China's Met Coal Market in the Doldrums, 4th Price Cut Starts

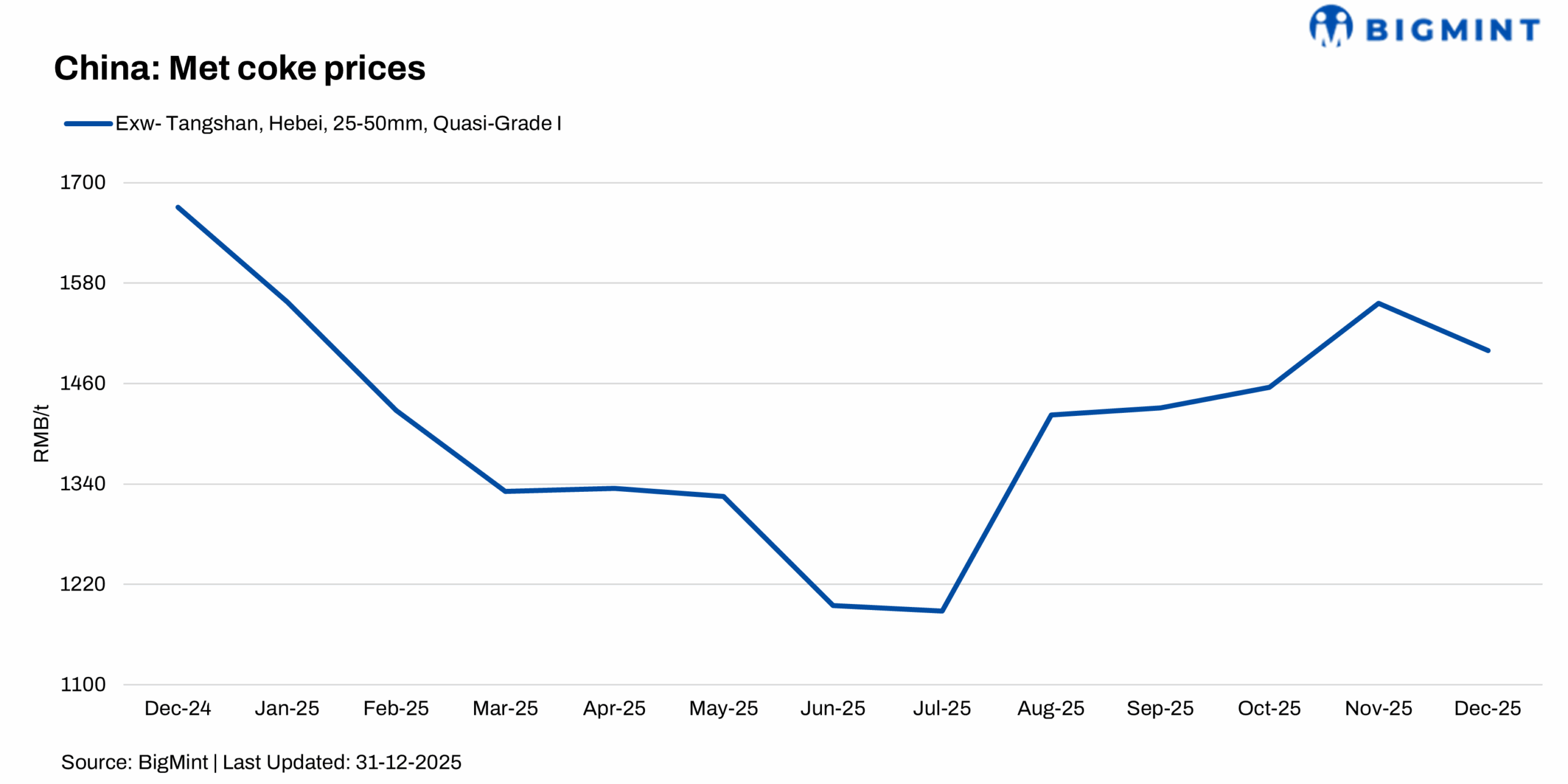

January 1, 2026 - China's metallurgical coke market remained in the doldrums on December 29, with steelmakers initiating a new price cut on the raw material. The outlook for the market remained gloomy, with further downside pressure still on the horizon.

On Monday, some steelmakers in North China's Hebei province and Tianjin municipality notified their coke suppliers that they would cut their purchasing prices for all met coke products by RMB 50-55/tonne ($7-7.7/t) on January 1, according to market sources.

This marked mills' fourth price-cutting attempt since late November, Mysteel Global notes. Over the previous three rounds of price negotiations, domestic coke makers had conceded a total reduction of RMB 150-165/t in their listing prices under pressure from steelmakers, as reported.

Some market players anticipate that cheaper met coke will stimulate demand from steelmakers, offering support and easing downward pressure for the market, according to sources.

However, market analysts warned that the scale of steelmakers' replenishment, if any, could be rather limited, as their inventories of coke feed remained ample. According to Mysteel's survey of 247 blast-furnace mills across the country, as of December 25 their combined coke stocks had climbed 1.3% on week to 6.42 million tonnes (mnt), enough to cover about 12 days of consumption.

While demand from steelmakers is expected to remain weak, coke price support from the coking coal market may also continue to soften. "The downtrend in coking coal prices may persist in the near term," a Shanxi-based analyst said, citing the lukewarm sentiment in coal trading.

"Leveraging the situation, steel mills might continue pushing for a fifth round of met coke price cuts," the analyst warned.

On Monday, Mysteel's assessment of China's quasi-first-grade met coke prices, for wet-quenching and dry-quenching types respectively, remained unchanged from the last session at RMB 1,439.2/t and RMB 1,566.9/t including the 13% VAT.

The same day, faltering futures prices reflected concerns among market players. On the Dalian Commodity Exchange, the most-traded met coke contract for next May delivery dropped 1.6% from last Friday's settlement price to end Monday's daytime trading session at RMB 1,680.5/t.

In the portside market, coke traders also trimmed their offers yesterday. Mysteel assessed the first-grade met coke (ash 12.5%, sulfur 0.65%, CSR 65%, MT 7%) at RMB 1,550/t on an ex-stock basis at Qingdao port in East China's Shandong province with VAT, down RMB 10/t from the previous day.