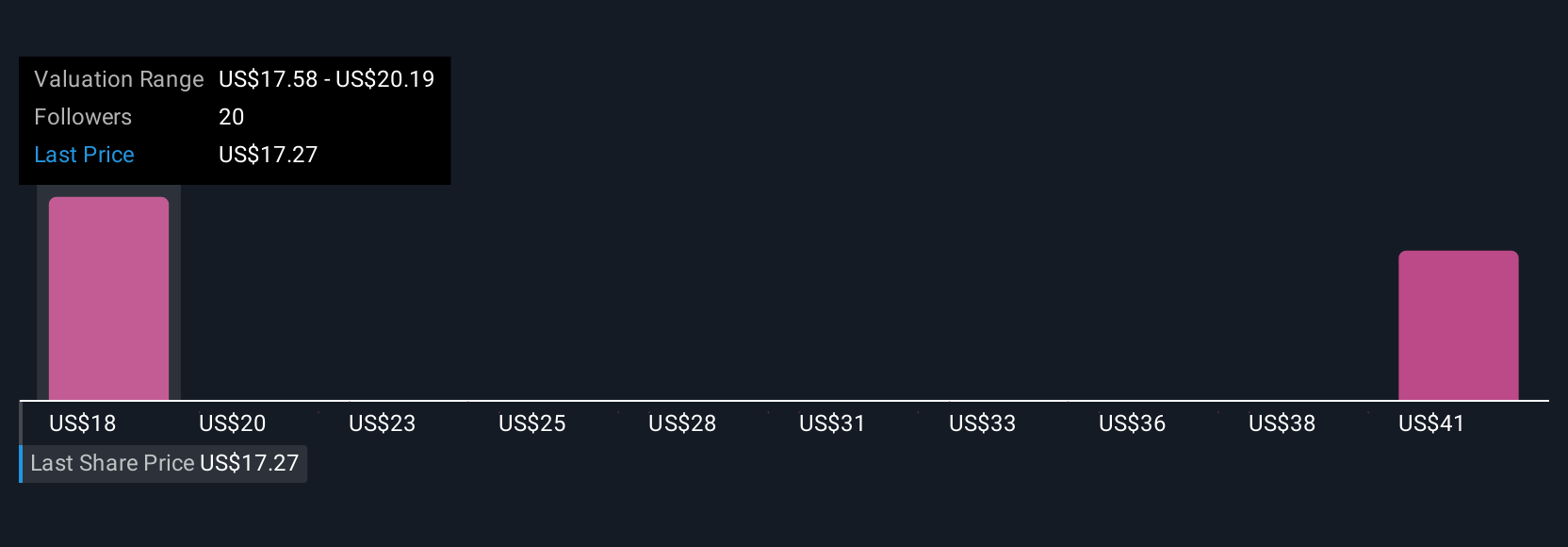

Peabody Energy’s fair value estimates from six Simply Wall St Community members span US$20 to US$45.76, revealing wide-ranging views on future performance. While policy tailwinds are driving positive sentiment now, diverse community outlooks suggest the risks around market shifts and regulatory changes remain top of mind, review other perspectives before making up your mind. |

|