|

Signature Sponsor

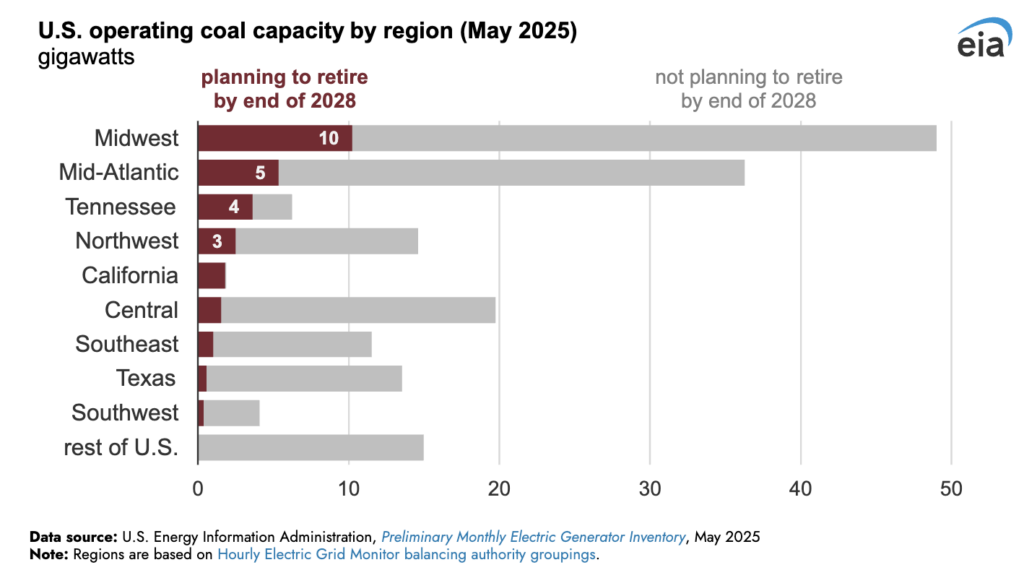

January 1, 2026 - A rapid succession of Section 202(c) emergency orders has forced utilities to keep more than 2 GW of coal capacity online in December alone, marking an unprecedented federal intervention in grid operations and triggering legal challenges from states and environmental groups. Across all orders issued since May 2025, the DOE has now stalled the retirement of at least 4.5 GW of coal capacity. The Department of Energy (DOE) issued four additional Section 202(c) emergency orders in December, directing utilities and grid operators to halt the retirement of coal-fired units—a combined capacity of more than 2 GW—across three regions: the Pacific Northwest, Midwest, and Mountain West. The new orders extend the Trump administration’s unprecedented run of federal grid interventions to at least 16 separate orders since May 2025.

On December 30, the DOE ordered co-owners of the 430-MW Craig Station Unit 1 in Colorado to maintain the coal-fired unit’s availability through March 30, 2026. Earlier, on December 23, the DOE issued directives requiring CenterPoint Energy and Northern Indiana Public Service Co. to keep three coal units—Unit 2 at F.B. Culley and Units 17 and 18 at the Schahfer station in Indiana—online through March 23. The orders follow a December 16 directive to TransAlta to keep Centralia Generating Station Unit 2 in Washington available through March 16.

Since May, the DOE has significantly expanded its use of Section 202(c) authority to compel the continued operation of generation and transmission assets deemed critical to grid reliability. Orders have repeatedly required utilities, independent system operators, and balancing authorities to override planned retirements, environmental operating limits, and market-based outcomes by mandating unit availability, extended run-hours, and coordinated operating measures to address projected supply shortfalls. Although each directive is time-limited—most spanning 60 to 90 days—their cumulative frequency and broad geographic reach represent a marked escalation in federal intervention in day-to-day grid operations.

The most recent order, issued December 30, directs Tri-State Generation and Transmission Association, a not-for-profit generation and transmission electric cooperative, and its four co-owners—Platte River Power Authority, Salt River Project, PacifiCorp, and Xcel Energy—to keep Unit 1 at the Craig Station in northwestern Colorado available to operate through March 30, 2026.

Craig Station is a three-unit coal-fired generating plant located near Craig in northwestern Colorado and operated by Tri-State Generation and Transmission Association. The facility has a combined nameplate capacity of 1,427.6 MW, consisting of Unit 1 (446.4 MW), Unit 2 (446.4 MW), and Unit 3 (534.8 MW). While Unit 1 was scheduled to cease operations on Dec. 31, 2025, Units 2 and 3 were slated for retirement in 2028.

Unit 1’s planned retirement stems from a September 2016 agreement among the Craig Station owners—Tri-State Generation and Transmission Association, PacifiCorp, Platte River Power Authority, Salt River Project, and Public Service Company of Colorado—with the Colorado Department of Public Health and Environment, the U.S. Environmental Protection Agency, and environmental groups to revise Colorado’s regional haze State Implementation Plan (SIP). The agreement followed a 2014 SIP that required significant reductions in nitrogen oxides at Unit 1 by August 2021. After reviewing compliance options—including installing additional emissions controls and switching fuels—the unit’s owners opted to seek an extension and commit to unit retirement, citing regulatory conditions, market outlooks, and the substantial cost of further emissions controls.

But, in its Dec. 30 order, the DOE said it relied in part on findings from the North American Electric Reliability Corp.’s (NERC’s) 2024 Long-Term Reliability Assessment, which identified growing reliability risks in the Western Electricity Coordinating Council’s (WECC’s) Northwest assessment area—covering Colorado, Idaho, Montana, Oregon, Utah, Washington, and Wyoming—amid accelerating baseload retirements. The DOE cited NERC’s projections that 5 GW “of baseload resource retirements are anticipated between 2024 and 2028.” It also pointed to the 2024 WECC Western Assessment of Resource Adequacy that found that peak demand in WECC’s Northwest-Central subregion (which includes Colorado) is “forecast to grow by 8.5% over the next decade, from 33 GW in 2025 to 36 GW in 2034.” WECC, the DOE noted, found most planned retirements involve “baseload generation, such as coal, natural gas, and nuclear.”

The DOE also cited the pace of generation retirements in Colorado, noting that since 2019, 571.3 MW of coal-fired capacity across six units at three sites have retired, reducing coal’s share of in-state generation from 45% to 28%. Looking ahead, the department pointed to Energy Information Administration projections showing that by 2029, about 3,700 MW of coal-fired generating capacity in Colorado is scheduled to retire—accounting for all but one coal-fired power plant in the state—alongside the retirement of 675.6 MW of natural gas-fired generating capacity. In contrast, intermittent wind resources accounted for more than 5,300 MW of Colorado’s electricity-generating capacity in 2025.

Ultimately, the DOE said it determined that “an emergency exists within the WECC Northwest assessment area due to a shortage of electric energy, a shortage of facilities for the generation of electric energy, and other causes.” It concluded that continued operation of Craig Unit 1 “will best meet the emergency and serve the public interest.” The agency also warned that if retired, a coal unit like Craig Unit 1 would be difficult to restart, and it said that “any stop and start of operation creates heating and cooling cycles that could cause an immediate failure that could take 30–60 days to repair,” with workforce, contract, and permitting constraints further extending restoration timelines.

Under the order, Tri-State and the unit’s co-owners will need to take all measures necessary to ensure Craig Unit 1 remains available to operate at the direction of either the Western Area Power Administration’s Rocky Mountain Region (Western Area Colorado–Missouri) in its role as balancing authority or Southwest Power Pool West in its role as reliability coordinator, as applicable, with sufficient time for orderly ramp-down following the order’s conclusion consistent with industry practices.

The DOE order, notably, halts a retirement that appeared central to Tri-State’s broader clean energy transition strategy. In August 2025, the Colorado Public Utilities Commission approved Tri-State’s 2023 Electric Resource Plan, which included Craig Unit 1’s scheduled retirement as part of a portfolio shift toward natural gas, renewables, and battery storage. Tri-State, which has been pursuing expanded participation in organized wholesale markets, also received Colorado PUC approval in December 2025 for its application to join Southwest Power Pool’s Western Energy Imbalance Service market—while simultaneously managing member exits and securing replacement capacity.

It is unclear if the forced extension of Craig Unit 1 through March 2026 disrupts that timeline and creates uncertainty for Tri-State and its member cooperatives, particularly given the DOE’s (now defunct) Grid Deployment Office terminated Tri-State’s $26.8 million Grid Resilience and Innovation Partnerships (GRIP) Program award earlier this year, eliminating federal support for grid modernization projects that were intended to support the utility’s transition away from coal.

On December 23, meanwhile, the DOE issued two separate emergency orders requiring Northern Indiana Public Service Company (NIPSCO) and CenterPoint Energy to maintain five coal-fired units online through March 23, 2026. The directives affect NIPSCO’s Schahfer Generating Station Units 17 and 18—which are each rated at 423.5 MW and slated for retirement at year-end—and CenterPoint Energy’s F.B. Culley Generating Station Unit 2 (103.7 MW), also scheduled to retire in December 2025.

The R.M. Schahfer Generating Station, located in Wheatfield, Indiana, is owned and operated by Northern Indiana Public Service Company (NIPSCO), a division of NiSource Inc. The plant consists of four units: two natural gas–fired units (129 MW each) and two coal-fired units—Units 17 and 18—each rated at 423.5 MW, for a combined coal capacity of 847 MW. Units 17 and 18 entered service in 1983 and 1986, respectively, and were approved for retirement by MISO following NIPSCO’s Attachment Y Suspension Notice, with coal combustion scheduled to cease by Dec. 31, 2025 absent a directive to remain open. In October 2025, NIPSCO formally notified Indiana regulators that the units were on track for permanent retirement under federal effluent limitation guidelines, but confirmed that cessation of coal combustion—and associated environmental compliance milestones—would depend on the absence of a reliability-driven order compelling continued operation.

The F.B. Culley Generating Station, located in Warrick County, Indiana, is owned and operated by CenterPoint Energy. The coal-fired facility consists of Unit 2 (103.7 MW) and Unit 3 (265.2 MW), for a combined nameplate capacity of 368.9 MW. Unit 2 entered service in 1966 and Unit 3 in 1973, with Unit 2 scheduled to retire in December 2025 under CenterPoint’s long-term generation transition strategy. In its 2023 Integrated Resource Plan, filed with the Indiana Utility Regulatory Commission, CenterPoint outlined a plan to end coal-fired generation in Indiana by 2027 and replace Culley’s coal output with a mix of renewable resources and natural gas-fired generation to meet new, more stringent MISO capacity requirements across all four seasons. The plan identified conversion of Unit 3—the last remaining coal unit—to natural gas by 2027 to preserve roughly 270 MW of dispatchable capacity, while allowing Unit 2 to retire as planned.

In both orders—like its previous emergency orders—the DOE found that if retired, coal units would be difficult to restart, warning that “any stop and start of operation creates heating and cooling cycles that could cause an immediate failure that could take 30–60 days to repair,” with workforce availability, contract constraints, permitting requirements, and potential disassembly further extending restoration timelines. The agency therefore directed that the affected units remain available to operate through March 23, 2026, with dispatch coordinated by MISO to minimize costs to ratepayers.

Echoing its other orders, the DOE determined that “an emergency exists in portions of the Midwest region of the United States due to a shortage of electric energy, a shortage of facilities for the generation of electricity, and other causes.” It concluded that continued operation of the units “will meet the emergency and serve the public interest.”

In justifying the Midwest extensions, the DOE leaned heavily on reliability assessments from MISO and the NERC, citing evidence that resource adequacy risks in MISO have shifted from a seasonal issue to a year-round concern. The agency specifically pointed to MISO findings showing that “reliability risks associated with resource adequacy have shifted from ‘summer only’ to a year-round concern,” with more than 60% of MISO’s MaxGen emergency events—triggered when available generation is insufficient—occurring outside the traditional summer peak season. However, the DOE also cited MISO documentation attributing the shift to accelerating retirements of dispatchable generation, declining reserve margins, increased reliance on weather-dependent resources, and more frequent extreme weather.

The orders come on the heels of the DOE’s December 16 emergency order directing TransAlta to ensure Unit 2 of the Centralia Generating Station in Centralia, Washington, remains available through March 16, 2026. The 730-MW coal unit, Washington’s last coal-fired power plant, was scheduled to shut down on December 31 under SB 5769, a state law that mandated closure by year-end.

So far, the Trump administration has issued more emergency orders in 2025 than in any prior comparable period over the past two decades, according to Congressional Research Service (CRS) analysis. The DOE’s emergency authority under Section 202(c) of the Federal Power Act is typically a rarely used provision that grants the Secretary of Energy broad discretion to temporarily override normal electricity market, regulatory, an

|

|