Manufacturing Outlooks Vary as Key US and ASEAN PMI Indicators Diverge

December 3, 2025 - Worldwide manufacturing business conditions improved in November but at a reduced and only very modest rate. Growth rates varied by region, with the US and ASEAN economies notably outperforming as both reported especially strong and accelerating expansions. However, trends in order book and inventory levels hint at these performances diverging in the coming months, linked in part to US tariff policy.

PMI signals weakened upturn

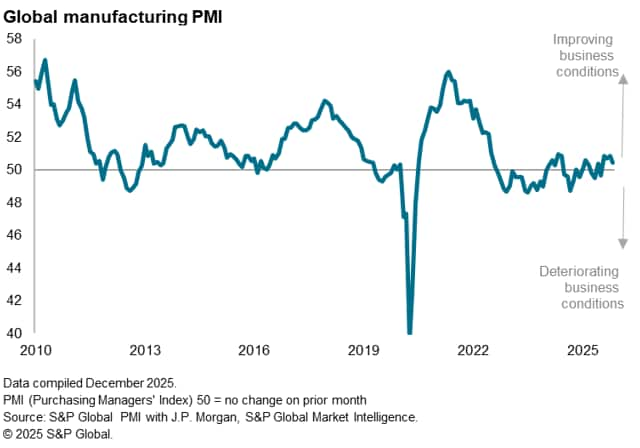

The Global Manufacturing PMI, sponsored by J.P. Morgan and compiled by S&P Global Market Intelligence, fell from 50.9 in October to 50.5 in November. The latest reading signalling only a very modest improvement in manufacturing conditions, and the weakest increase since the PMI rose back above 50.0 in August.

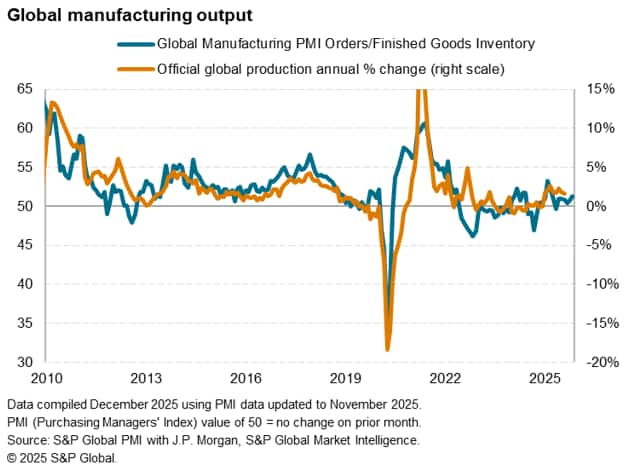

Both output and new orders rose globally at the slowest rates for four months, with both registering only slight increases in volumes. However, the sustained, albeit weaker, order book growth alongside a drop in finished goods stock hints at a further global production gain in December.

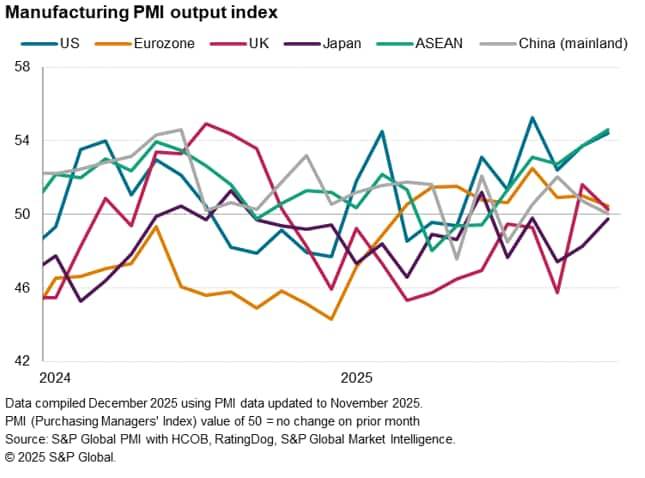

That said, regional variations in terms of both current output growth and survey signals for production in the coming months vary markedly around the world.

US and ASEAN outperform in terms of current output growth

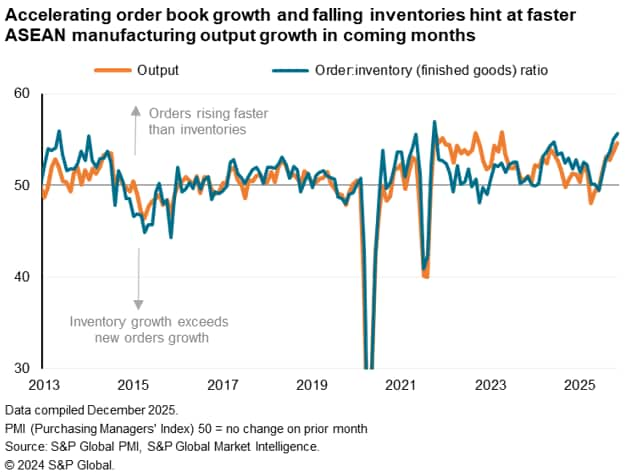

Having contracted for three months after the US announcement of higher-than-anticipated tariffs in April, manufacturing output growth across the ASEAN economy has since recovered pace, such that November saw the steepest monthly increase since April 2023. Growth was led by Thailand, India and Vietnam, which also secured the top three spots in the global rankings.

The US also reported especially strong manufacturing growth in November, with output not only up for a sixth straight month but also showing the third-sharpest monthly gain seen over the past three-and-a-half years.

In contrast, manufacturing growth stalled in mainland China and production declined slightly in Japan.

Especially marked factory downturns were meanwhile seen in Russia, Mexico, France, Taiwan and the Philippines. More modest but still notable declines were also reported in Canada, Brazil, Malaysia and South Korea.

Diverging future output signals

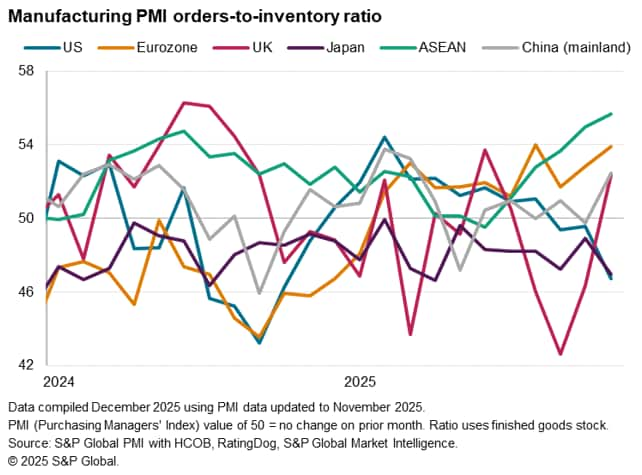

Looking ahead, a widely used guide to near-term future production trends is the ratio of new orders to finished goods inventories. If new orders inflows are rising but inventories are falling, production will likely rise to meet demand, and vice versa.

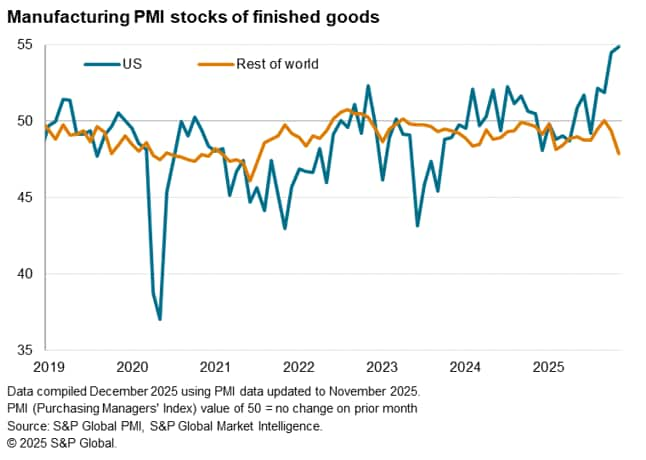

November saw an interesting divergence in these new orders to inventory ratios. Notably, the ratio hit a four-year high across the ASEAN region (and one of the highest readings on record), hinting at higher production in the coming months.

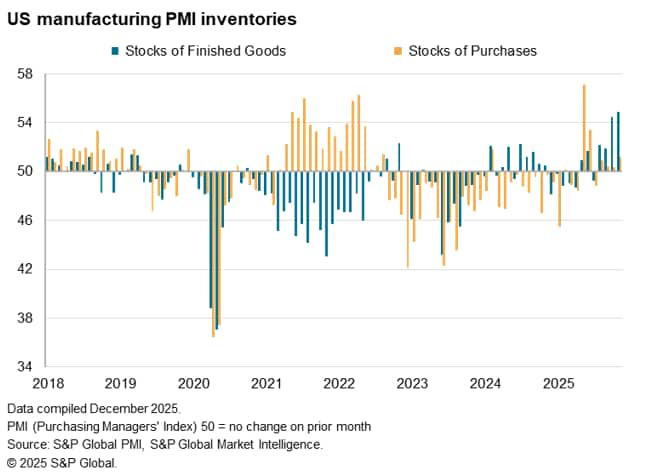

However, the equivalent US ratio fell to its lowest since October of last year (and one of the lowest on record), hinting at lower production in the coming months.

While ASEAN new orders rose in November at the fastest rate for just over four years, US new order inflows slowed to only a very modest rate. Meanwhile, high sales depleted warehouse stocks of finished goods across the ASEAN economy whereas US finished goods inventories have risen at unprecedented rates over the past two months amid sluggish sales.

While the orders-inventory ratio also fell in Japan, it rose in the eurozone and mainland China, suggesting these latter two economies could also see production growth accelerate as firms respond to higher demand relative to inventory levels.

Tariff distortions

A key difference between the US and elsewhere is that US companies report that factories have been using up inputs bought ahead of potential tariff-related price rises, as reflected by a sharp rise in inventories of inputs in the second quarter of the year. However, the additional output created from these inputs in the second half of the year has not always been sold, resulting in the accumulation of in finished goods inventory.

This stock overhang therefore points to a potential cooling of US factory growth in the coming months relative to the rest of the world.